1. Krafton IR: What was discussed?

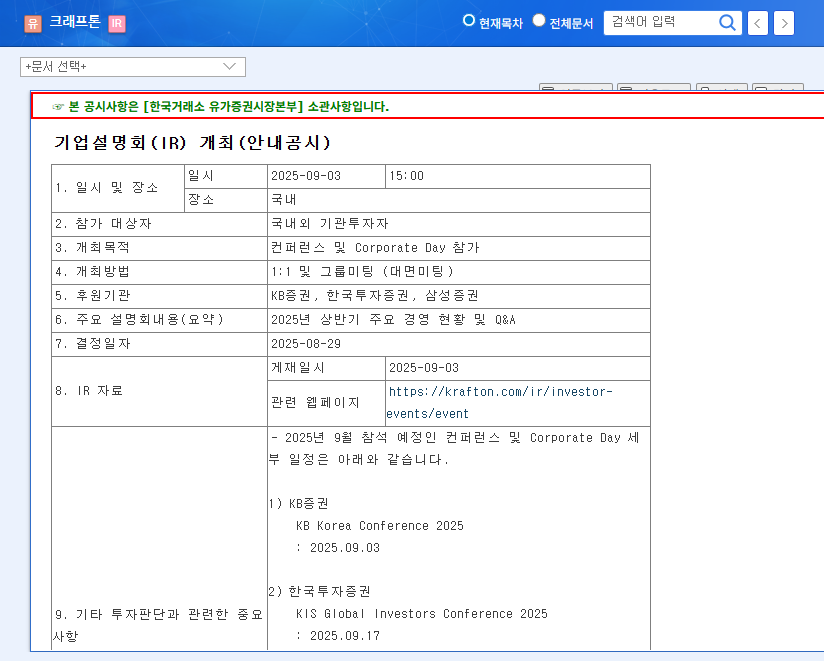

On September 3, 2025, Krafton held its IR presentation as part of its conference and Corporate Day participation. The company shared its 2025 first-half performance and future strategies, and addressed investor questions. Key takeaways include:

- Sluggish Performance: Declining performance of ‘PUBG Mobile’ and weakening PC sales contributed to a significant drop in revenue and operating profit.

- Future Growth Engines: Krafton aims to secure new growth drivers through the launch of its new IP ‘inZOI’ and investments in AI technology.

- Business Diversification: The company is expanding beyond gaming into areas like short-form dramas and ad tech.

2. Why is this important?

This IR is a crucial indicator of Krafton’s future trajectory. Investors should pay close attention for the following reasons:

- Overcoming Slowing Growth: Krafton faces the challenge of overcoming slowing growth. The IR needs to present concrete strategies to address this issue.

- New IP Success: The market has mixed expectations regarding the success of ‘inZOI’. The IR needs to provide concrete information and a clear vision for ‘inZOI’ to gain investor confidence.

- Leveraging AI: Krafton is actively investing in AI technology. The IR needs to clearly explain how this technology will be applied to game development and operations.

3. What should investors do?

Investors should carefully analyze the information presented in the IR and focus on the following:

- ‘inZOI’ Launch Plan and Projected Performance: Look for specific details such as release date, target market, and projected sales.

- AI Investment Results and Commercialization Plan: Examine the roadmap for integrating AI into game development and operations.

- Global Market Strategy: Assess the plans for expansion into key markets and strategies for improving performance.

4. Action Plan for Investors

Develop an investment strategy based on the information presented in the IR.

- Positive Signals: Concrete and achievable growth strategies, strong potential for ‘inZOI’ success, and successful commercialization of AI are positive signs.

- Negative Signals: Vague future strategies, uncertain prospects for ‘inZOI’, and lack of a clear plan for AI utilization are negative signals.

It is crucial to make investment decisions based on a comprehensive consideration of the IR content and market conditions.

How was Krafton’s performance in the first half of 2025?

Krafton experienced a decline in both revenue and operating profit in the first half of 2025. This was primarily due to the underperformance of ‘PUBG Mobile’ and weakening PC sales.

What is Krafton’s new IP ‘inZOI’?

‘inZOI’ is Krafton’s new intellectual property. The IR is expected to reveal more concrete information and launch plans for ‘inZOI’.

How is Krafton investing in AI technology?

Krafton is actively investing in core AI research and development. The company plans to leverage AI to improve efficiency in game development and operations.