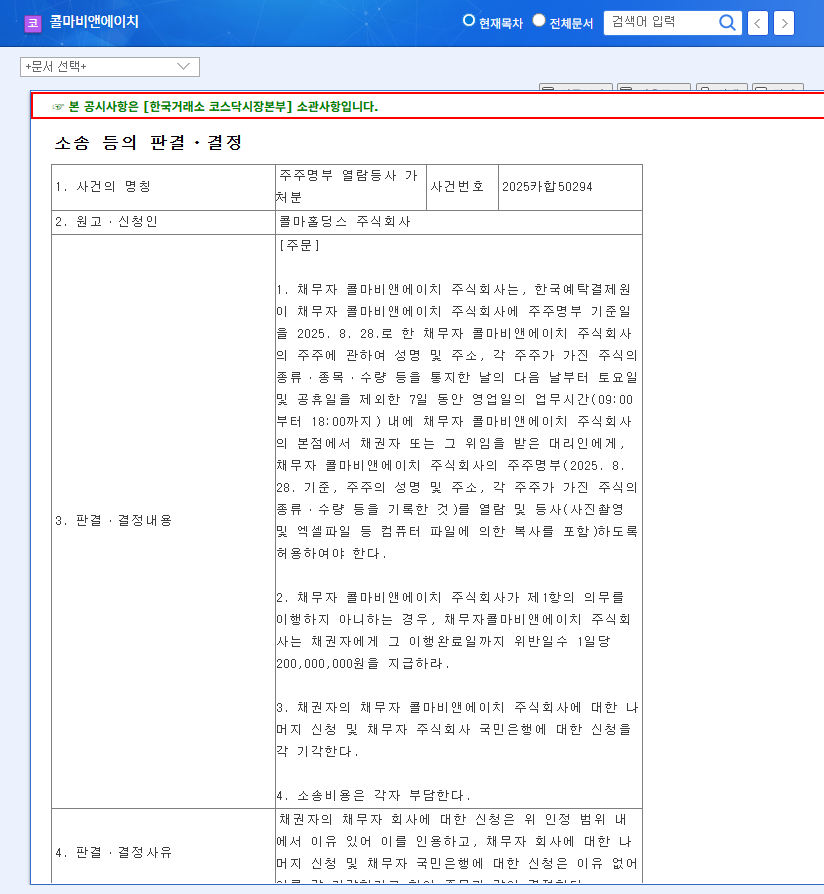

1. What Happened? Kolmar BNH Shareholder Registry Inspection Ruling

The court granted Kolmar Holdings’ request for an injunction to inspect and copy Kolmar BNH’s shareholder registry. This allows Kolmar Holdings access to shareholder information, which can be used for voting at shareholder meetings, participation in management, and other actions.

2. Why Does it Matter? Potential Management Disputes and Investment Implications

This ruling increases the likelihood of a management dispute between Kolmar Holdings and the existing management team. Such disputes can lead to increased management uncertainty, stock price volatility, and changes in business strategy. While the short-term impact on stock price may be negative, there’s potential for positive long-term changes that enhance shareholder value.

3. Kolmar BNH Fundamentals and Market Environment Analysis

Kolmar BNH maintains stable performance in the health functional food and cosmetics ODM/OEM business and continues its efforts to secure new growth engines. However, declining average selling prices and decreased R&D spending require attention regarding profitability and future growth.

4. What Should Investors Do? Kolmar BNH Investment Strategy

- Short-term Investors: Exercise caution due to potential stock price volatility and adopt a prudent investment strategy.

- Long-term Investors: Closely monitor the management dispute and the company’s response, exploring long-term investment opportunities.

- All Investors: Stay informed by referring to company disclosures, news, and market analysis, incorporating this information into investment decisions.

Frequently Asked Questions (FAQ)

What is an injunction for inspection and copying of the shareholder registry?

It’s a court order granting a specific shareholder the right to inspect and copy a company’s shareholder registry.

How will this ruling affect Kolmar BNH’s stock price?

In the short term, increased uncertainty may lead to stock price volatility. However, it could lead to improved corporate governance and enhanced shareholder value in the long run.

What is the outlook for Kolmar BNH?

While the company has a solid business foundation and growth potential, the future outlook depends on the progression of the management dispute and the company’s response.