1. What Happened?: Preferred Bidder Selected for SK Oceanplant Stake Sale

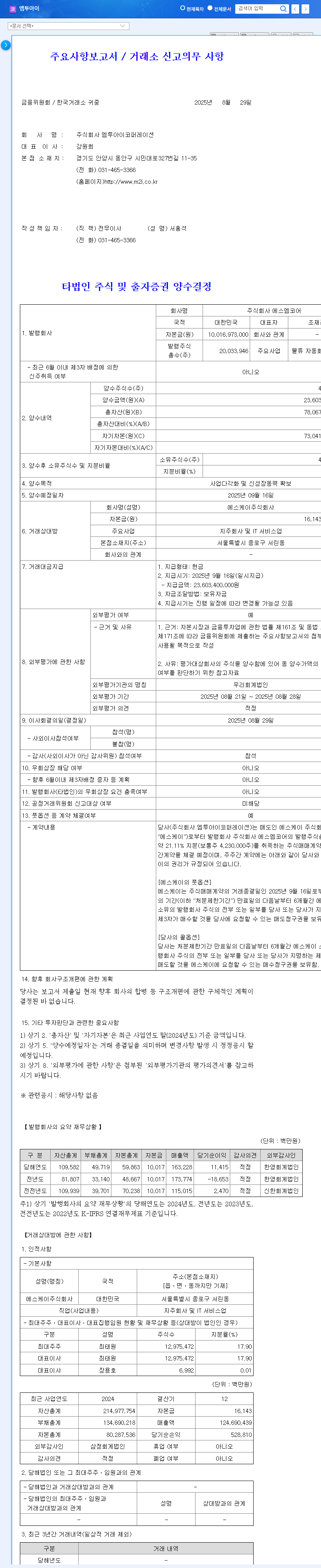

