LG Q2 2025 Earnings Call: Key Analysis and Investment Strategies

1. What Happened?: Q2 Earnings and Subsidiary Performance

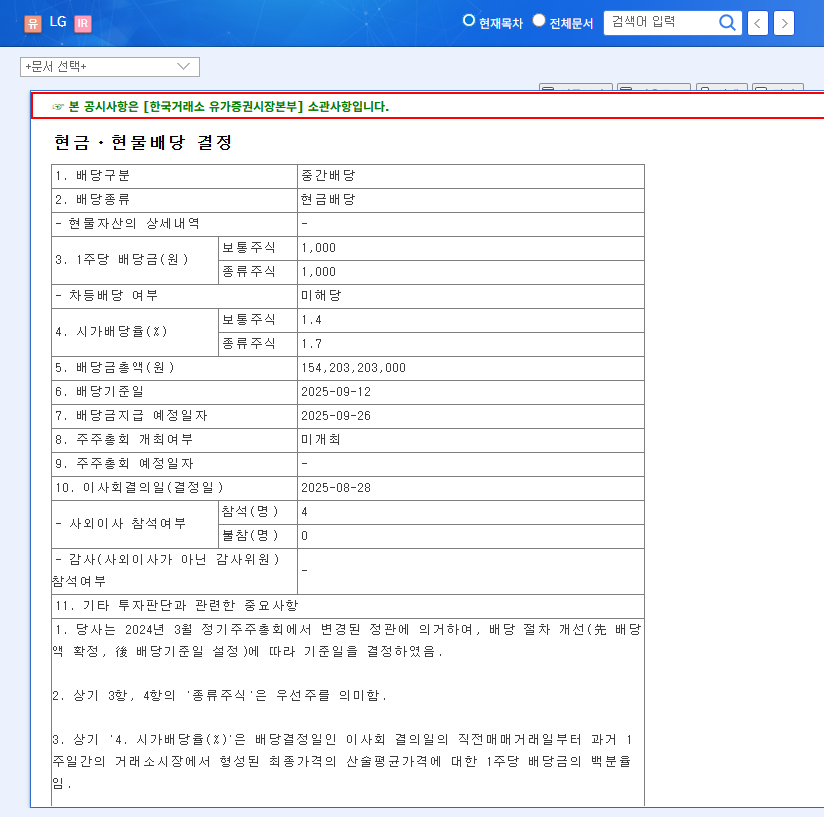

LG recorded consolidated revenue of KRW 3.7338 trillion in the first half of 2025, an 8.3% increase year-over-year. Strong performance from LG Energy Solution and LG CNS drove this growth. However, the continued deficit in LG Chem’s petrochemical division and declining sales prices for some LG Electronics products raise concerns.

- LG CNS: Showed strong growth in cloud, AI, and digital business services.

- LG Electronics: Demonstrated growth in new businesses like VS (Vehicle component Solutions) and camera modules.

- LG Chem: Positive signs from LG Energy Solution’s performance and LG Chem’s life sciences division turning profitable are countered by ongoing losses in the petrochemical division.

- LG Uplus: 5G business growth is positive, but slowing growth in the IPTV market is a concern.

2. Why These Results?: Positive and Negative Influences

Enhanced communication and sharing of growth drivers through the IR event are positive. However, varying subsidiary performance and macroeconomic uncertainties pose challenges.

3. What’s Next?: Outlook and Investment Strategies

LG is expected to maintain stable fundamentals and continue its growth trajectory, driven by LG CNS and LG Electronics. However, a cautious investment approach is necessary, considering risk factors like the global economic slowdown.

