1. What’s happening with the share buyback?

Mobase has signed a treasury stock acquisition agreement with Shinhan Investment Corp. for KRW 3 billion. The contract period runs from September 5, 2025, to March 4, 2026. This represents 4.21% of the market capitalization and aims to stabilize stock prices and enhance shareholder value.

2. Why the share buyback?

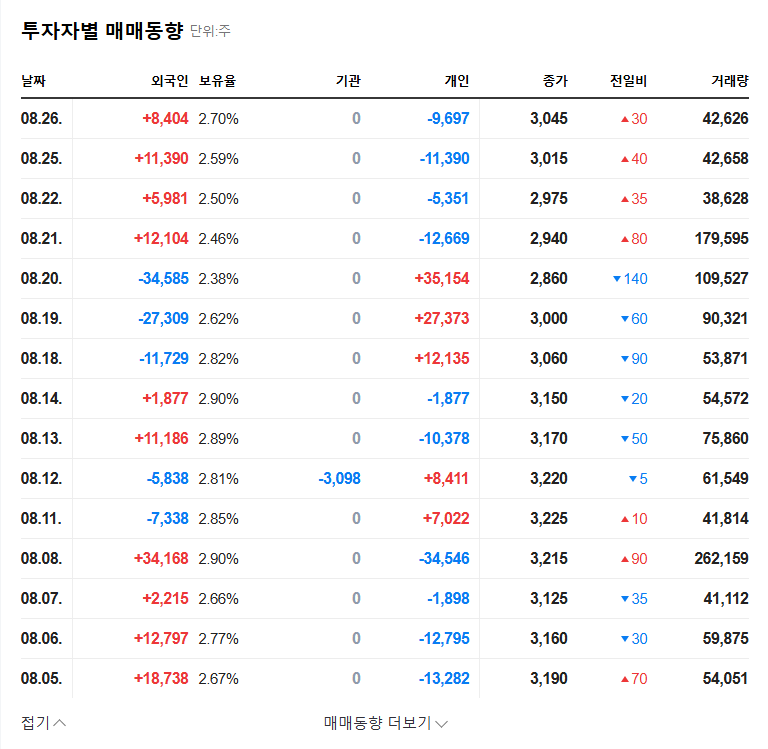

Mobase experienced sluggish performance in the first half of 2025, with sales declining 6.17% year-on-year, and operating profit and net profit plummeting by 53.8% and 87.3%, respectively. The share buyback is likely intended to defend against further stock price declines and improve investor sentiment.

3. What’s the potential impact?

- Positive Impacts: Short-term stock price increase, enhanced shareholder value, improved investor sentiment

- Negative Impacts: Temporary effects without fundamental improvement, reduced effectiveness in a declining market, possibility of continued poor performance

4. What should investors do?

Short-term investors might focus on the potential for a rebound, while long-term investors should carefully examine Mobase’s fundamentals. Pay close attention to the recovery of auto parts sales, improvement in profitability, and the resolution of the Indian tax dispute. Also, consider potential risk factors such as overseas plant utilization rates and customer dependency.

FAQ

What is Mobase’s main business?

Mobase’s primary business is the manufacture and sale of mobile phone and automotive parts, with automotive parts representing a significant portion of its revenue.

Do share buybacks always have a positive impact on stock prices?

Not necessarily. Share buybacks can boost stock prices in the short term, but without fundamental improvements in the company, long-term effects are difficult to expect.

What precautions should I take when investing in Mobase?

Consider the risk factors, such as poor performance, declining sales in its main business segment, and the ongoing Indian tax dispute. Pay attention to changes in the macroeconomic environment and industry trends.