1. The ₩44.2B Lawsuit: What Happened?

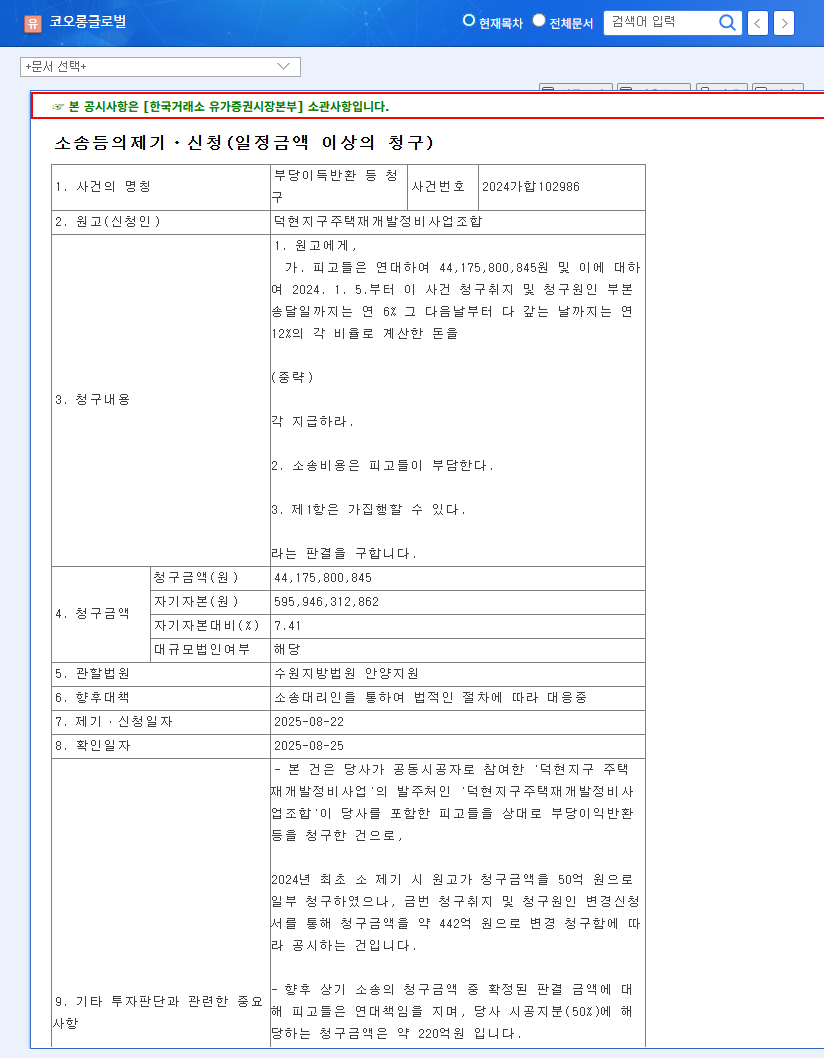

Kolon Global is being sued by a redevelopment association for ₩44.2 billion, alleging unjust enrichment. The core issue revolves around claims of improper gains during a redevelopment project. Kolon Global has retained legal counsel and is actively defending itself.

2. Potential Impact of the Lawsuit

This lawsuit could have various impacts on Kolon Global’s financial standing and stock price. In the short term, it could increase financial burden and negatively affect investor sentiment. Long-term impacts could include changes to profitability and financial structure, depending on the outcome, and potential effects on future redevelopment contracts.

3. What Should Investors Do?

Investors should closely monitor the lawsuit’s progress and any official announcements from the company. It’s crucial to reassess investment strategies, considering the potential risks associated with the lawsuit’s outcome. Avoid hasty decisions and prioritize careful investment choices based on objective information.

4. Investor Action Plan

- Stay Informed: Continuously monitor Kolon Global’s official announcements and related news for updates on the lawsuit.

- Assess Risk: Evaluate the potential for loss based on possible outcomes and adjust your investment strategy accordingly.

- Seek Advice: Consult with a financial advisor if necessary to adjust your portfolio or take other appropriate actions.

Frequently Asked Questions

Q: How might this lawsuit affect Kolon Global’s stock price?

A: In the short term, negative investor sentiment could put downward pressure on the stock. The medium to long-term impact will depend heavily on the outcome of the lawsuit, potentially increasing volatility.

Q: How is Kolon Global responding to the lawsuit?

A: Kolon Global has stated that they have retained legal counsel and are actively defending themselves through the appropriate legal channels.

Q: What actions should investors take?

A: Investors should closely monitor the progress of the lawsuit and company announcements. It’s advisable to reassess investment strategies and consult with a financial advisor if needed.