1. KG Steel Announces $480 Million Investment in Startup Korea Fund

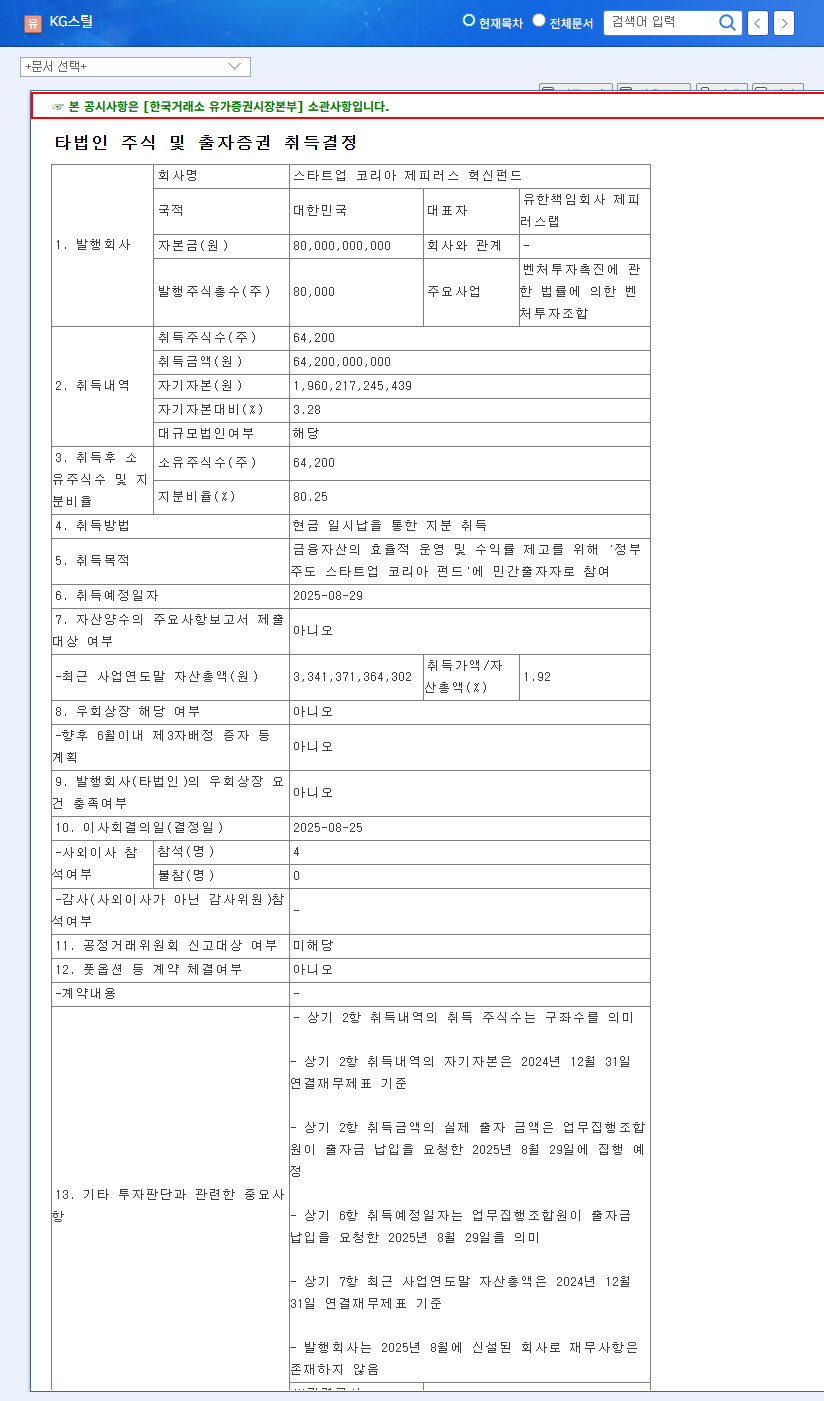

On August 25, 2025, KG Steel announced a $480 million investment in the Startup Korea Zephyrus Innovation Fund, acquiring an 80.25% stake. The company stated that the investment aims to optimize financial asset management and enhance returns.

2. KG Steel’s Fundamentals: A Mixed Bag

KG Steel’s 2025 half-year results present a mixed picture. While sales and operating profit declined by 50.9% and 50.5% year-on-year, respectively, net profit increased by 114.3% due to gains in financial income and foreign exchange. The steel division faced challenges due to market downturn, but other segments showed positive growth with a return to profitability.

3. Venture Fund Investment: Opportunity or Threat?

3.1 Potential Benefits

- Improved profitability and financial structure

- Exploration of new business opportunities and securing future growth engines

- Positive image enhancement through participation in a government-led fund

3.2 Potential Risks and Considerations

- Short-term liquidity decrease (3.28% of capital)

- Inherent risks of venture investment

- Uncertainty related to fund performance

- Market concerns about large-scale investment amid steel market downturn

4. Action Plan for Investors

KG Steel’s investment can be interpreted as a strategic move for long-term growth. However, investors should carefully consider the risks associated with venture investments and KG Steel’s financial situation.

- Continuously monitor KG Steel’s fund management and investment performance

- Observe steel market recovery and KG Steel’s business diversification strategy

- Consult with financial advisors and align investment decisions with personal goals and risk tolerance

FAQ

What is the purpose of KG Steel’s venture fund investment?

The investment aims to optimize financial asset management, enhance returns, and explore new business opportunities for future growth.

What is the investment amount and its impact on KG Steel’s financial status?

The investment is $480 million and may cause short-term liquidity decrease, although it represents only 3.28% of the company’s capital.

What are the key risks of this investment?

Key risks include the inherent risks of venture investment, uncertainty surrounding fund performance, and the challenging steel market environment.

Leave a Reply