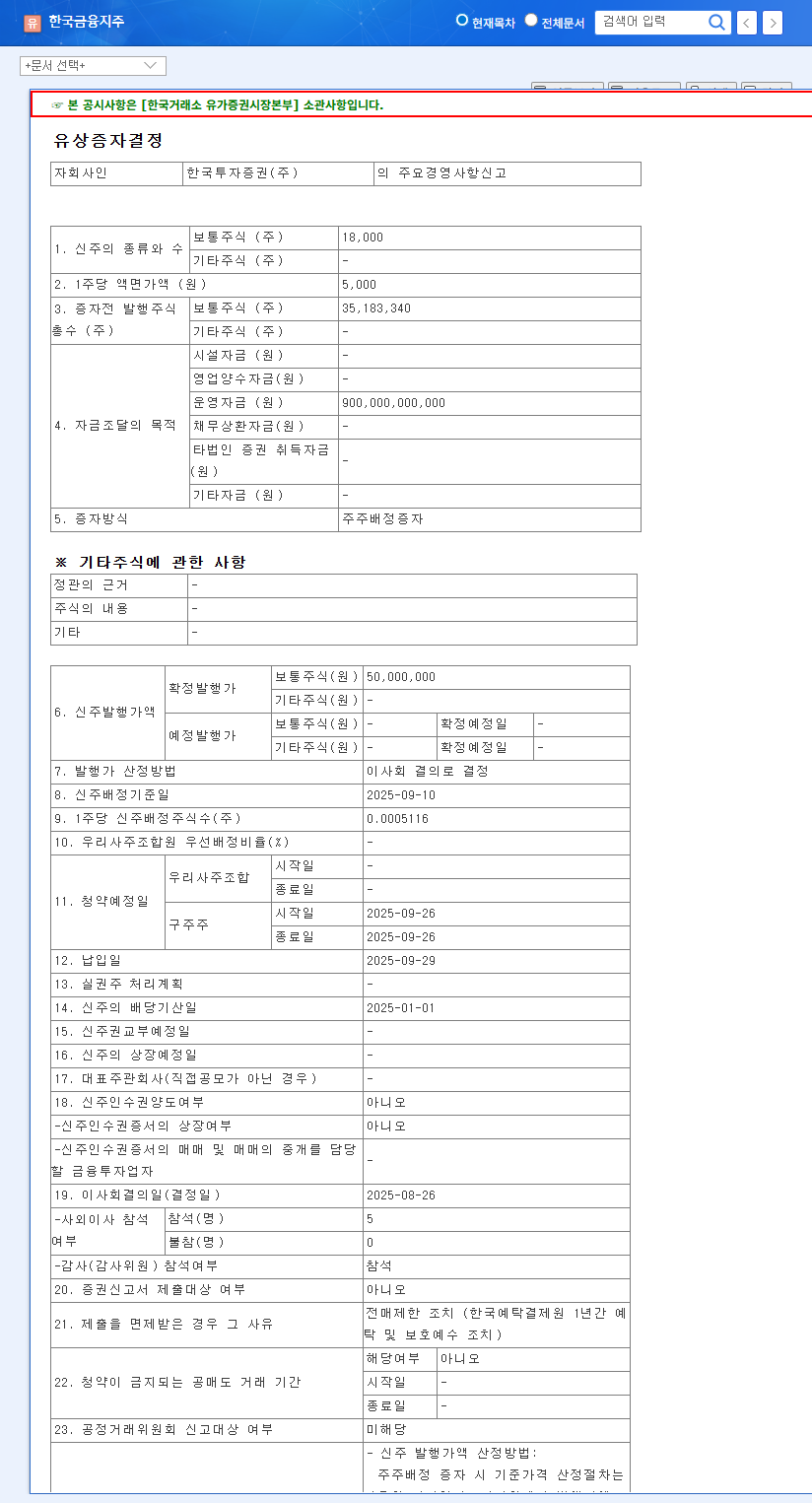

1. What Happened? Korea Financial Group’s Rights Offering

On August 26, 2025, Korea Financial Group announced a $9 billion rights offering for Korea Investment & Securities to secure operating funds.

2. Why the Rights Offering? Background and Purpose

This rights offering aims to strengthen Korea Investment & Securities’ financial stability and lay the groundwork for business expansion. With intensifying competition in the securities industry and accelerating digital transformation, this proactive capital increase is seen as a strategy to secure future growth engines and strengthen market competitiveness. The first half of 2025 saw modest economic growth driven by consumption recovery and export growth, but the financial market is facing intensified competition.

3. What’s the Impact? Analysis for Investors

- Positive Aspects:

- Strengthened financial soundness and potential credit rating improvement through capital increase

- Expected long-term increase in corporate value through business expansion and enhanced competitiveness

- Existing shareholders can maintain their stake through the rights offering

- Negative Aspects:

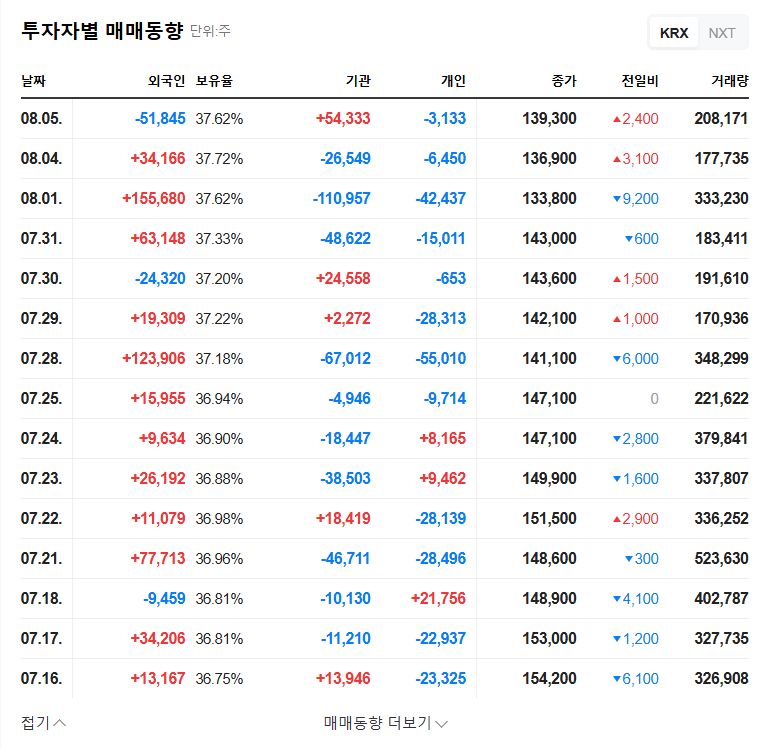

- Potential for short-term stock dilution

- Risk of investment loss if funds are not utilized effectively

4. What Should Investors Do? Action Plan

Rather than reacting to short-term stock price fluctuations, investors should carefully review Korea Financial Group’s growth potential and fund utilization plan from a long-term perspective. It is essential to continuously monitor future disclosures on fund usage plans and business performance and establish an investment strategy aligned with individual investment preferences and goals.

FAQ

Q: What is the size of Korea Financial Group’s rights offering?

A: It is $9 billion.

Q: What is the purpose of the rights offering?

A: It is to secure operating funds for Korea Investment & Securities.

Q: What is the method of the rights offering?

A: It is a rights offering.

Q: How will the rights offering affect the stock price?

A: There is a possibility of stock dilution in the short term, but there is also a possibility of stock price increase depending on business performance in the long term.