1. Naibek IR: What to Expect?

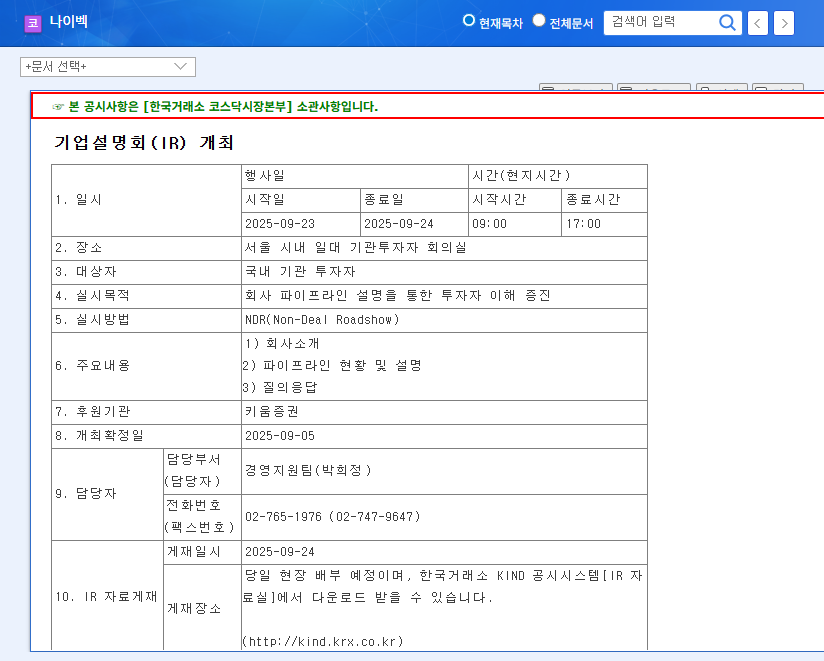

On September 23, 2025, at 9:00 AM, Naibek will hold an investor relations (IR) session. The company will provide a detailed overview of its business, key pipeline updates, and future growth strategies. Investors are particularly eager for details regarding the recently announced licensing agreement with a US biopharmaceutical company.

2. Why Naibek?

Naibek has established a stable foundation in the dental bone graft material market and is driving innovative growth through the development of peptide-based pharmaceuticals.

- $430M Licensing Agreement: The licensing of NP-201 (peptide fibrosis treatment) validates Naibek’s technological prowess. The substantial milestone and royalty payments will strengthen their financial position and accelerate future R&D efforts.

- Diverse Pipeline: With a pipeline of peptide treatments for various diseases including fibrosis, obesity, and sarcopenia, Naibek demonstrates high growth potential.

- CDMO Business Expansion: The establishment of GMP facilities for peptide APIs marks their entry into the CDMO market, creating a new revenue stream.

Their 2025 semi-annual report highlights strong financial performance, including increased revenue and a return to profitability, signaling continued growth.

3. The Impact of the IR

This IR is expected to positively impact investor sentiment and potentially re-evaluate Naibek’s corporate value. Providing details on the licensing agreement and increasing pipeline visibility can enhance investor confidence. However, failing to meet market expectations or providing unsatisfactory responses to unexpected questions could lead to short-term stock volatility.

4. Investor Action Plan

If you are considering investing in Naibek, carefully review the information presented during the IR and focus on the following:

- Specific terms and future plans for the NP-201 licensing agreement

- Development status and market competitiveness of each pipeline candidate

- Detailed growth strategy for the CDMO business

Focus on the company’s long-term growth potential rather than short-term stock fluctuations, and continuously monitor macroeconomic conditions and market trends.

What are Naibek’s main businesses?

Naibek’s main businesses include dental bone graft materials, peptide drug development, and CDMO services for peptide APIs.

What is Naibek’s core technology?

Naibek’s core technology is PEPTARDEL, a peptide-based drug development platform.

What is Naibek’s future growth strategy?

Naibek aims to achieve sustainable growth through the expansion of its peptide drug pipeline and the launch of its CDMO business.