1. What Happened? LG Innotek Q2 2025 Earnings Overview

LG Innotek reported a significant decline in operating profit and net income in Q2 2025 compared to the same period last year. Several factors contributed to this downturn, including macroeconomic uncertainty, increased competition, and rising costs. The company’s heavy reliance on the optical solutions business and its substantial inventory levels (KRW 1.46 trillion) present significant risks.

2. Why Did This Happen? Analyzing the Factors Behind the Decline

The primary drivers of the profit decline are maturing mobile market conditions, intensifying competition, rising costs, and exchange rate volatility. As a company heavily reliant on optical solutions, LG Innotek was directly impacted by the slowdown in the mobile market. Global economic uncertainties and resulting fluctuations in exchange rates and raw material prices also contributed to the negative performance.

3. What’s Next? Key IR Focus Areas & Future Outlook

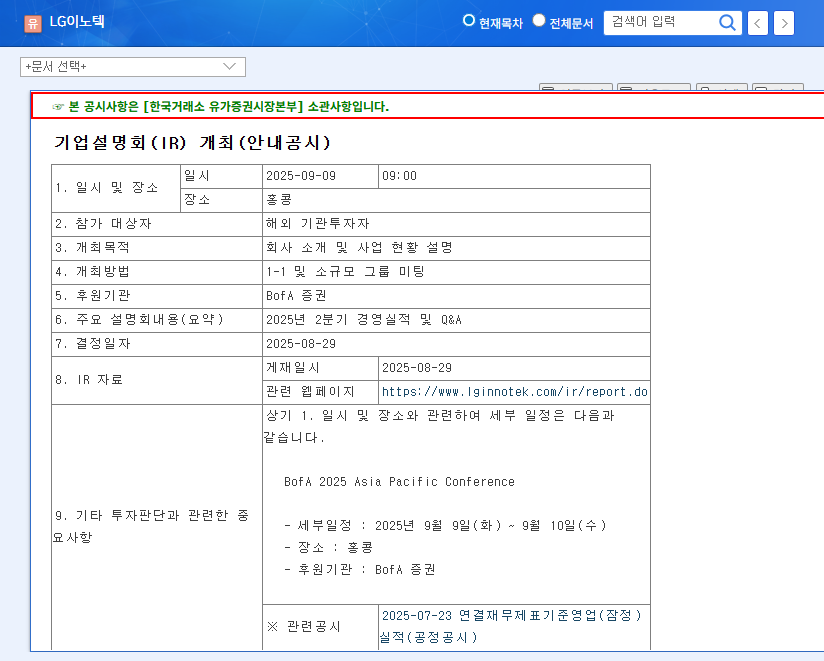

The September 9th IR meeting is expected to focus on strategies for improving profitability and growth plans for new business areas such as substrate materials and automotive components. Investors will be closely watching for concrete growth roadmaps and plans for future technology investments. The IR’s content could significantly impact short-term stock price volatility. In the long term, the company’s ability to enhance its competitiveness and diversify its portfolio will determine its future trajectory.

4. Action Plan for Investors

- Analyze the IR: Carefully review the earnings data, business outlook, and Q&A session from the IR to inform your investment decisions.

- Monitor Macroeconomic Factors: Stay informed about fluctuations in exchange rates, interest rates, and raw material prices, and understand their impact on LG Innotek’s performance.

- Analyze Competitors: Conduct comparative analyses with competitors to assess LG Innotek’s relative strengths and weaknesses.

Frequently Asked Questions

What are LG Innotek’s main business segments?

LG Innotek operates in optical solutions, substrate materials, and automotive components. They are a global leader in smartphone camera modules.

What are the key things to watch for in the upcoming IR?

Focus on their explanation for the Q2 decline, strategies for profit improvement, and concrete growth plans for new business areas like substrate materials and automotive components.

What is the outlook for LG Innotek’s stock price?

Short-term price volatility is expected depending on the IR’s content and market reaction. Long-term prospects depend on the company’s ability to strengthen competitiveness and grow its new businesses.