Korea Land Trust Q2 2025 Earnings: Key Takeaways

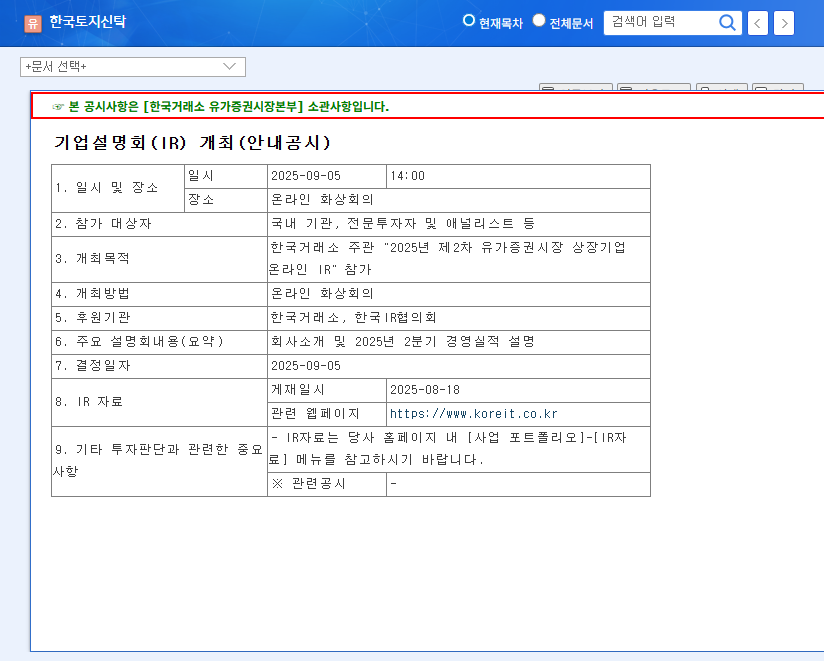

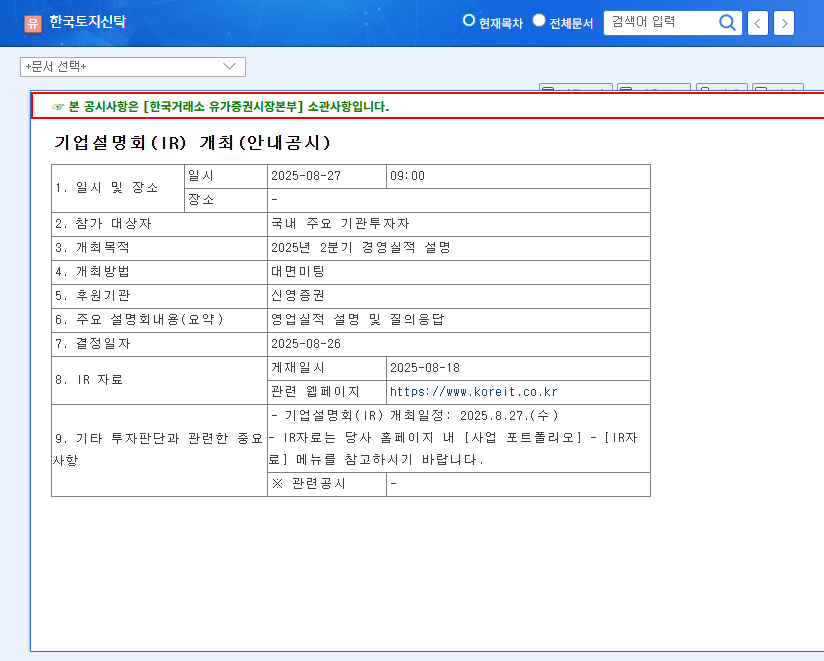

On September 5, 2025, Korea Land Trust released its Q2 2025 financial results. Market attention was focused on the performance following a slight return to profitability in Q1 and the progress of key businesses like urban redevelopment and REITs.

