LKCHEM IR Key Analysis: What Happened?

LKCHEM achieved robust H1 2025 results with revenue of KRW 9.135 billion and an operating margin of 24.35%. This indicates consistent growth year-over-year. Their strong competitive edge in precursors and ligands for semiconductor thin film deposition processes has secured a significant market share in High-k and Low-k materials.

LKCHEM’s Growth Drivers: Why Pay Attention?

LKCHEM’s growth is not accidental. Continuous R&D investment and a focus on strengthening technological competitiveness have driven their focus on next-generation materials development. The successful localization of HfCl4 is expected to further solidify their domestic market leadership. Moreover, the growth of the HBM and system semiconductor markets, fueled by the AI boom, will positively impact demand for LKCHEM’s key products.

IR Key Insights & Investment Strategy: What’s Next?

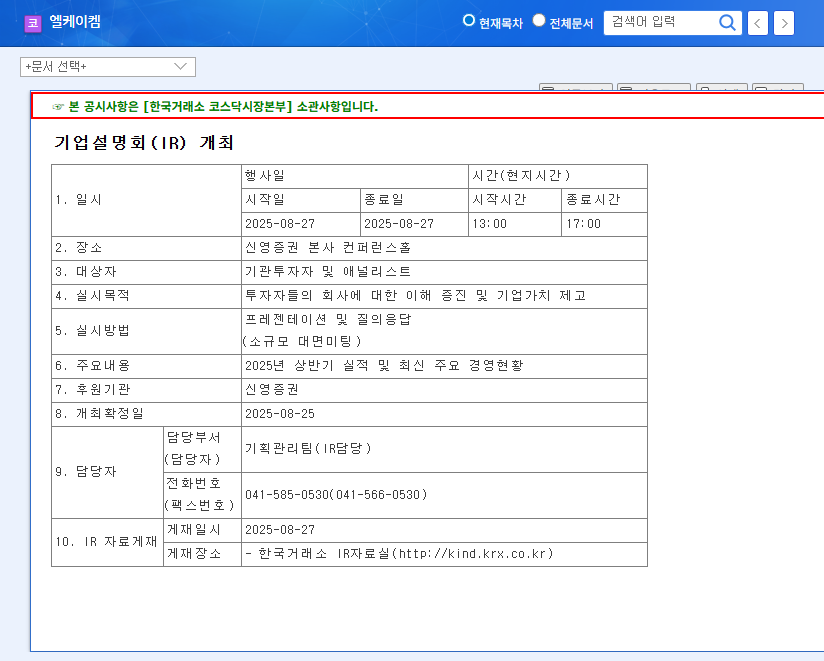

This IR will present positive H1 results alongside future growth strategies and new business plans. The announcement of HfCl4 localization achievements is expected to garner significant investor attention. However, potential risk factors such as exchange rate volatility and increased market competition should also be considered.

- Short-Term Investment Strategy: Carefully analyze the IR announcements and market reaction to manage potential short-term stock price volatility.

- Mid-to-Long-Term Investment Strategy: A long-term investment perspective is advisable, considering the growth of the semiconductor market and LKCHEM’s technological competitiveness.

Action Plan for Investors

If you’re considering investing in LKCHEM’s growth potential, thoroughly review the IR announcements and consult with investment professionals. Continuous monitoring of external factors, such as exchange rate fluctuations, is also crucial.

Frequently Asked Questions

What is LKCHEM’s main business?

LKCHEM primarily produces precursors and ligands for semiconductor thin film deposition processes.

What are the key investment points for LKCHEM?

Key investment points include robust semiconductor market growth, strong technological competitiveness, sound financials, and active R&D investment.

What are the precautions for investing in LKCHEM?

Investors should consider potential risk factors such as exchange rate volatility and increased competition in the semiconductor market.