1. What Happened?

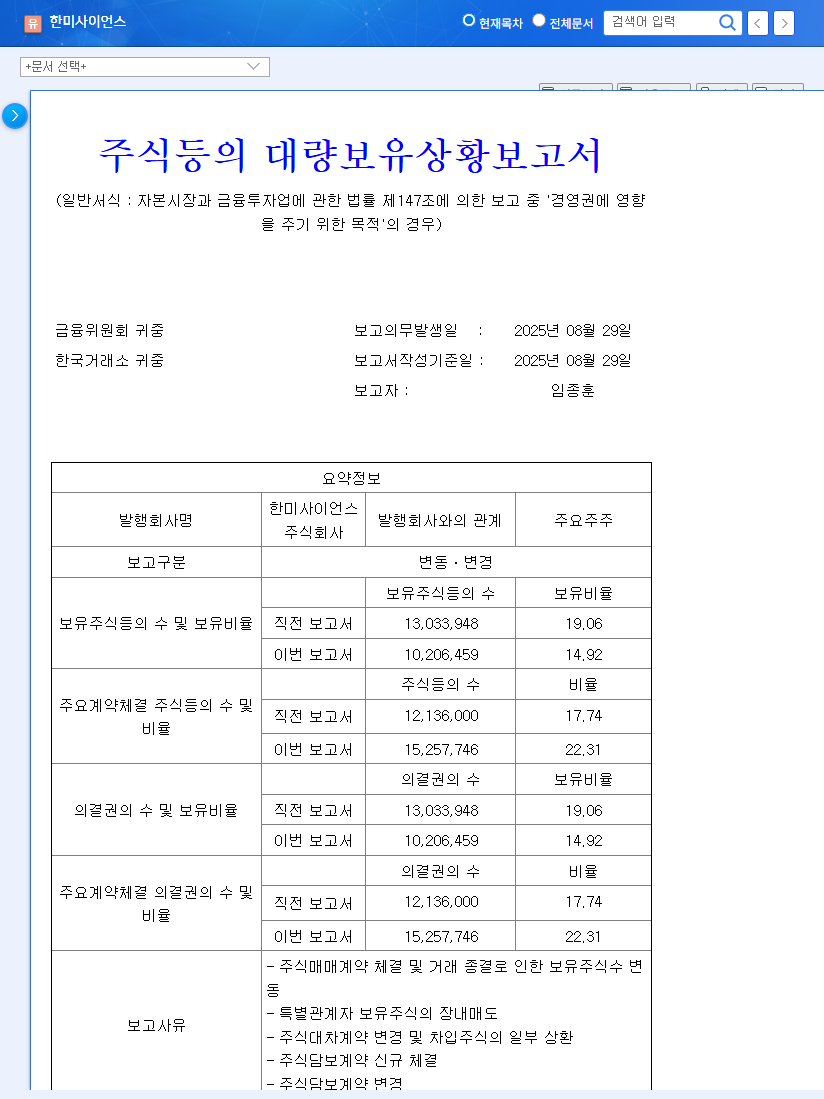

CEO Lim Jong-yoon and related parties sold a total of 2,767,489 shares in an off-market transaction. This reduced Lim’s stake from 19.06% to 14.92%. The key sales details are as follows:

- – DX&VX: -212,884 shares

- – Lim Jong-yoon: -2,341,814 shares

- – Hong Ji-yoon: -212,791 shares

2. Why Did This Happen?

The disclosed reasons for the sale include the conclusion of a stock trading contract, over-the-counter sales by related parties, changes in stock lending agreements and repayment of borrowed shares, and new and amended stock pledge agreements. While the exact reasons require further disclosure, this significant sale raises questions about potential management changes.

3. What’s Next?

Short-Term Impact

The large volume of shares sold and the increased uncertainty regarding management control are expected to put downward pressure on the stock price. Lim’s stake sale, in particular, is likely to negatively impact investor sentiment.

Long-Term Impact

Investors should pay attention to the potential shift in management structure and any new management strategies. The continuation or change of the healthcare business growth strategy and holding company strategy will significantly impact the company’s value. The current unstable macroeconomic environment may further amplify these uncertainties.

4. What Should Investors Do?

Investors should be wary of short-term stock price volatility. From a long-term investment perspective, it is crucial to thoroughly analyze the management transition, the new management’s business strategy, and the growth potential of the healthcare business before making investment decisions.

Frequently Asked Questions

What does Lim Jong-yoon’s stake sale signify?

In the short term, it could put downward pressure on the stock price, and in the long term, it suggests the possibility of management changes. This is a significant event that could influence the company’s future management strategies and direction.

How are Hanmi Science’s fundamentals?

Based on the 2025 semi-annual report, growth in the healthcare business sector is expected, and the company shows a stable business structure and improving profitability. However, management uncertainty could affect long-term fundamental management.

How should investors react?

Investors should be cautious of short-term stock price volatility and make investment decisions based on a comprehensive analysis of the management transition, the new management’s business strategy, and the growth potential of the healthcare business.