What Happened?

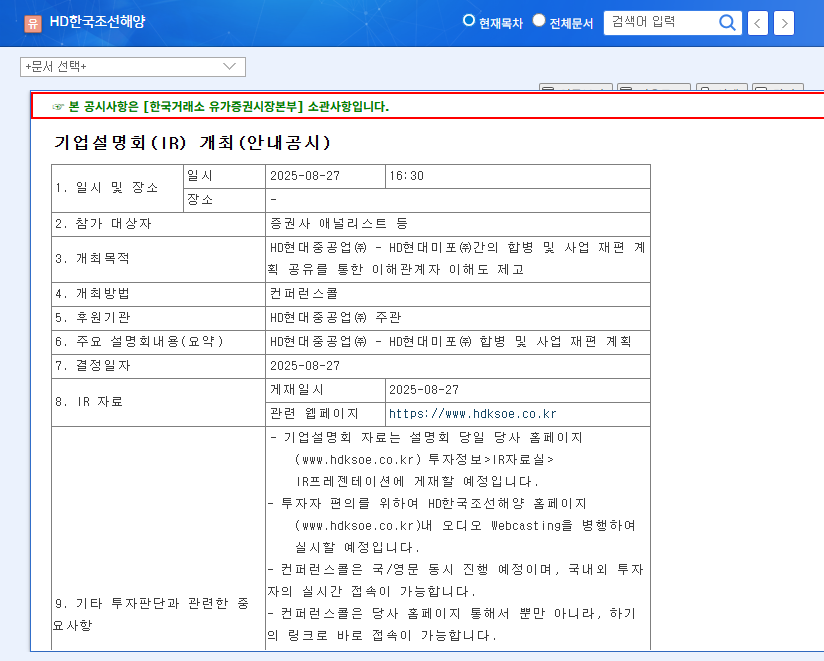

On August 27, 2025, HD Hyundai Heavy Industries announced its plan to merge HD Hyundai Heavy Industries and HD Hyundai Mipo Dockyard during an investor relations (IR) presentation. This announcement has caught the attention of investors as a potentially significant event in the shipbuilding industry.

Why Merge?

HD Hyundai Heavy Industries aims to achieve synergies across all areas, including production, R&D, and sales, through this merger. The company seeks to enhance global competitiveness by realizing economies of scale, reducing costs, and securing future technologies. As competition intensifies in eco-friendly vessels and smart ship technology, this merger is expected to provide a crucial foothold for securing future market leadership.

What are the Potential Outcomes?

- Positive Effects: Synergies, enhanced competitiveness, improved financial structure, increased investment attractiveness, potential stock price increase.

- Negative Effects: Challenges in cultural and system integration, restructuring and workforce issues, uncertainties in the integration process, market volatility, potential stock price decline.

As of the first half of 2025, HD Hyundai Heavy Industries boasts a robust order backlog and improved profitability, which raises expectations for merger synergies. However, external factors such as a global economic slowdown and exchange rate fluctuations, as well as risks associated with the integration process, warrant careful consideration.

What Should Investors Do?

- Carefully analyze the IR announcement (merger ratio, restructuring plan, synergy effects, risk management measures).

- Identify future growth drivers (technology in eco-friendly ships, ammonia/hydrogen-powered ships).

- Monitor macroeconomic and market conditions (global economy, exchange rates, interest rates, shipping market).

- Evaluate the company’s ability to manage merger risks.

This merger represents a critical turning point for HD Hyundai Heavy Industries. Investors should carefully consider both the positive and negative aspects before making investment decisions.

Frequently Asked Questions

What will happen to the stock price after the merger?

The merger announcement may increase stock price volatility in the short term. The long-term stock outlook depends on the successful realization of merger synergies.

What are the expected synergy effects of the merger?

Economies of scale, cost reductions, technological advancements, and enhanced market competitiveness are expected.

What are the risk factors associated with the merger?

Cultural clashes, delays in the integration process, unexpected costs, and changes in the market environment are potential risks.