1. What will be discussed at Gemvax’s IR?

The main topics of this IR will be the progress of GV1001 development, explanation of the rights offering, and a Q&A session with investors. The focus will be on whether solutions will be presented for Gemvax’s biggest current issues: capital impairment and continuous operating losses.

2. Why is Gemvax holding an IR?

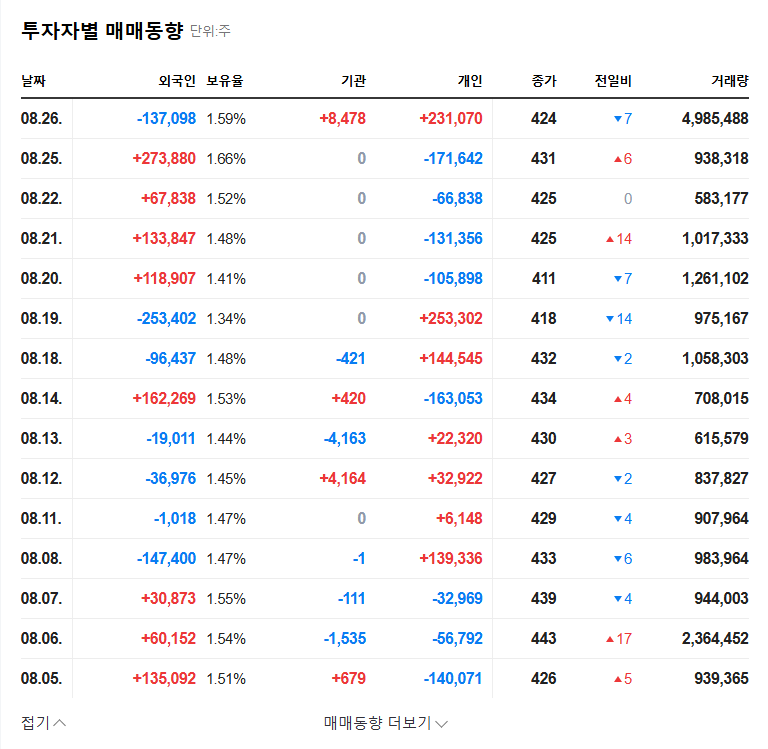

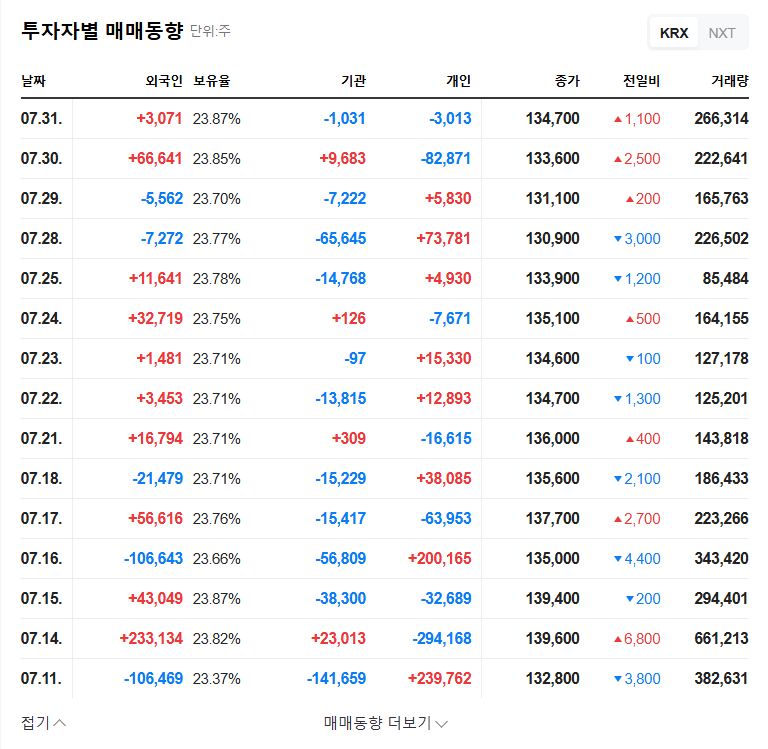

Gemvax is currently facing difficult circumstances. Its bio business (GV1001) carries high development risks, its environmental business is facing intensifying competition, and its financial status is marked by severe capital impairment. This IR is interpreted as an attempt to alleviate investor concerns, enhance understanding of the company, and improve investment sentiment.

3. What will Gemvax’s future look like after the IR?

- Positive GV1001 Development: Positive news regarding FDA orphan drug designation and clinical trials could create upward momentum for the stock price.

- Successful Rights Offering: A clear explanation of the use of funds and measures to minimize dilution of existing shareholder value could have a positive impact.

- Failure to Improve Financial Structure: Failure to present convincing solutions will likely lead to a decline in stock price.

However, a worsening macroeconomic situation (fluctuations in exchange rates, interest rates, and oil prices) could negatively affect Gemvax.

4. What should investors do?

Investors should carefully analyze the information presented at the IR, paying close attention to the following:

- Any positive updates regarding GV1001 development

- The concreteness and validity of the rights offering fund utilization plan

- Presentation of a roadmap for resolving capital impairment and improving financial structure

It’s crucial to make cautious investment decisions by referring to market reactions and expert analysis after the IR.

What are Gemvax’s main businesses?

Gemvax’s main businesses are environmental pollution control and bio business (GV1001 drug development). They have also recently entered the waste plastic pyrolysis oil refining business.

What is Gemvax’s financial status?

There are significant concerns about Gemvax’s financial health due to high debt-to-equity ratio, continuous operating losses, and severe capital impairment.

What is GV1001?

GV1001 is a drug candidate being developed for the treatment of Alzheimer’s disease, Progressive Supranuclear Palsy (PSP), and other conditions.