Mulim Capital Reduces Stake in JaeYoung SoluTech by 2.57%p… Why?

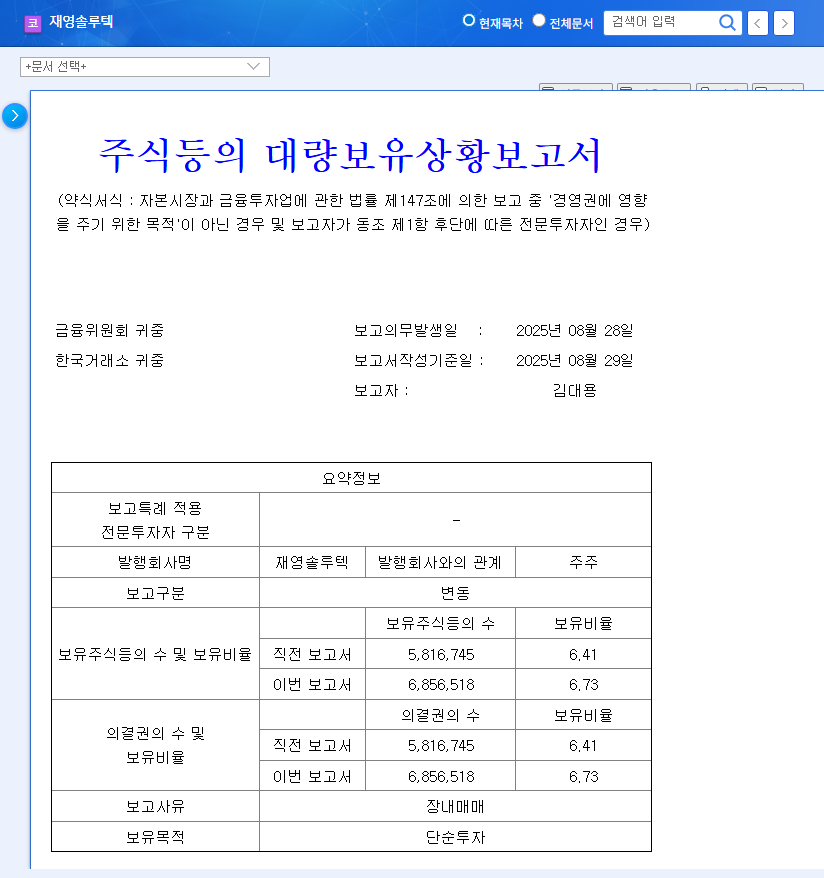

Mulim Capital sold 2,491,775 shares acquired after exercising convertible bond (CB) warrants, reducing its stake from 20.73% to 18.16%. Given its initial purpose of simple investment, profit-taking seems highly likely.

JaeYoung SoluTech Hampered by Sluggish Performance

According to the 2025 semi-annual report, JaeYoung SoluTech’s consolidated revenue increased, but operating profit plummeted by 96.6%, recording a net loss of KRW 2.95 billion. Foreign exchange losses and increased interest expenses are cited as the main causes. While standalone performance improved, the consolidated sluggish performance will inevitably negatively impact investor sentiment.

How Will Mulim Capital’s Stake Reduction Affect JaeYoung SoluTech’s Stock Price?

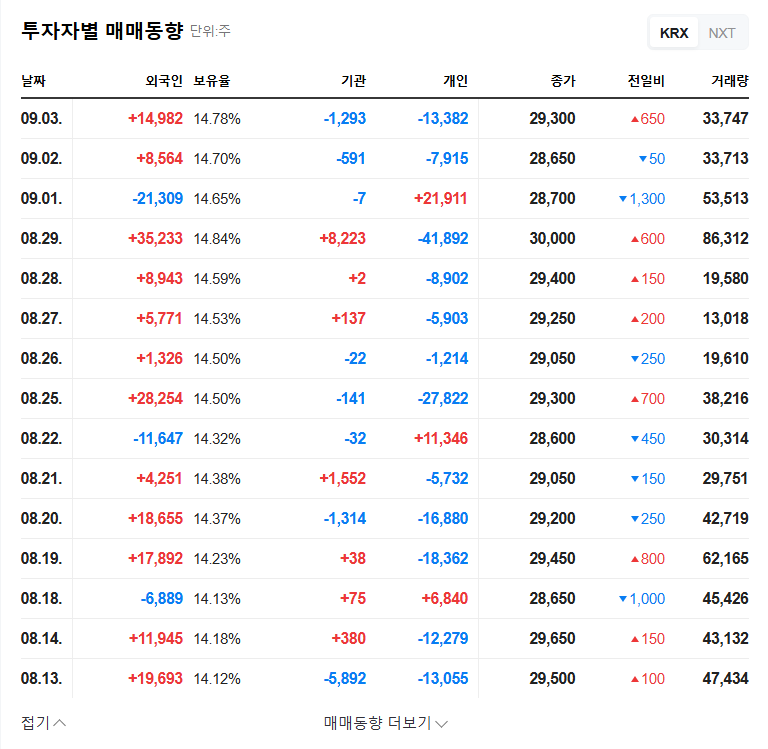

The decrease in stake amid sluggish performance could further dampen investor sentiment. Downward pressure on the stock price is expected in the short term, and the process of absorbing the large sell-off volume and earnings improvement will determine the direction of the stock price.

What Choices Should Investors Make?

Short-term investors need to take a cautious approach, considering the possibility of increased stock price volatility.

Mid- to long-term investors should watch for the growth potential of the nano-optics business and efforts to improve the financial structure, and check whether profitability improves and financial soundness is secured.

FAQ

Why did Mulim Capital reduce its stake in JaeYoung SoluTech?

It appears that they sold the shares to realize profits after exercising convertible bond warrants.

How was JaeYoung SoluTech’s performance in the first half of 2025?

The company recorded a sharp drop in consolidated operating profit and a net loss. Foreign exchange losses and increased interest expenses are the main causes.

What is the outlook for JaeYoung SoluTech’s stock price?

Downward pressure is expected in the short term due to Mulim Capital’s stake reduction. The stock’s direction will depend on whether earnings improve in the mid- to long-term.

Should I invest in JaeYoung SoluTech?

Short-term investment should be approached with caution, while mid- to long-term investment requires monitoring the growth of the nano-optics business and improvements in the financial structure.