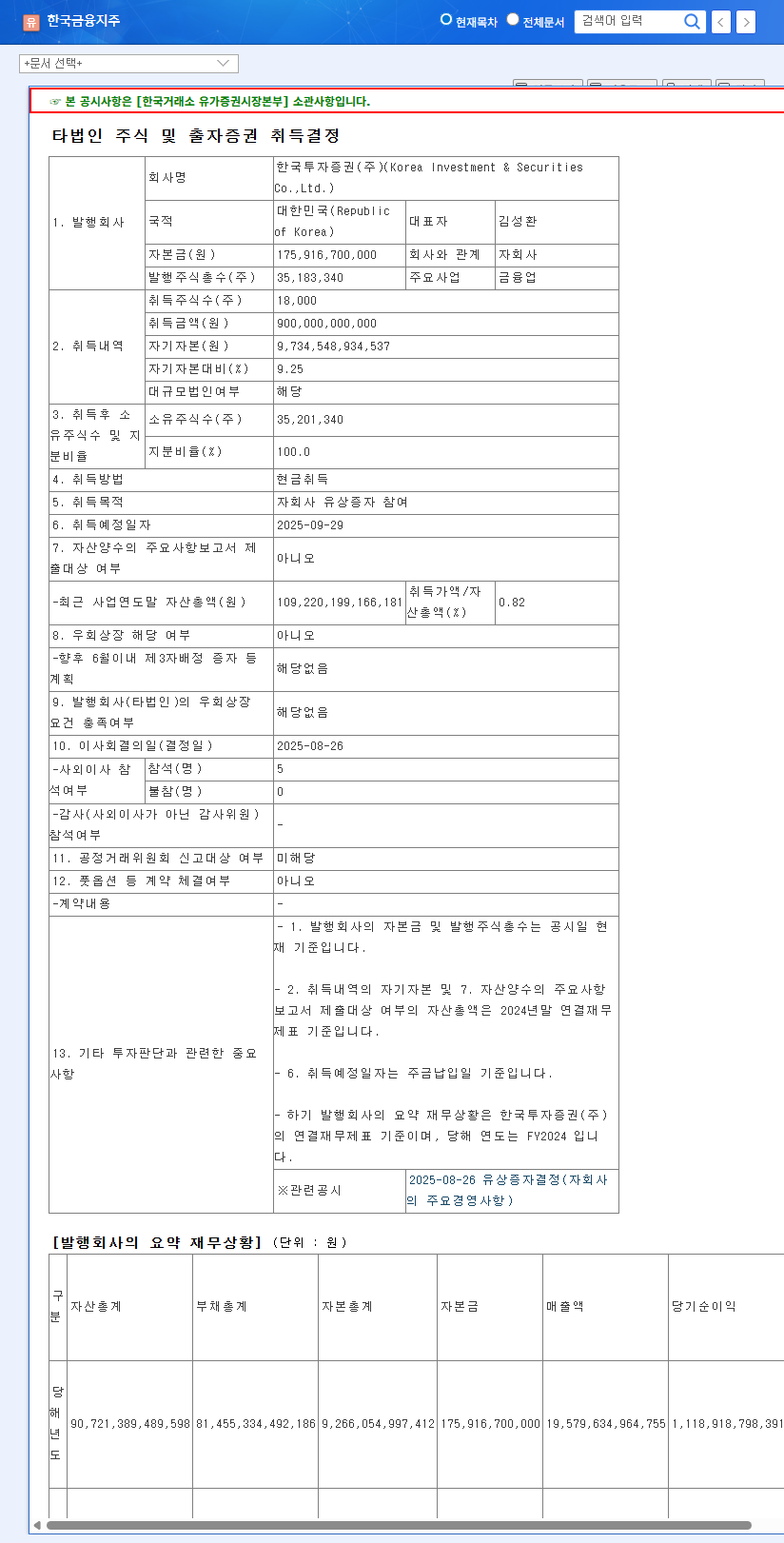

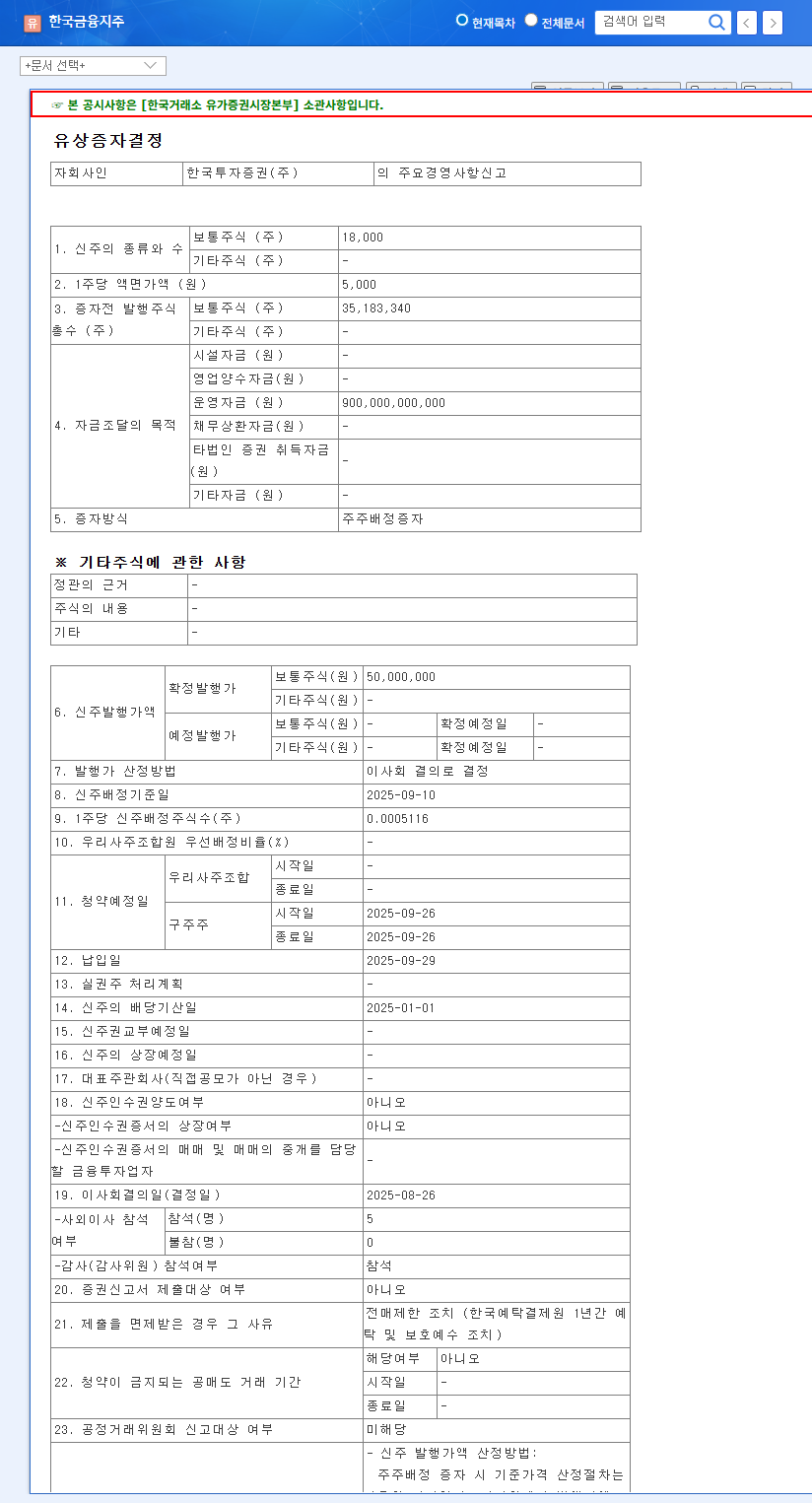

1. What’s the ₩900 Billion Investment About?

Korea Investment & Securities, a key subsidiary of Korea Investment Holdings, is undertaking a ₩900 billion rights offering, fully subscribed by its parent company. Scheduled for September 29, 2025, this investment aims to bolster Korea Investment & Securities’ financial standing and pave the way for future growth.

2. Why This Strategic Decision?

This investment will empower Korea Investment & Securities to enhance its competitiveness in key business areas such as investment banking, asset management, and overseas investments. The increased capital will enable larger-scale investments and provide stability in volatile market conditions. The parent company’s strong support demonstrates confidence in Korea Investment & Securities’ growth potential and boosts market confidence.

