1. Jobi’s Insider Stake Sale: What Happened?

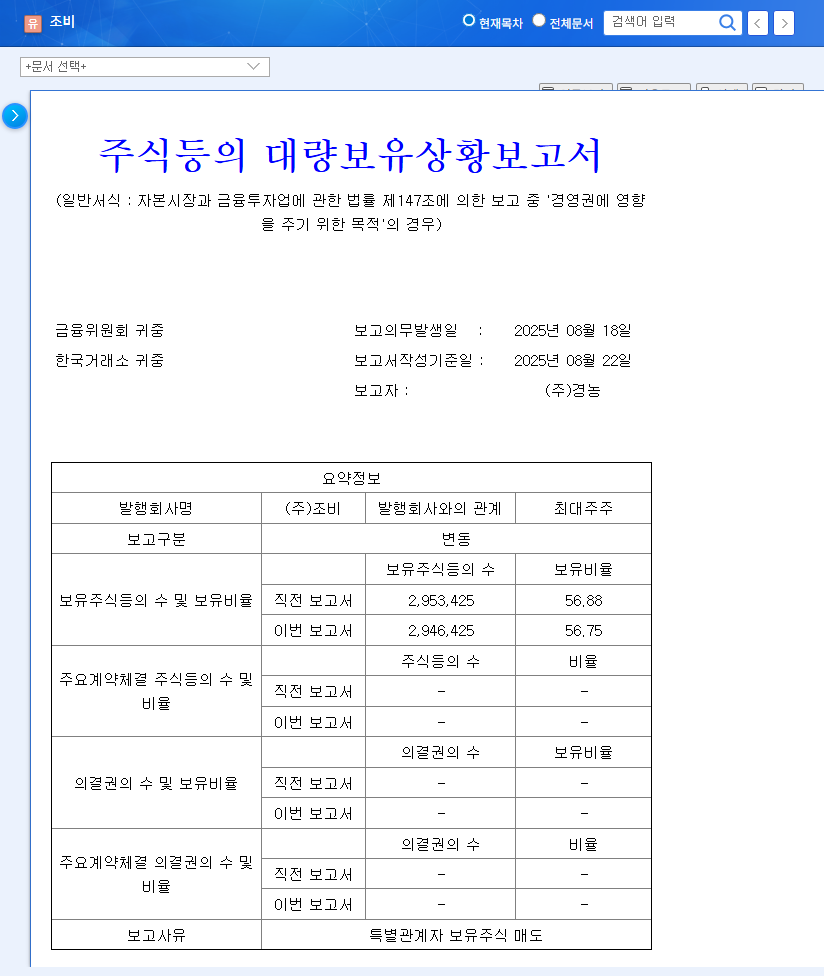

Leaders Chemical sold 7,000 shares of Jobi stock between August 18th and 20th, 2025. This slightly reduced the total insider stake, including KyungNong Corporation, from 56.88% to 56.75%.

2. Why Does the Stake Sale Matter?

While not a direct threat to management control, this stake sale, combined with Jobi’s recent fundamentals, could negatively impact investor sentiment. Despite returning to profitability, continued decline in sales, increasing debt ratio, and high accounts receivable balance could raise concerns among investors. The market may interpret this stake sale as a sell signal from major shareholders, potentially leading to increased stock volatility.

3. Jobi’s Current Situation and Future Outlook

Jobi is experiencing declining sales in its fertilizer business, but cost reductions and improved non-operating income have led to a return to profitability. However, the increased debt ratio and high accounts receivable require caution regarding financial soundness. While the company is focusing on developing functional fertilizers to adapt to market trends like smart farms and precision agriculture, tangible results are yet to be seen. External uncertainties, including fluctuations in raw material prices and exchange rates, as well as the possibility of interest rate hikes, also exist.

4. Action Plan for Investors

- Short-term Investment Strategy: Monitor stock price fluctuations following the stake sale and take a cautious approach, observing improvements in fundamentals and changes in macroeconomic indicators.

- Long-term Investment Strategy: Consider various factors comprehensively, including sales recovery and diversification, strengthening financial soundness, securing competitiveness in the functional fertilizer business, managing raw material and exchange rate risks, and changes in macroeconomic indicators.

Q. Will the insider stake sale affect Jobi’s management control?

A. The scale of this sale is not large enough to pose a direct threat to management control, but it could be interpreted as a negative signal by the market.

Q. Is Jobi’s return to profitability sustainable?

A. Considering the continuous decline in sales, increasing debt ratio, and high accounts receivable, the sustainability of the return to profitability is uncertain. Future sales recovery and strengthening of financial soundness are crucial.

Q. What should investors be aware of when investing in Jobi?

A. In the short term, pay attention to stock price volatility following the stake sale. In the long term, continuously monitor sales recovery, strengthening of financial soundness, and new business performance. Also, consider the impact of macroeconomic variables such as raw material prices, exchange rates, and interest rates.