1. What Happened at Lotte Shopping?

Lotte Shopping reported weak performance in the first half of 2025, with revenue of KRW 6.8065 trillion (down 51.3% YoY) and operating profit of KRW 188.9 billion (down 60.1% YoY). Discount stores swung to an operating loss, and electronics stores experienced a significant downturn. Department stores maintained high operating profit margins, but operating profit decreased due to increased promotional expenses and renewal investments. Despite a decline in revenue, e-commerce narrowed its losses, showing early signs of successful digital transformation.

2. Why Did This Happen?

Internally, intensified competition in discount stores and electronics stores, along with structural factors affecting the supermarket/home shopping/cinema business, contributed to the decline in performance. Externally, macroeconomic uncertainties such as high exchange rates, interest rates, and inflation further complicated Lotte Shopping’s business environment.

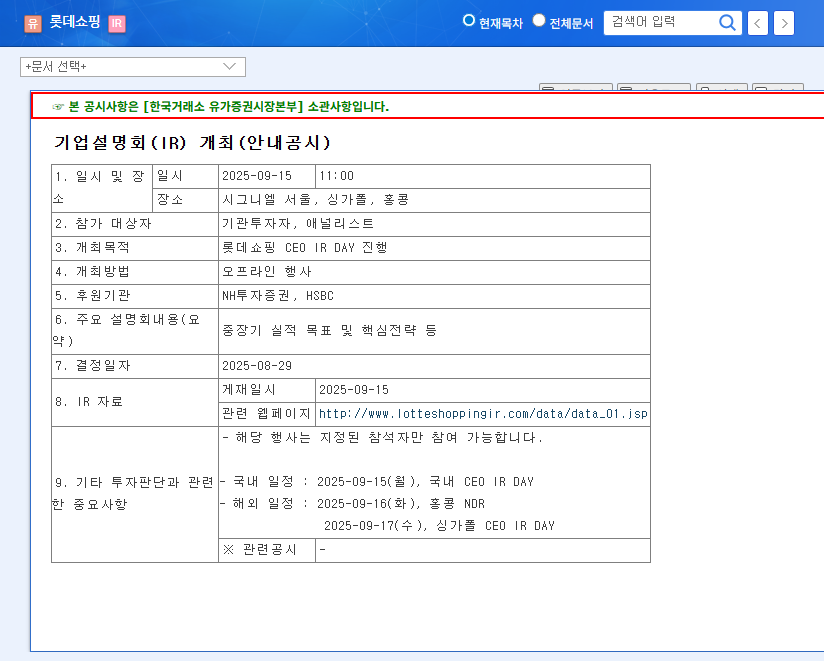

3. What’s Next for Lotte Shopping? – September IR Day Analysis

The IR Day on September 15th is a crucial opportunity to ascertain Lotte Shopping’s future strategic direction. On the positive side, presenting mid-to-long-term growth strategies could stimulate investment sentiment. However, if the current fundamental weakness persists, there’s a risk of failing to meet market expectations.

- Opportunities: Restructuring of underperforming businesses, e-commerce growth strategies, and a roadmap for digital transformation.

- Risks: Further deterioration of fundamentals, persistent macroeconomic uncertainty, and falling short of market expectations.

4. What Should Investors Do? – Investment Strategy Recommendations

Investors should carefully analyze the announcements from the IR Day and continuously monitor macroeconomic changes and earnings trends. Making sound investment decisions requires a comprehensive assessment of mid-to-long-term growth potential and strategy execution capabilities. Maintaining a conservative investment approach is advisable, given the short-term underperformance and macroeconomic uncertainties.

Q: How was Lotte Shopping’s performance in the first half of 2025?

A: Revenue decreased by 51.3% YoY to KRW 6.8065 trillion, and operating profit declined by 60.1% YoY to KRW 188.9 billion. The struggles of discount stores and electronics stores were particularly noticeable.

Q: What is the outlook for Lotte Shopping?

A: The outlook depends on the mid-to-long-term strategies to be announced at the September IR Day. The success of restructuring underperforming businesses, growing e-commerce, and implementing digital transformation will be key factors.

Q: What should investors consider when investing in Lotte Shopping?

A: Investors should carefully analyze the IR Day announcements, continuously monitor macroeconomic conditions and earnings trends, and make prudent investment decisions from a conservative perspective.