1. INZI Controls’ ₩13.9B Investment: What Happened?

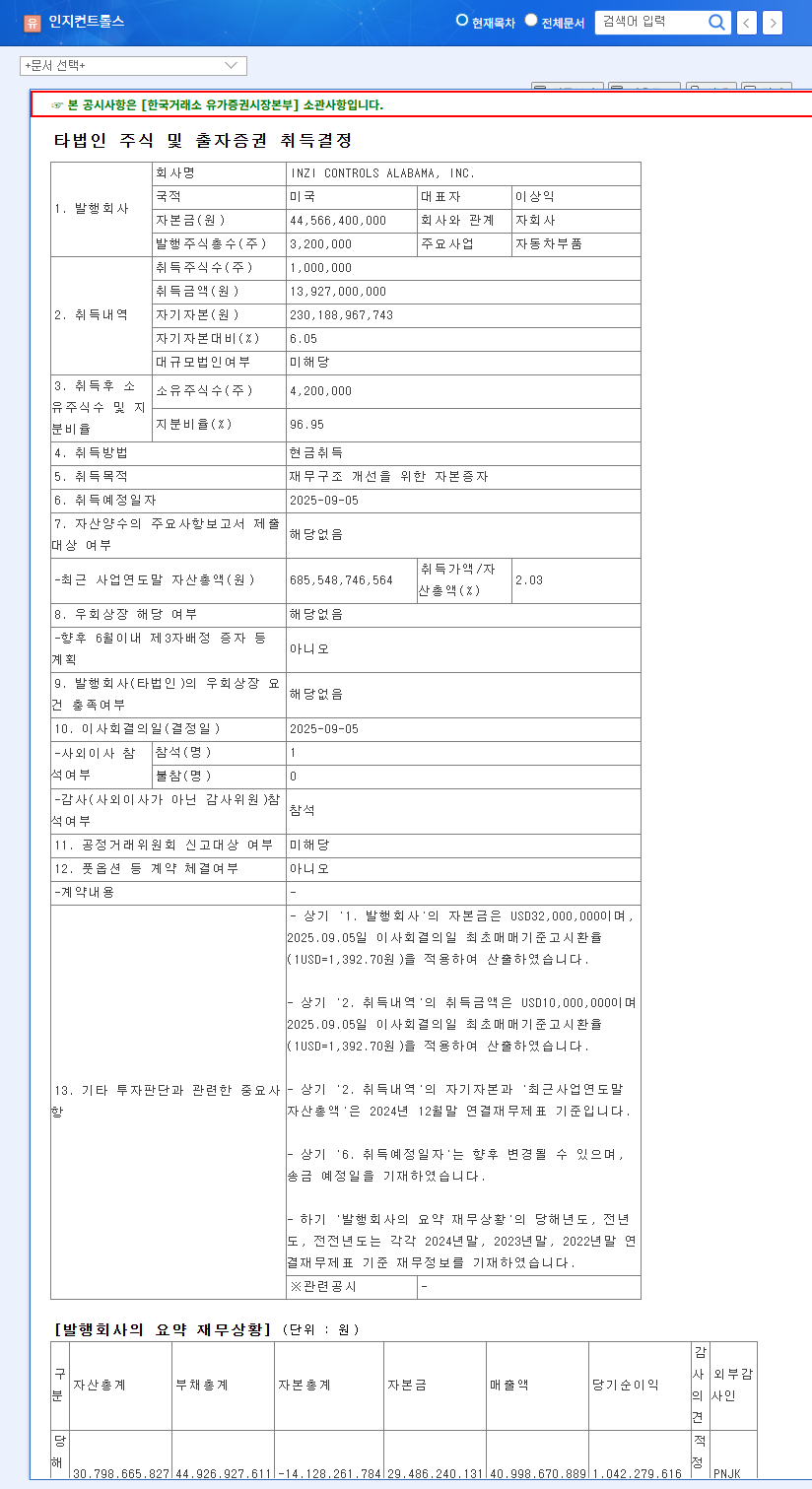

On September 5, 2025, INZI Controls announced a ₩13.9 billion capital increase for its US subsidiary, INZI CONTROLS ALABAMA, INC. This will increase INZI Controls’ stake in the subsidiary to 96.95%. The investment aims to improve the subsidiary’s financial structure, laying the groundwork for a stronger presence in the US market.

2. Why Invest in the US Subsidiary?: Background and Objectives

Despite increased consolidated revenue in the first half of 2025, INZI Controls experienced declining profitability. With sales in North America showing a downward trend, improving the financial structure and competitiveness of the US subsidiary has become crucial. This investment is seen as a strategy to secure the financial soundness of the US subsidiary and strengthen its position in the growing North American market, particularly in the eco-friendly vehicle sector.

3. What Are the Outcomes of the Investment?: Financial/Business Impact and Stock Forecast

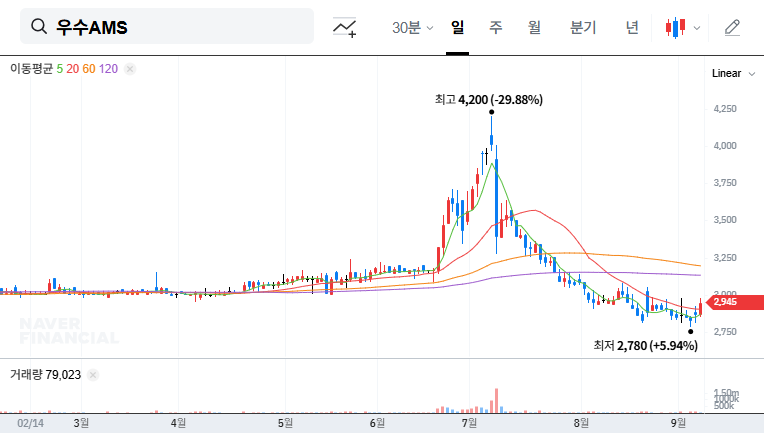

In the short term, the ₩13.9 billion cash outflow could raise concerns about liquidity. However, in the long run, the investment is expected to improve the financial structure and profitability of the US subsidiary, benefiting from the growth of the eco-friendly vehicle market. While the stock price may experience volatility in the short term, it is likely to be positively impacted in the medium to long term.

4. What Should Investors Do?: Key Considerations and Recommendations

- Monitor Financial Improvement: Investors should continuously monitor the financial improvement of the US subsidiary and its impact on INZI Controls’ consolidated earnings.

- Keep an Eye on Future Funding Plans: Analyze the impact on financial soundness if INZI Controls announces further investments or funding plans.

- Check Macroeconomic Indicators: Understand how macroeconomic variables like exchange rates and interest rates affect INZI Controls’ performance, and incorporate these factors into investment strategies.

It is crucial for investors to make investment decisions based on a long-term perspective, considering the growth potential of INZI Controls.

Frequently Asked Questions (FAQ)

What is INZI Controls’ main business?

INZI Controls is an automotive parts manufacturer, producing a variety of components, including parts for eco-friendly vehicles.

Will the ₩13.9 billion investment be a significant burden for INZI Controls?

While it may strain short-term liquidity, it’s considered a strategic investment for securing long-term growth drivers. The financial improvement following the investment needs close monitoring.

Is it a good time to invest in INZI Controls stock?

Investment decisions should be made carefully based on the investor’s own judgment. This analysis is for informational purposes only and does not constitute investment advice.