LG’s Q2 Earnings: A Mixed Bag

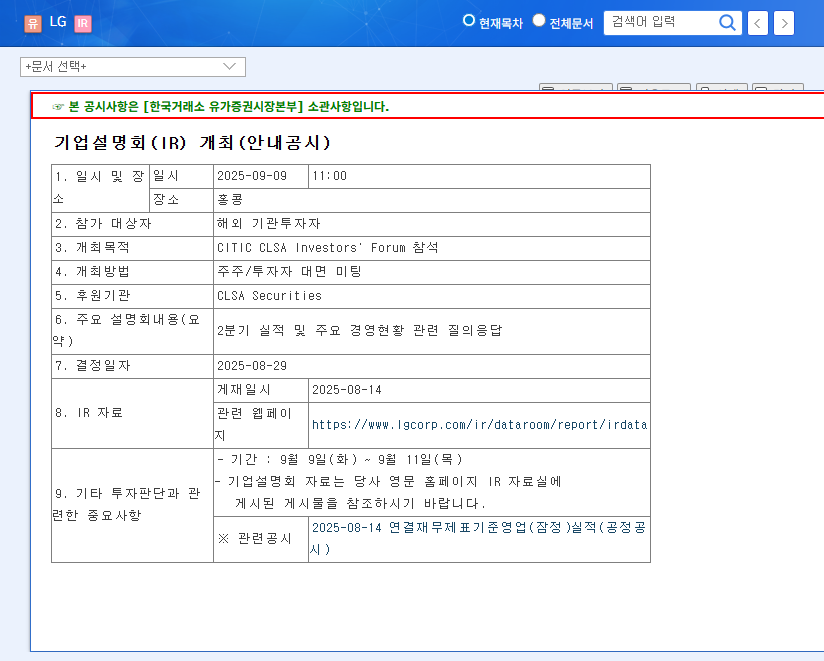

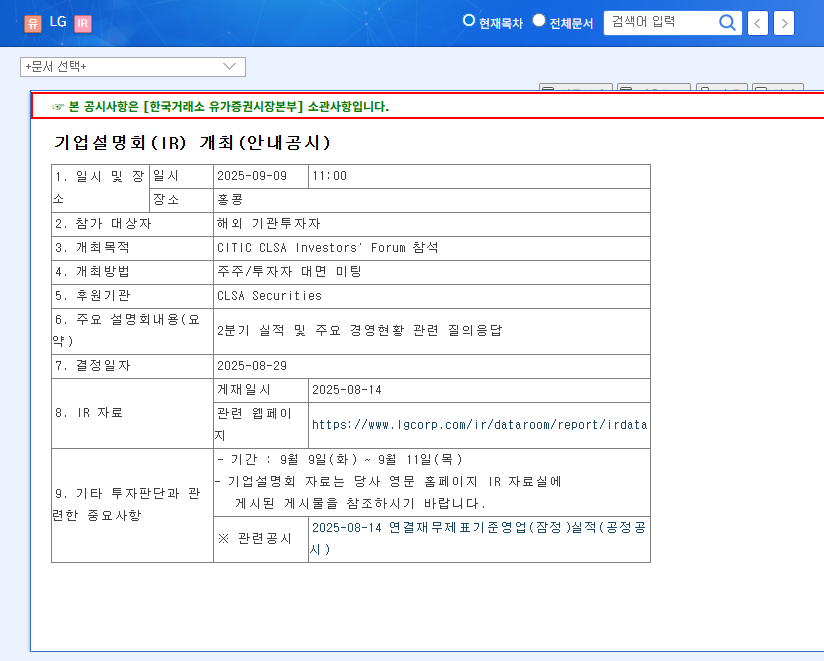

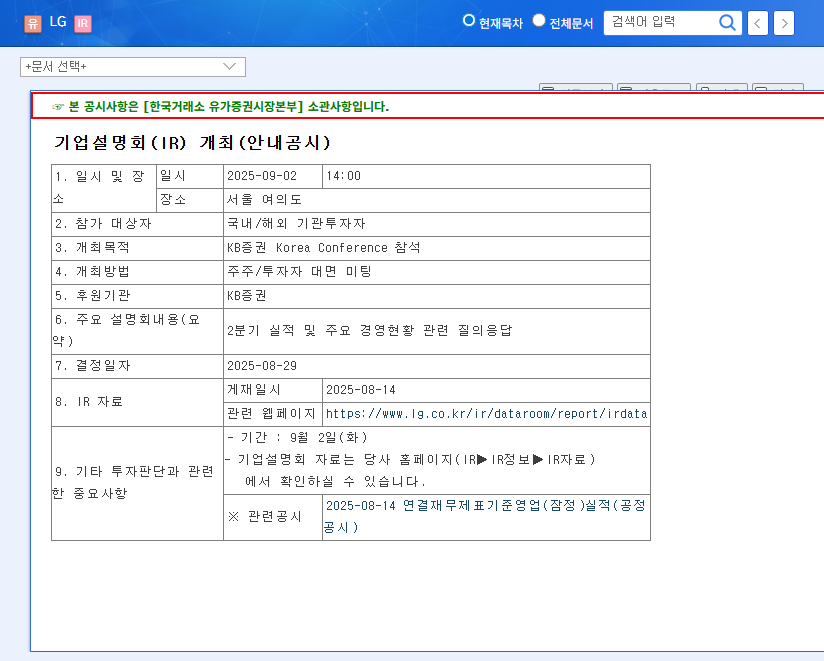

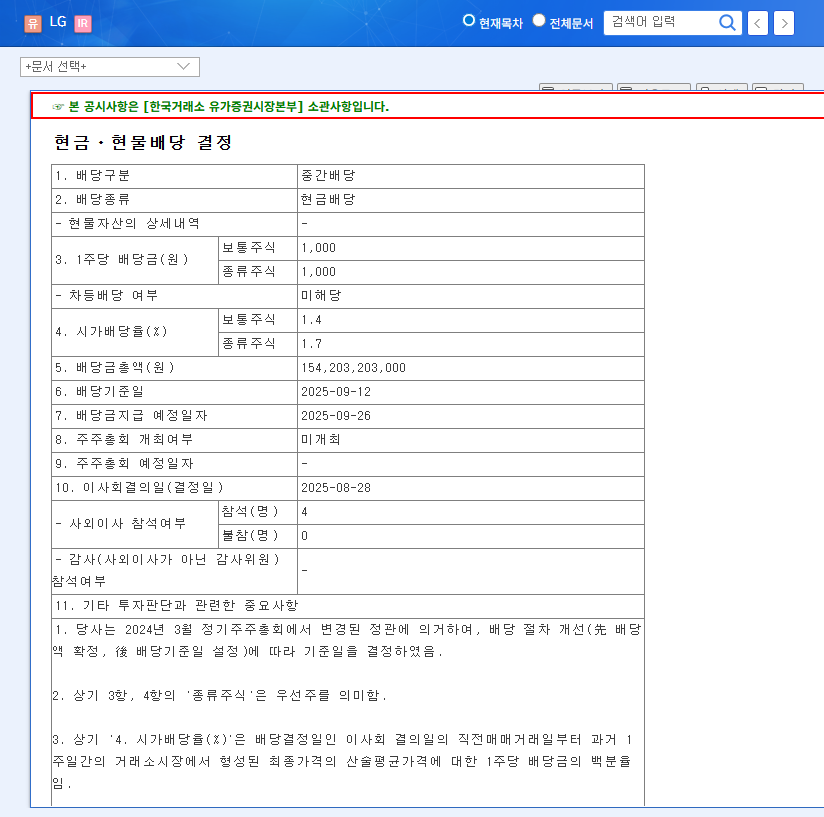

LG’s Q2 2025 earnings presented a contrasting picture between standalone and consolidated figures. Standalone operating profit declined 18.3% year-on-year due to lower dividend income. However, consolidated revenue grew by 8.3%, driven by strong performance in LG CNS’s IT services and improvements in LG Energy Solution’s results. This mixed performance presents both opportunities and concerns for investors evaluating LG’s future.

Growth Drivers and Future Strategies: AI, Renewable Energy, and Advanced Materials

LG is focusing on AI, renewable energy, and advanced materials to secure future growth engines. The expansion of LG CNS’s AI and cloud business and LG Energy Solution’s increasing global market share are expected to support LG’s long-term growth. The forum is expected to provide details on the progress and future investment plans for these new growth businesses.

Key Takeaways for Investors

Investors should carefully analyze the information provided during LG’s IR activities. Pay close attention to the following:

- • Plans to address the decline in standalone performance

- • Strategies to navigate macroeconomic uncertainties

- • Explanations for the volatility in subsidiary performance

- • Concrete plans for securing future growth engines

Based on this information, investors should comprehensively assess LG’s investment value and make informed decisions aligned with their investment strategies.

Frequently Asked Questions

What was the main reason for LG’s decline in Q2 standalone earnings?

The primary factor was a decrease in dividend income, suggesting potential slowdowns in subsidiary performance or changes in dividend policies.

What are LG’s future growth drivers?

LG is focusing on AI, renewable energy, and advanced materials to drive its future growth.

What key information should investors focus on from this IR event?

Investors should pay attention to plans for improving standalone performance, strategies for dealing with macroeconomic uncertainties, explanations for subsidiary performance volatility, and plans for securing future growth engines.