- Maintain a Long-Term Perspective

- Monitor Key Subsidiary Performance

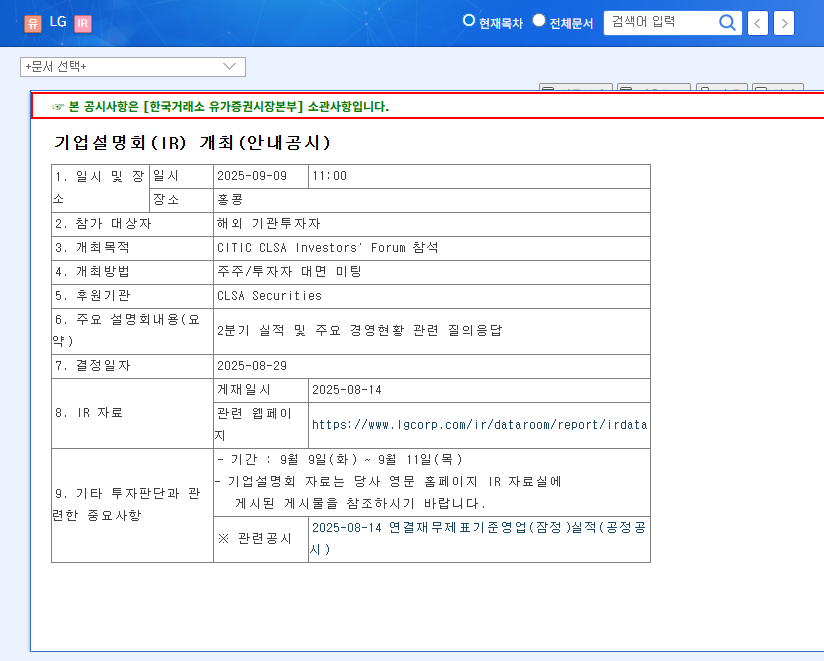

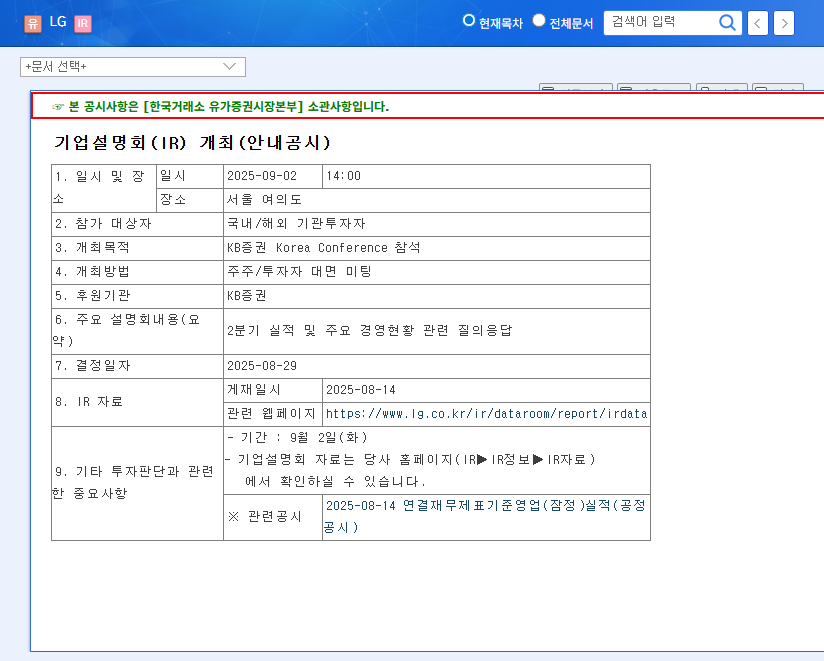

- Review Investment Strategy After the September 3rd IR Event

4. Investor Action Plan

Carefully analyze the Q2 2025 earnings and management updates released on September 3rd and adjust your investment strategy accordingly. Continuously monitor macroeconomic volatility and subsidiary performance variations.

Frequently Asked Questions (FAQ)

How did LG perform in Q2 2025?

LG recorded consolidated revenue of KRW 3.7338 trillion in Q2 2025, an 8.3% increase year-over-year.

What are LG’s main growth drivers?

Strong performance from LG Energy Solution and LG CNS drove LG’s growth. LG CNS, in particular, showed strong growth in cloud, AI, and digital business services.

What are the key considerations for investing in LG?

Investors should consider the global economic slowdown, geopolitical risks, the ongoing deficit in LG Chem’s petrochemical division, and declining sales prices for some LG Electronics products.