1. What Happened?

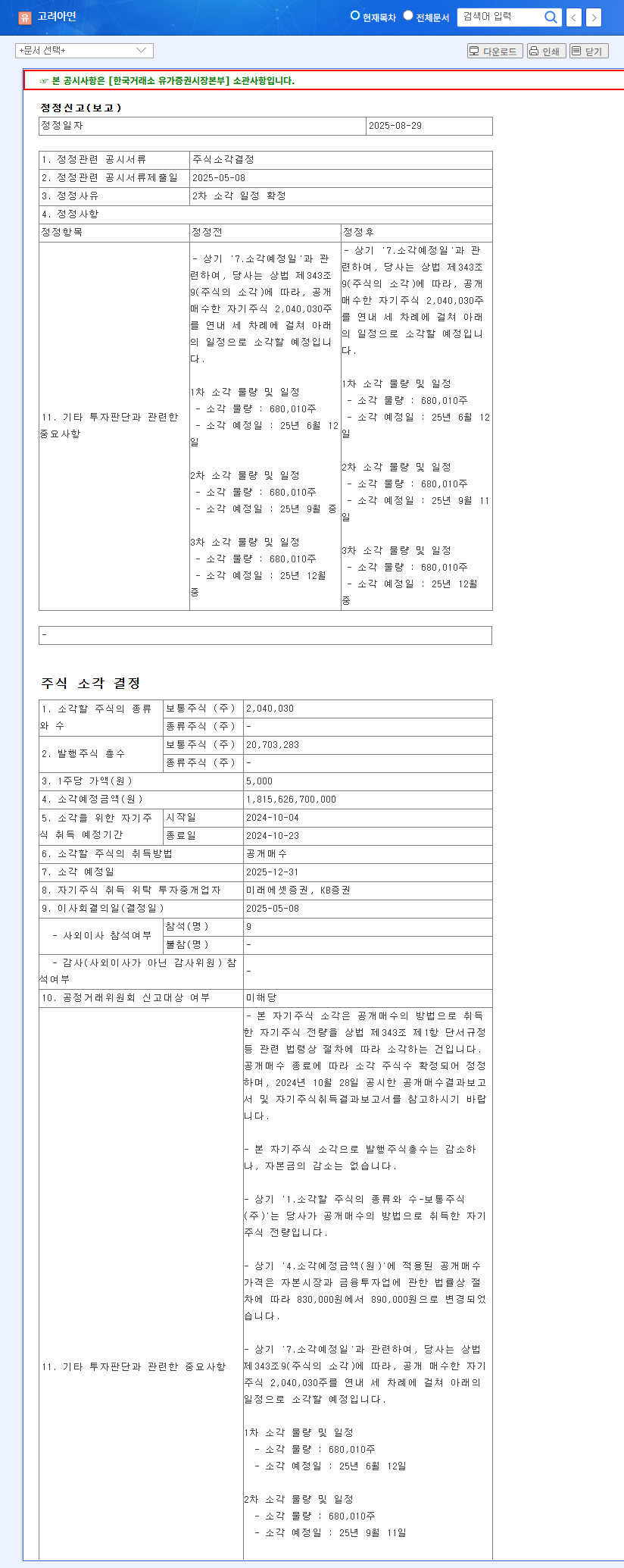

Korea Zinc will repurchase and retire approximately KRW 1.8156 trillion worth of its own shares by the end of 2025. This represents a significant portion, about 11.28%, of its outstanding shares.

2. Why the Buyback?

Share buybacks are a common way to return value to shareholders. Reducing the number of outstanding shares increases earnings per share (EPS) and book value per share (BPS), potentially driving up the stock price. It’s also interpreted as a strategic move to consolidate friendly stakes amidst the ongoing management dispute.

3. So, What Happens to the Stock Price?

- Short-Term Impact: The announcement can boost investor sentiment and lead to a short-term price increase. However, the substantial $1.8 billion outflow could pose a short-term financial burden.

- Long-Term Impact: The long-term stock performance depends on the company’s fundamentals, growth potential of new businesses, and the outcome of the management dispute.

4. What Should Investors Do?

- Short-Term Investors: Capitalize on the potential short-term momentum, but carefully consider when to take profits.

- Long-Term Investors: Closely monitor the management dispute, new business performance, and any further shareholder return policies, adjusting investment strategies accordingly. Consider the potential for weakened financial health.

What is a share buyback?

A share buyback is when a company repurchases its own shares from the market and retires them. This reduces the number of outstanding shares, increasing the value of each remaining share, which is generally beneficial for shareholders.

How will Korea Zinc’s buyback affect its stock price?

While it can be a positive catalyst in the short term, the long-term impact will depend on the company’s fundamentals, new business growth, and the resolution of the management dispute.

What should investors be cautious about?

Investors should carefully consider the potential financial burden from the large cash outflow and the ongoing management dispute. The macroeconomic environment and volatility in the base metals market should also be monitored.