1. What Happened? : After-Hours Block Deal of ISU Specialty Chemicals

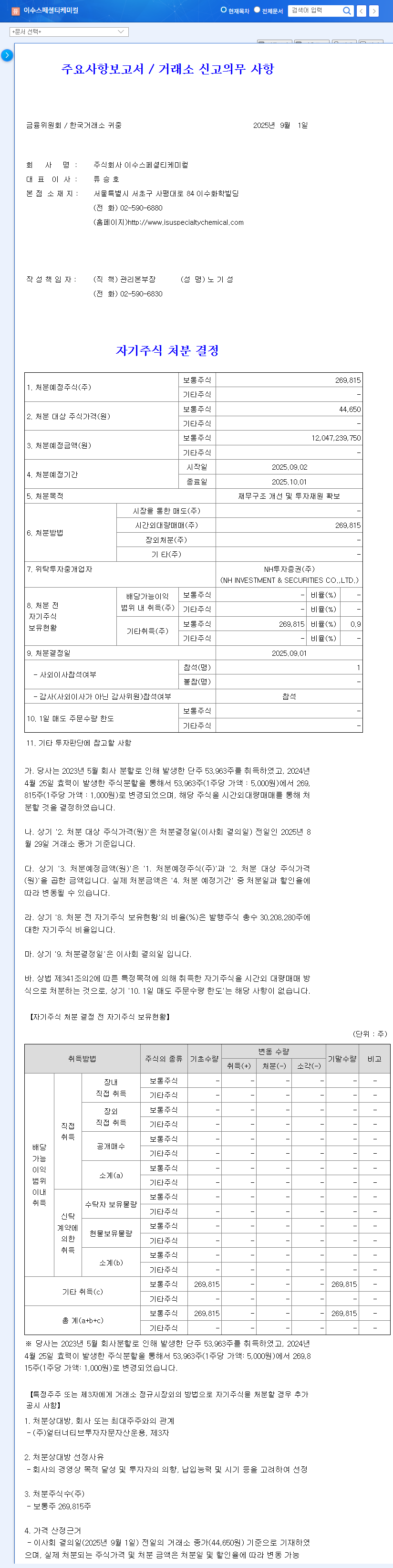

Before the market opened on September 2, 2025, a large after-hours block deal occurred, involving 539,630 shares of ISU Specialty Chemicals, worth 23.5 billion KRW. Foreign investors net bought 12.3 billion KRW, while financial investors net sold 11.7 billion KRW.

2. Why Did This Happen? : Background Analysis

Positive Factors:

- Strong performance in the first half of 2025 (revenue +28.5% YoY, operating profit turnaround)

- Full-scale launch of solid-state battery materials business and MOU signing

- Stable sales base for key fine chemical products such as TDM

Negative Factors:

- High debt-to-equity ratio (182%) and interest rate fluctuation risk

- Cost burden due to rising raw material prices and logistics costs

- Uncertainty surrounding new business ventures

3. What’s Next? : Impact Analysis and Investment Strategies

Short-Term Impact: Foreign buying could create short-term upward momentum, but investors should consider the absorption of financial investors’ selling volume and overall market sentiment.

Mid-to-Long-Term Impact: Careful monitoring of fundamental improvements, financial structure stabilization, and new business performance is crucial. Changes in the macroeconomic environment are also key factors in shaping investment strategies.

Investor Action Plan:

- Short-term investors: Assess foreign buying, selling volume, and overall market sentiment.

- Mid-to-long-term investors: Continuously monitor fundamental improvements, new business performance, and macroeconomic variables while adjusting investment strategies accordingly.

FAQ

What is an after-hours block deal?

An after-hours block deal refers to a large volume of shares traded outside of regular trading hours. It often involves institutional investors and can significantly impact stock prices.

Will this after-hours block deal positively affect the stock price?

While foreign buying can be viewed positively, investors should consider financial investors’ selling and the company’s fundamental risks. Short-term price increases are possible, but the mid-to-long-term impact remains uncertain.

What should investors be aware of when investing in ISU Specialty Chemicals?

Investors should be mindful of the high debt-to-equity ratio, exchange rate volatility, and uncertainty surrounding new businesses. Monitoring changes in the macroeconomic environment is also crucial.