1. Kolmar Korea’s Q2 IR: What to Expect

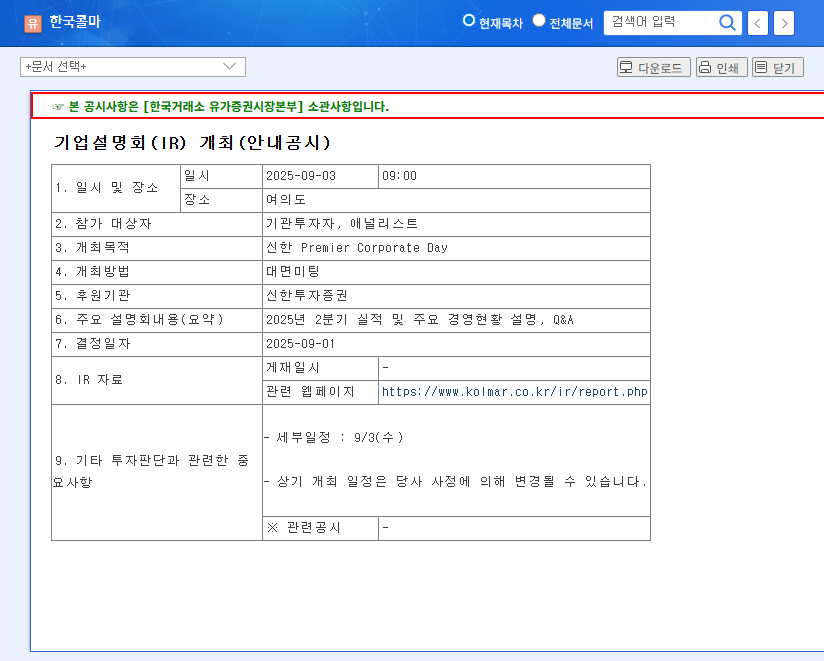

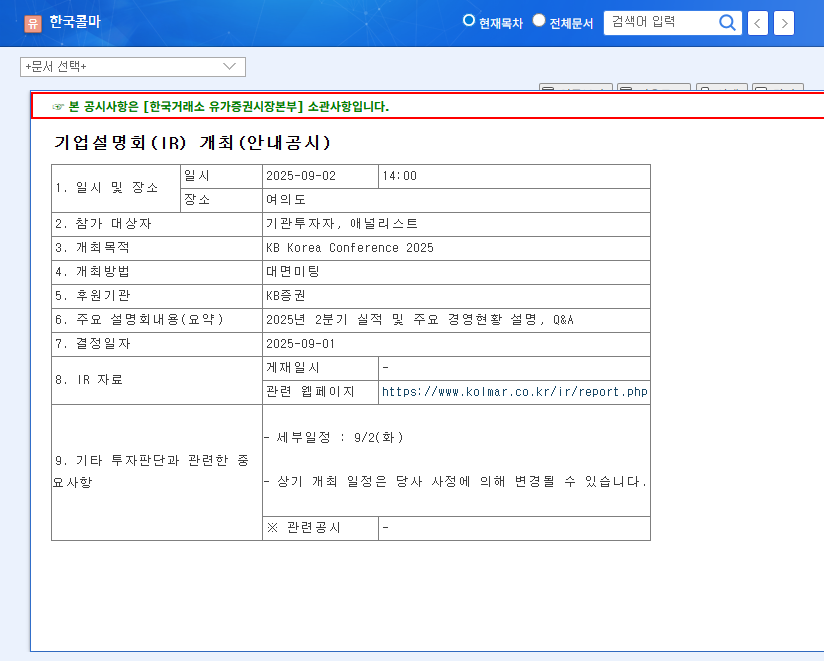

Kolmar Korea will announce its Q2 2025 earnings and key management updates at the ‘Shinhan Premier Corporate Day’ on September 3, 2025, at 9:00 AM. The market is keenly focused on the continued growth of the cosmetics business and the progress of H&K’s new drug development.

2. Core Business Growth and Solid Financials: Investment Highlights

Driven by strong cosmetics ODM performance and H&K’s solid earnings, Kolmar Korea maintains stable growth. The company’s robust financial structure and continuous R&D investment bode well for future growth. Furthermore, their commitment to ESG management fosters sustainable development.

- Strengths: Strong cosmetics performance, H&K earnings contribution, diversified business portfolio, stable financials, R&D investment, strong ESG management

3. Potential Risks: Factors to Consider

Despite the positive outlook, external factors like exchange rate fluctuations, raw material price volatility, interest rate changes, and economic downturns can impact Kolmar Korea’s performance. Increased competition in the cosmetics and pharmaceutical markets is also a key concern.

- Considerations: Exchange rate fluctuations, raw material price volatility, interest rate and economic fluctuations, increased competition

4. Investor Action Plan: Post-IR Strategy

Carefully review the IR presentation and compare it to market expectations to formulate your investment strategy. Pay close attention to management’s future business strategies and risk management plans to make informed investment decisions.

Frequently Asked Questions (FAQ)

What are Kolmar Korea’s main businesses?

Kolmar Korea manufactures and sells cosmetics, pharmaceuticals, and health functional foods. The company excels in cosmetics ODM/OEM and pharmaceuticals.

What are the key takeaways from this IR?

Focus on Q2 earnings, future business strategies, continued cosmetics growth, H&K’s new drug development progress, and strategies for managing exchange rate and raw material price fluctuations.

Is Kolmar Korea a worthwhile investment?

Kolmar Korea demonstrates solid fundamentals and growth potential. However, investment decisions should be made carefully, considering individual risk tolerance and investment goals. Refer to the IR materials and market analysis before making a decision.