Reasons for Performance and Recovery Strategies

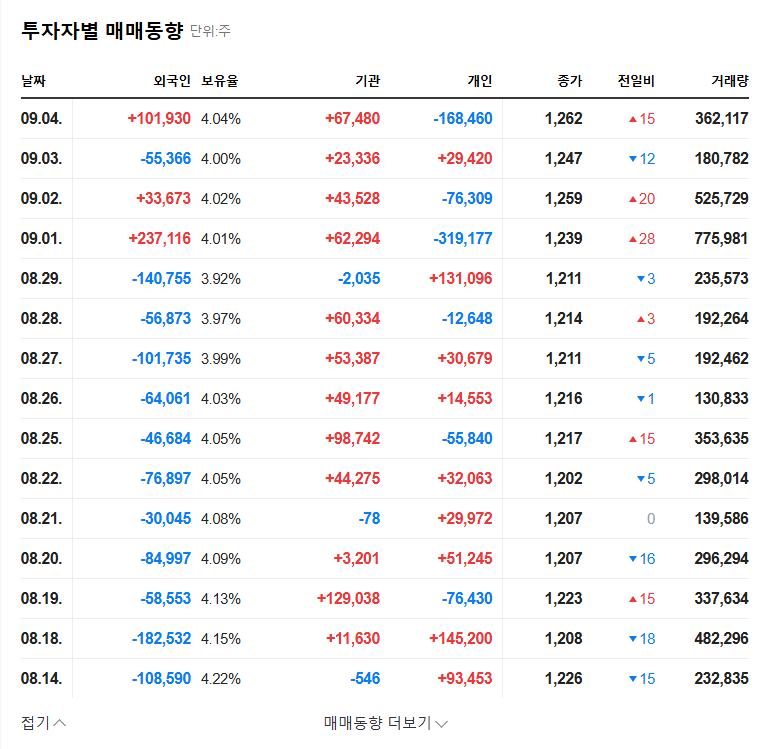

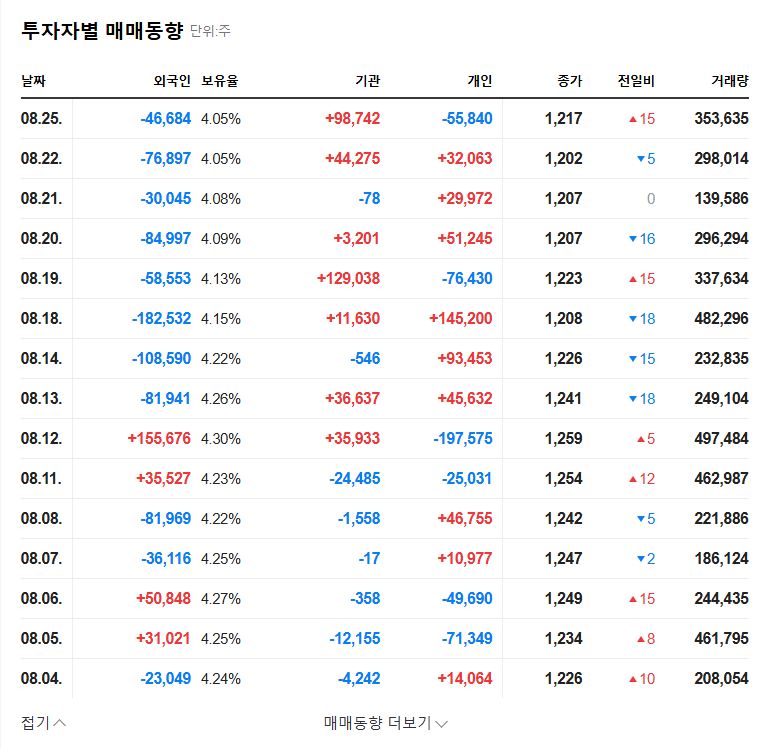

The recent downturn in the real estate market and changes in the interest rate environment have negatively impacted Korea Land Trust’s performance. Key profit and loss items, such as trust fees, interest income on trust accounts, and gains on securities valuation and disposal, are trending downwards. However, the company is pursuing diversification strategies, including reducing its reliance on loan-based trust and expanding its focus on urban redevelopment and REITs.

Key Checkpoints for Investors

- Q2 Earnings: Whether the trend of returning to profit is sustained and future outlook.

- Portfolio Diversification: Performance and growth potential of urban redevelopment and REIT businesses.

- Risk Management: Strategies for responding to macroeconomic variables such as interest rates and exchange rate fluctuations.

- ESG Management: Efforts to strengthen ESG management for sustainable growth.

Investment Strategy: Should You Invest in Korea Land Trust Now?

It’s crucial to carefully analyze the IR presentation and make investment decisions based on a comprehensive consideration of market conditions and macroeconomic indicators. Pay close attention to the growth potential of the urban redevelopment and REITs businesses and Korea Land Trust’s risk management capabilities.

FAQ

What are the main businesses of Korea Land Trust?

Korea Land Trust primarily provides comprehensive real estate financial services, focusing on real estate trust business. In addition to loan-based land trust, they operate a diversified business portfolio, including urban redevelopment and REITs.

How has Korea Land Trust been performing recently?

Recent performance has been somewhat sluggish due to the downturn in the real estate market, but the company returned to a slight profit in Q1 2025. You can find details on Q2 performance and future outlook in the IR materials.

What are the key investment points for Korea Land Trust?

Key investment points include the growth potential of urban redevelopment and REITs businesses, a stable financial structure, and proactive ESG management efforts.