1. Cocoon’s Treasury Stock Buyback: What Happened?

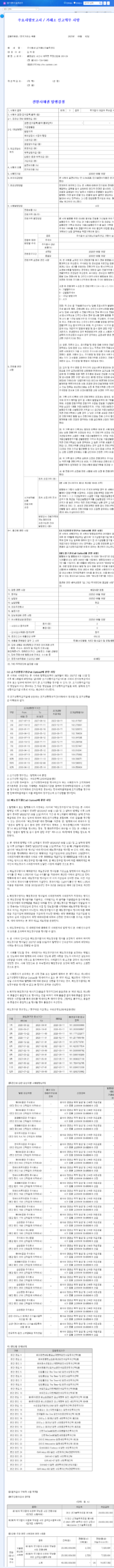

On September 3, 2025, Cocoon announced a treasury stock buyback of 162,953 common shares (approximately 1.13% of the market capitalization). The scheduled buyback date is September 19th, with a total value of KRW 3.9 billion.

2. Why the Buyback?

This treasury stock buyback is interpreted as a decision to enhance shareholder value. The decrease in the number of outstanding shares leads to an increase in book value per share (BPS) and earnings per share (EPS), which can positively impact the stock price. It is also interpreted as a shareholder-friendly policy, demonstrating management’s commitment to returning value to shareholders.

3. Impact on Investors?

- Positive Effects:

- Increase in per-share value (BPS, EPS increase)

- Strengthened shareholder return policy

- Improved financial structure (capital efficiency)

- Potential for short-term stock price momentum

- Considerations:

- Recent sluggish performance (decline in sales and operating profit in the first half of 2025)

- Increased market volatility

- Relative impact of the buyback size

4. What Should Investors Do?

While the treasury stock buyback can act as a short-term positive catalyst, from a long-term investment perspective, it’s crucial to thoroughly analyze the company’s fundamentals. In particular, as Cocoon has recently experienced a continued slowdown in performance, investors should carefully monitor whether new business performance materializes and efforts to strengthen the competitiveness of existing businesses. The impact of macroeconomic variables such as interest rates and exchange rates should also be considered.

FAQ

What is Cocoon’s main business?

Cocoon is a business data brokerage platform that provides external institutional data in API form. Its main business segments are data services and payment services.

Does a treasury stock buyback always have a positive impact on the stock price?

Generally, it has a positive impact, but not always. Stock price reactions can vary depending on various factors, including market conditions, corporate fundamentals, and the size of the buyback.

What is Cocoon’s future outlook?

Key variables include whether new businesses such as MyData and digital healthcare materialize and whether the company can strengthen the competitiveness of its existing businesses. Attention should also be paid to changes in the macroeconomic environment.