1. The $7 Trillion Question: What’s Happening?

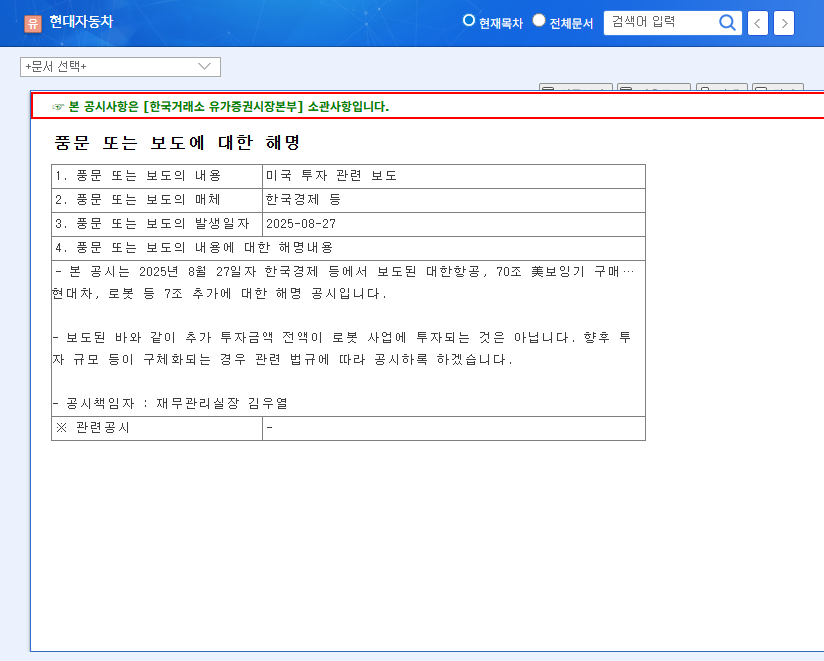

Reports surfaced on August 27, 2025, suggesting Hyundai is planning a massive $7 trillion investment in the US, with a significant portion potentially directed towards robotics. However, Hyundai clarified that the investment amount, especially regarding robotics, isn’t finalized and details will be disclosed later.

2. Why is Hyundai Investing in the US?

This investment aligns with Hyundai’s transition into a ‘Smart Mobility Solution Provider’. The US is a key market for EVs, robotics, and future mobility solutions, and Hyundai likely aims to secure a leading position. Furthermore, US government policies promoting green technologies and the Inflation Reduction Act (IRA) are likely influencing factors.

3. Hyundai’s Core Business and Investment Strategy

- Electric Vehicles (EVs): Building on the success of the Ioniq series, Hyundai is strengthening its EV lineup to expand its US market share.

- Robotics: Hyundai is fostering its robotics venture as a future growth engine and this investment could accelerate its technology development and market entry.

- Hydrogen: As a leader in hydrogen fuel cell technology, Hyundai continues to invest in building a hydrogen ecosystem and related technologies.

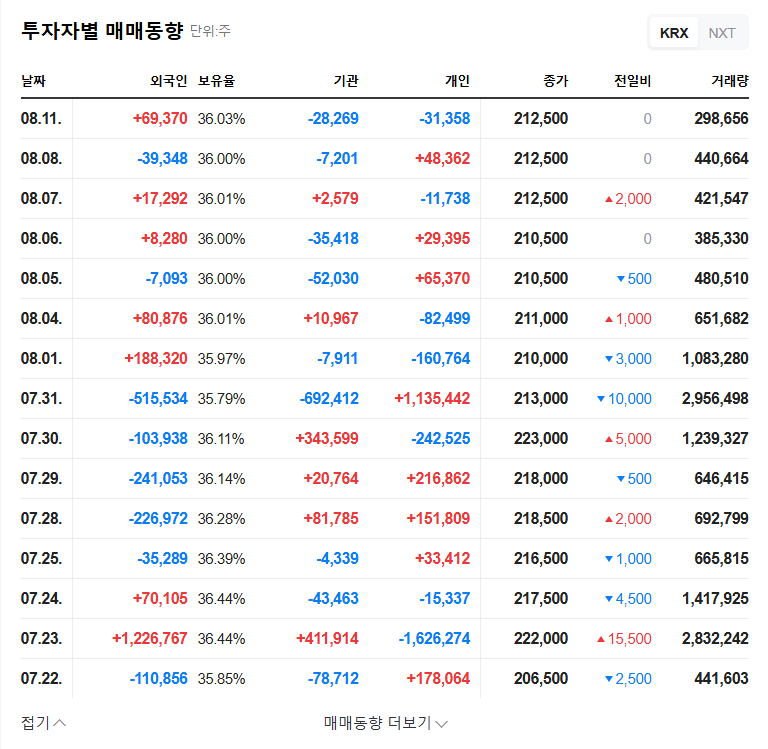

4. Action Plan for Investors

Hyundai’s US investment signals long-term growth potential. However, with the specifics yet to be confirmed, a cautious approach is advised. Monitor official announcements and market conditions closely to inform your investment strategy.

Frequently Asked Questions

Is Hyundai’s $7 trillion US investment confirmed?

No, the exact amount and details are yet to be officially confirmed by Hyundai.

Why is Hyundai investing in robotics?

Robotics is a crucial part of the future mobility landscape, and Hyundai sees it as a key growth area.

Should I invest in Hyundai now?

Hyundai has strong growth potential, but uncertainties remain regarding the investment. Carefully analyze official disclosures and market conditions before making any investment decisions.