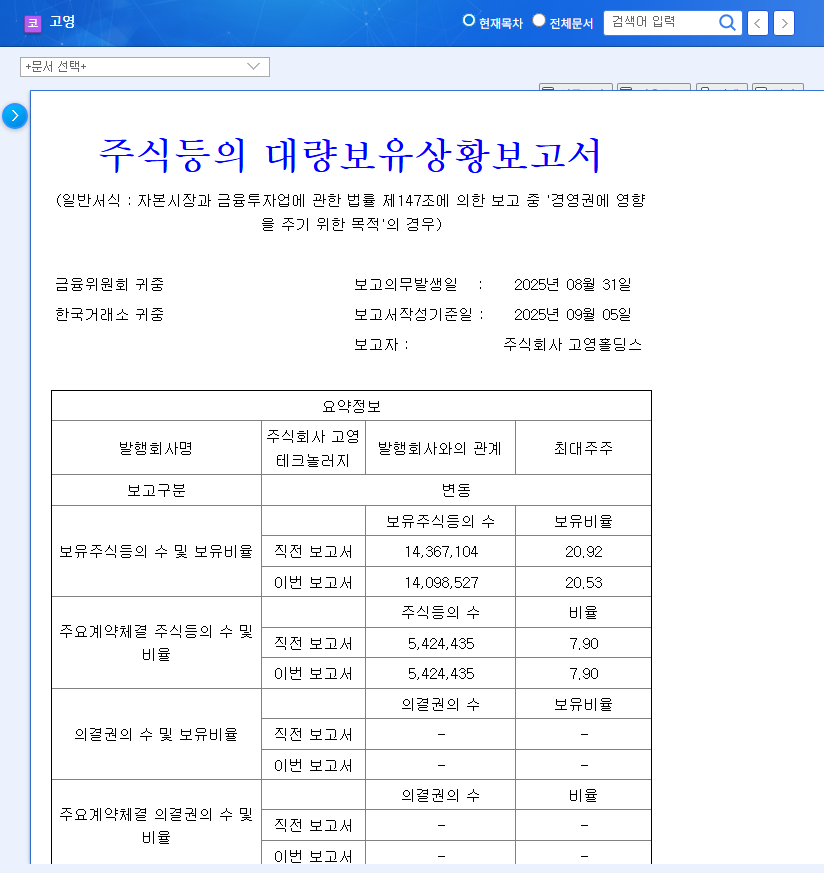

What Happened?: Delisting Review Extended

The Korea Exchange extended AccessBio’s delisting review period to September 26, 2025. This extension raises serious questions about the company’s ability to remain listed on the exchange.

Why?: Increased Uncertainty Surrounding Delisting

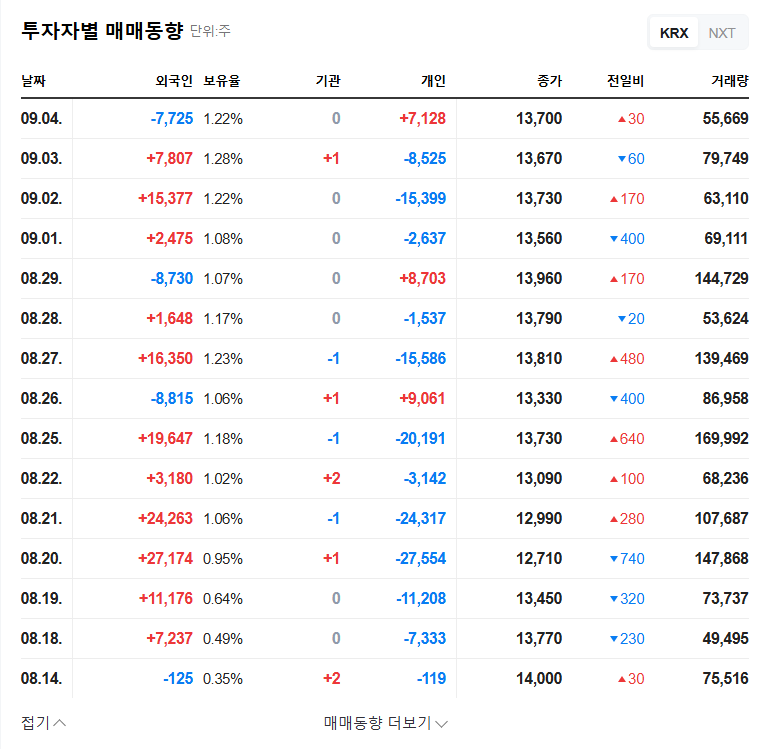

The extension suggests that the Korea Exchange requires more information to assess AccessBio’s eligibility for continued listing. This uncertainty adds to investor concerns and could lead to increased stock price volatility.

What’s Next?: Potential Risks and Opportunities

- Worst-Case Scenario: Delisting could result in significant losses for investors.

- Continued Uncertainty: Stock price volatility is likely to persist throughout the review period.

- Potential Opportunity: If AccessBio is not delisted, the resolution of uncertainty could lead to a rebound in stock price, although the probability is low.

Investor Action Plan

Investors should closely monitor the Korea Exchange’s final decision and any related announcements. Maintaining a rational approach during this period of uncertainty is crucial. Consider establishing a stop-loss strategy to mitigate potential losses.

What is AccessBio’s delisting review?

The delisting review is a process by which the Korea Exchange evaluates a company’s suitability for continued listing. Factors such as financial health and management transparency are considered.

When will the review results be announced?

The review period has been extended to September 26, 2025, but further extensions are possible.

What should investors do?

Investors should closely monitor announcements and exercise caution. Consider a stop-loss strategy to manage risk.