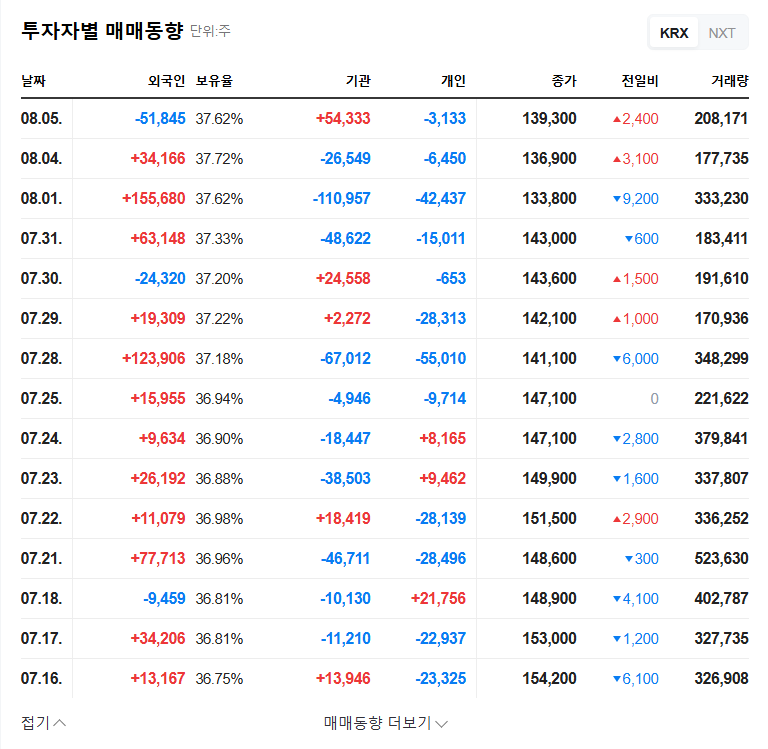

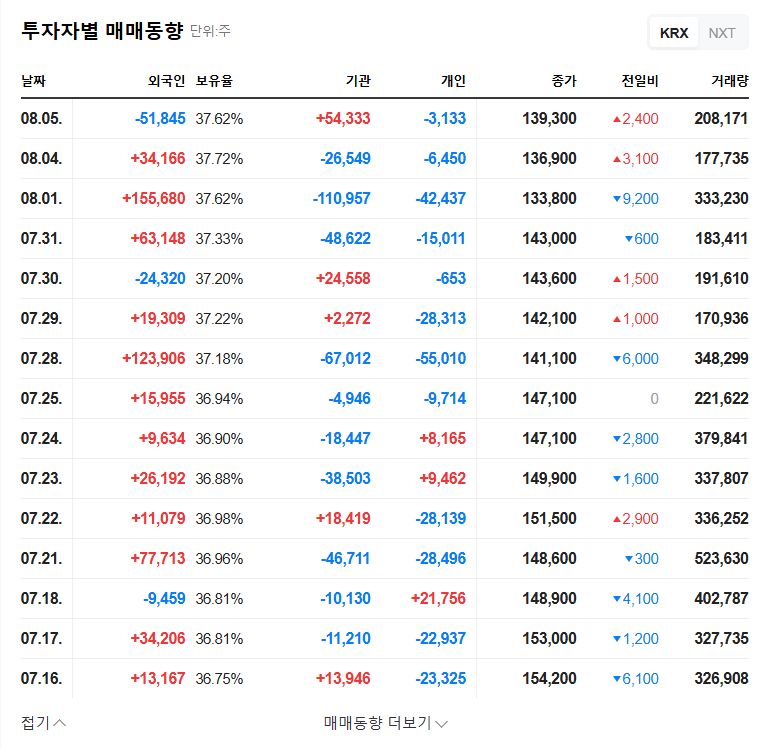

3. What are the Potential Outcomes?

Positive outcomes include enhanced financial health, business expansion and increased competitiveness, a clear signal of parent company support, and positive market sentiment. However, potential risks include short-term liquidity pressures due to the substantial ₩900 billion outflow, uncertainty surrounding investment efficiency, and the overall unstable macroeconomic environment.

- Positive Long-Term Outlook: This investment is a strategic move for Korea Investment & Securities’ long-term growth and is expected to contribute to increased corporate value.

- Short-Term Volatility Expected: Market conditions and the effectiveness of the investment strategy could lead to short-term stock price fluctuations.

4. What Should Investors Do?

Investors should consider the comprehensive impact of this event on both Korea Investment Holdings and Korea Investment & Securities. Focusing on the long-term growth potential rather than short-term price fluctuations is crucial. Before making any investment decisions, consult with financial advisors and carefully assess your investment goals and risk tolerance.

Frequently Asked Questions

What is the size of the investment?

Korea Investment Holdings is investing ₩900 billion into Korea Investment & Securities.

What is the purpose of the investment?

The investment aims to strengthen Korea Investment & Securities’ financial position and provide resources for future business expansion.

What are the potential benefits of this investment?

Potential benefits include enhanced financial health, increased competitiveness, a clear signal of parent company support, and positive market sentiment.

What are the potential risks of this investment?

Potential risks include short-term liquidity pressures, uncertainty about investment efficiency, and the impact of the macroeconomic environment.

What should investors consider?

Investors should focus on the long-term growth potential and consult with financial advisors before making any investment decisions.