1. What Happened? : VIP Asset Management Acquires 5.82% Stake in Korea FT

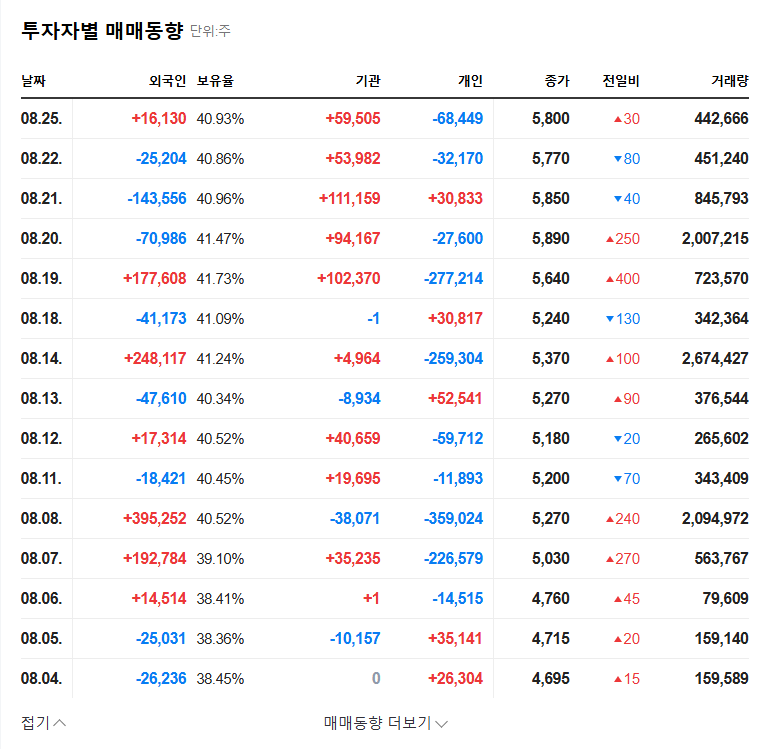

VIP Asset Management acquired a 5.82% stake in Korea FT through on-market purchases from August 19 to 25, 2025. While stated as a simple investment, market expectations are rising regarding Korea FT’s growth potential.

2. Why Did VIP Asset Management Invest in Korea FT? : Analysis of Corporate Fundamentals and Market Expectations

Korea FT manufactures automotive fuel systems and interior parts, and is securing future growth engines by investing in new businesses such as ADAS software and in-vehicle infotainment VIM. While financial soundness is improving, derivative valuation losses due to EUR/KRW exchange rate fluctuations and uncertainties surrounding the new VIM business could pose risks.

3. Impact of this Investment on Korea FT? : Positive Impacts and Potential Risks

- Positive Impacts: Increased institutional investor interest can improve investment sentiment and generate upward momentum in stock price.

- Potential Risks: VIP Asset Management’s further purchase decisions, exchange rate volatility, and uncertainties in the new business can affect the stock price.

4. What Should Investors Do? : Short-term and Mid- to Long-term Investment Strategies

In the short term, VIP Asset Management’s stake disclosure could drive stock price increases. However, in the mid- to long-term, it’s crucial to closely monitor Korea FT’s earnings improvement, new business performance, and exchange rate volatility management capabilities. Thorough analysis and information verification are essential before making investment decisions.

Frequently Asked Questions

How will VIP Asset Management’s stake acquisition affect Korea FT’s stock price?

In the short term, improved investment sentiment and stock price increases can be expected. However, the mid-to-long-term impact depends on the company’s fundamentals and external factors.

What are the investment risks of Korea FT?

Derivative valuation losses due to exchange rate fluctuations and uncertainties related to the new business are key risk factors.

How can I invest in Korea FT?

Before making investment decisions, it’s recommended to thoroughly analyze the company’s financial status, business plans, and market conditions, and seek professional advice.