1. What Happened?: Large Holding Report Analysis

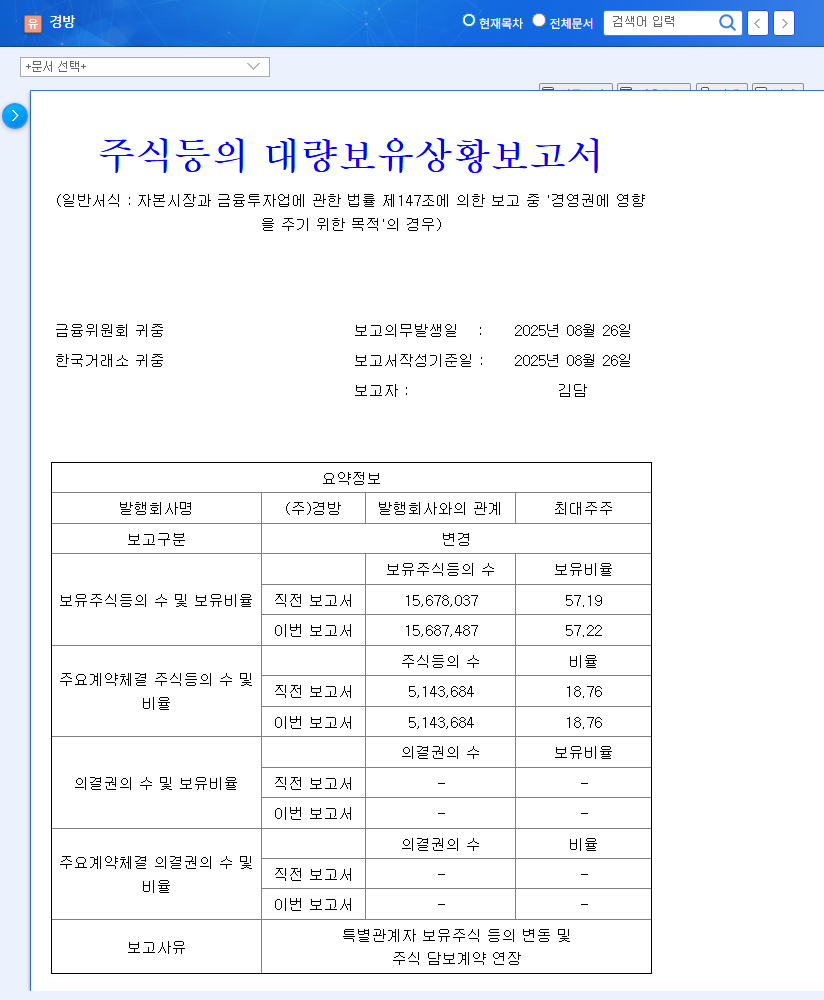

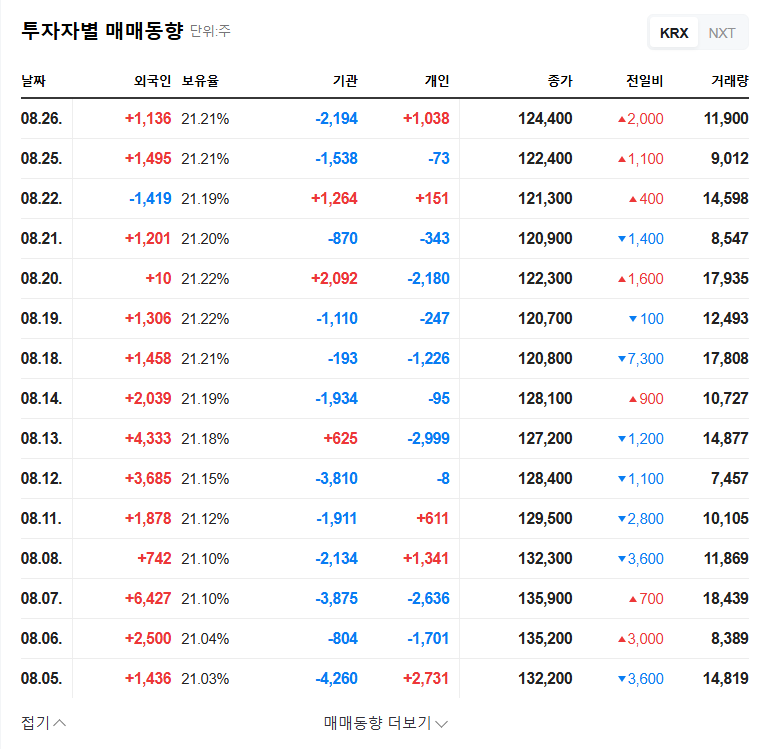

On August 27, 2025, Kyungbang’s CEO, Kim Dam, reported a slight increase in his stake from 57.19% to 57.22%. The reason for the change is the fluctuation of shares held by related parties and the extension of stock collateral agreements. Although reported for the purpose of influencing management control, the change in stake itself is minimal.

2. Why It Matters: Fundamental and Market Analysis

This report reaffirms the stability of management control. However, it is necessary to consider Kyungbang’s fundamentals, which have both positive and negative aspects.

- Positive Factors: Strong real estate development business, efforts to transition the textile business to eco-friendly practices, stable financial structure

- Negative Factors: Sluggish textile business, financial risks of the JEDI subsidiary, high proportion of investment real estate, sensitivity to raw materials and exchange rates

The recent rise in exchange rates is a burden on the textile business, but the possibility of interest rate cuts is positive.

3. What To Do: Investment Strategy

The impact of the large holding report itself is limited. Rather, factors such as a turnaround in the textile business, financial improvement of the JEDI subsidiary, and changes in the macroeconomic environment will have a greater impact on the stock price. The current investment opinion is ‘Neutral’.

4. Action Plan for Investors

Rather than making hasty investment decisions, the following factors should be continuously monitored:

- Whether the textile business performance improves

- Improvement in the financial structure of the JEDI subsidiary

- Exchange rate and interest rate trends

- Real estate market conditions

Frequently Asked Questions

What are Kyungbang’s main businesses?

Kyungbang engages in textile manufacturing and sales, real estate leasing and development.

Will this large holding report have a significant impact on the stock price?

The impact of the report itself is expected to be limited. It is positive in terms of management stability, but fundamental and market conditions should be considered comprehensively.

What should investors be aware of when investing in Kyungbang?

Investors should pay close attention to the sluggish textile business, the financial risks of the JEDI subsidiary, and exchange rate and interest rate volatility.