KB Financial Group H1 2025 Earnings Analysis

KB Financial Group achieved a consolidated net income of KRW 3.436 trillion in the first half of 2025, marking an impressive 23.8% year-on-year growth. This result was driven by the combined growth of both interest and non-interest income.

Key Fundamentals

- Strong Financial Health: Maintaining an industry-leading BIS capital adequacy ratio of 16.36%, KB demonstrates a stable management foundation.

- Excellent Liquidity: A liquidity ratio of 366.19% indicates ample short-term payment capacity and the ability to navigate market volatility.

- Sound Asset Quality: Low NPL and NPL ratios demonstrate effective risk management capabilities.

Future Growth Drivers

KB Financial Group is expanding its growth engines in the non-banking sector, building on the stable growth of its banking division. Key drivers include strengthening the IB competitiveness of KB Securities, maximizing CSM strategy at KB Insurance, and expanding the senior life platform business at KB Life Insurance. Overseas expansion and fintech investments by KB Capital, as well as digital transformation efforts at KB Kookmin Card, are also expected to drive future growth.

Investment Considerations

Potential risks to consider include the possibility of global and domestic economic slowdown, interest rate fluctuations, exchange rate volatility, and real estate PF risks. The risks related to KB Real Estate Trust require ongoing monitoring.

Action Plan for Investors

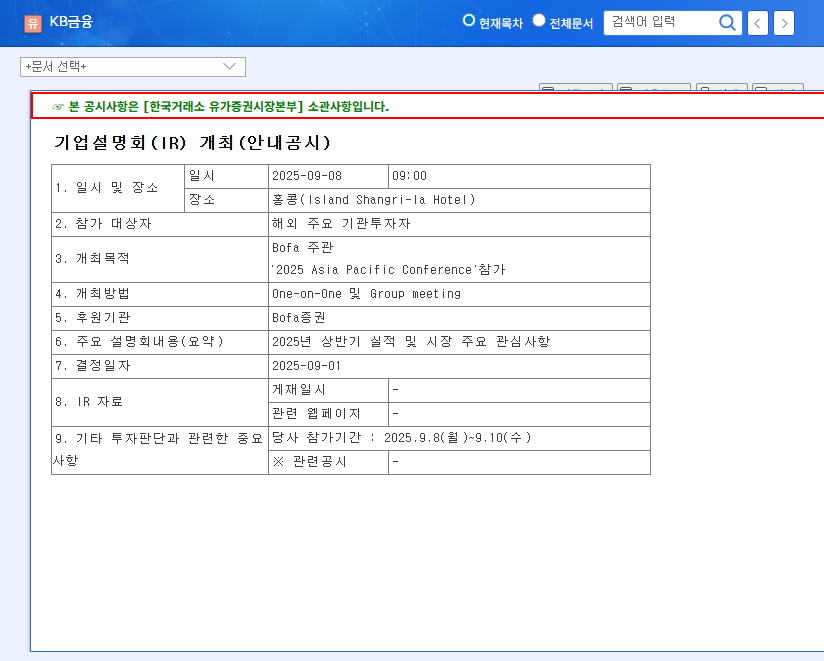

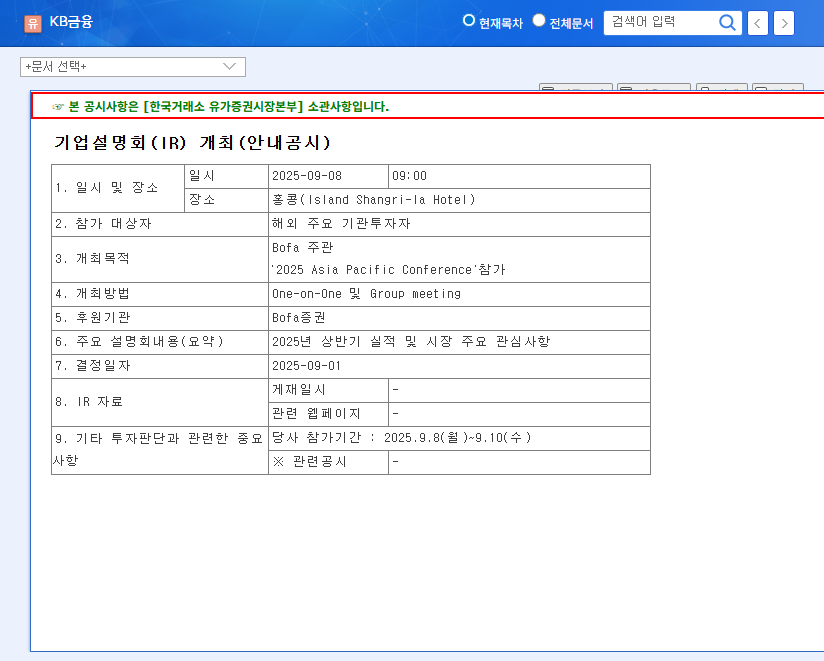

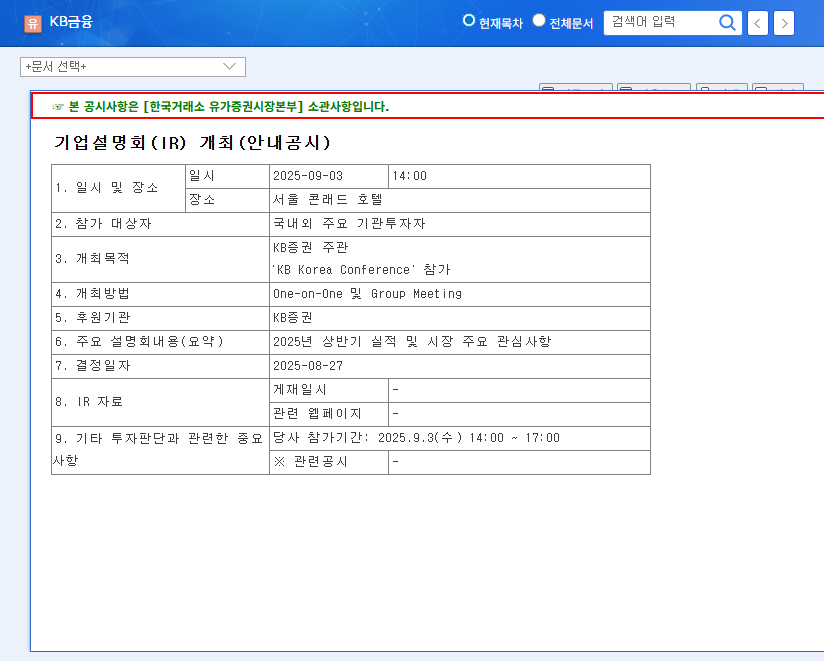

- Monitor KB Financial Group’s IR activities and earnings announcements to stay informed about changes in fundamentals.

- Analyze the impact of macroeconomic indicator changes on KB Financial Group and adjust your investment strategy accordingly.

- Conduct competitor analysis to understand KB Financial Group’s relative strengths and weaknesses to inform your investment decisions.

FAQ

What are KB Financial Group’s key H1 2025 financial results?

KB Financial Group achieved a consolidated net income of KRW 3.436 trillion in H1 2025, a 23.8% increase year-on-year.

What are the main growth drivers for KB Financial Group?

Key growth drivers include the stable growth of the banking division, growth in non-banking sectors like KB Securities, KB Insurance, and KB Life Insurance, as well as digital transformation and fintech investments.

What should investors be aware of when considering KB Financial Group?

Investors should consider macroeconomic uncertainties, increased competition in the financial market, and real estate PF risks.