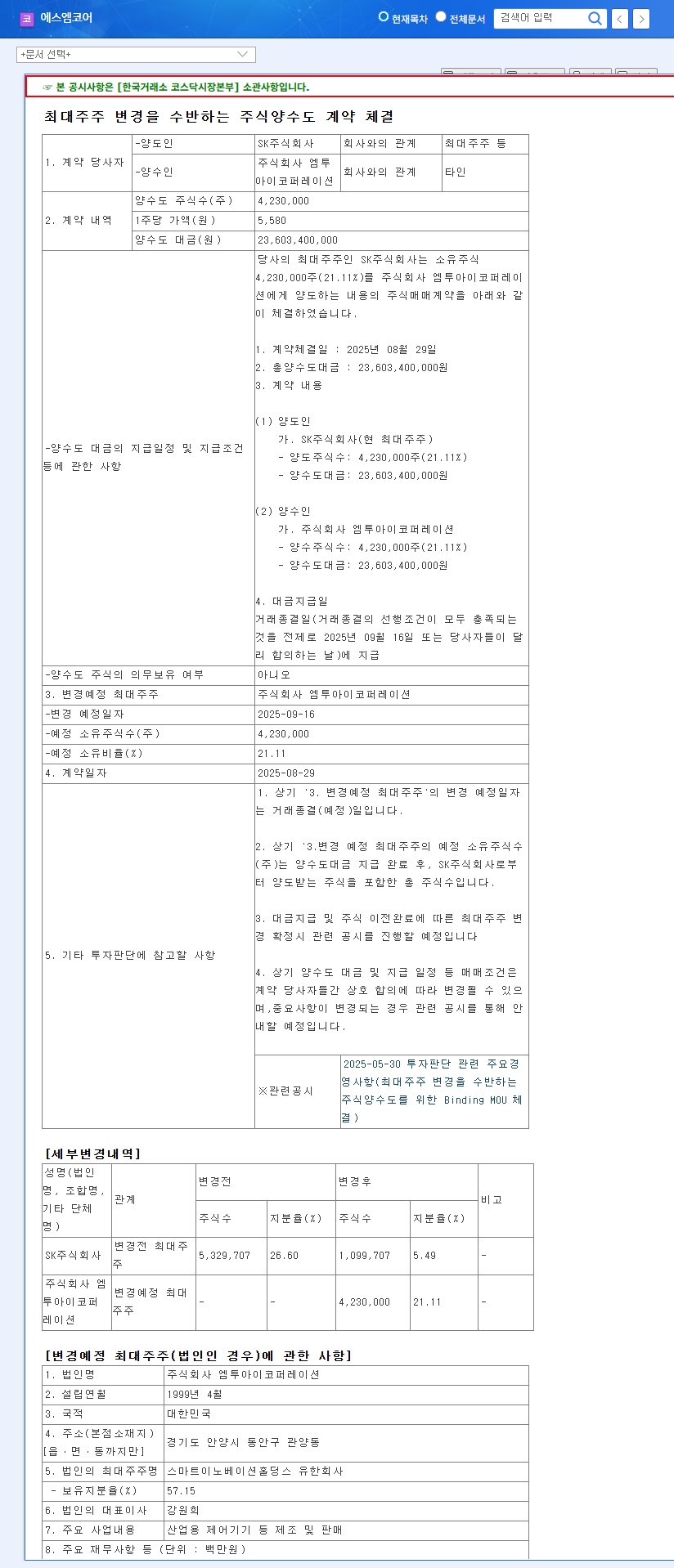

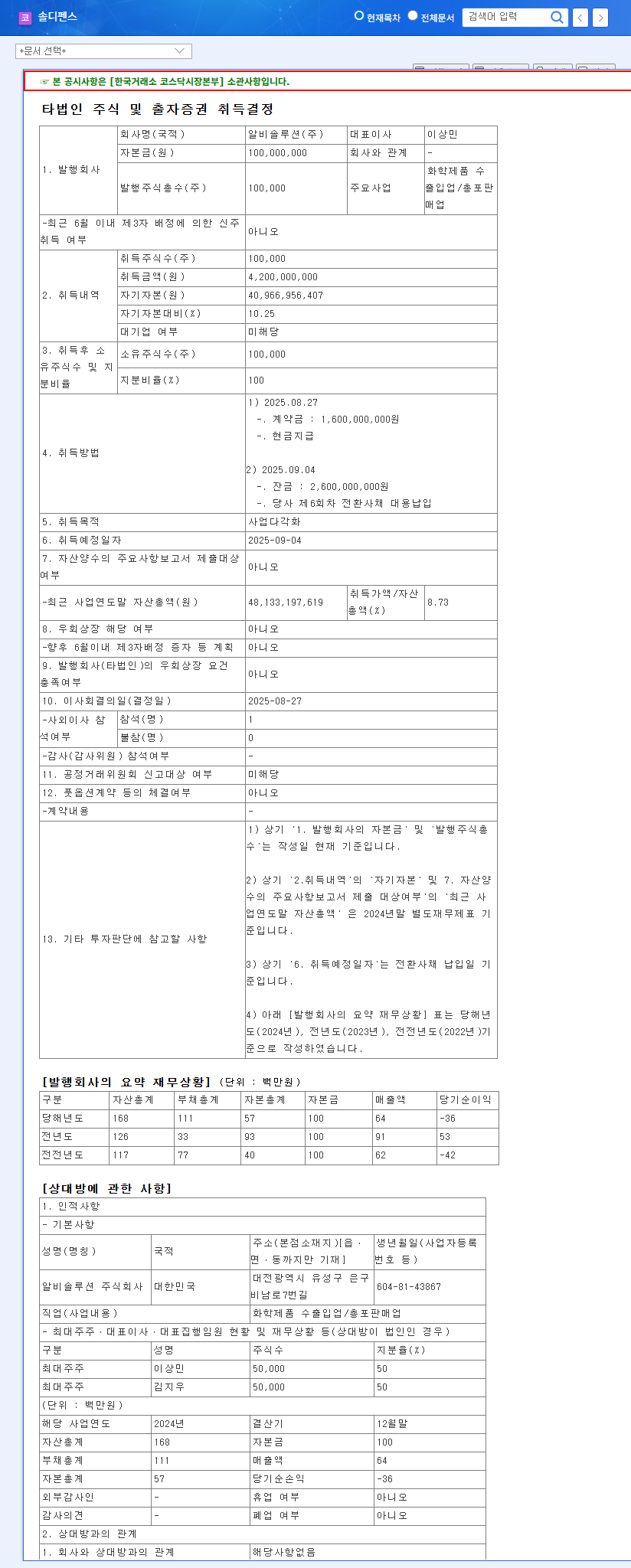

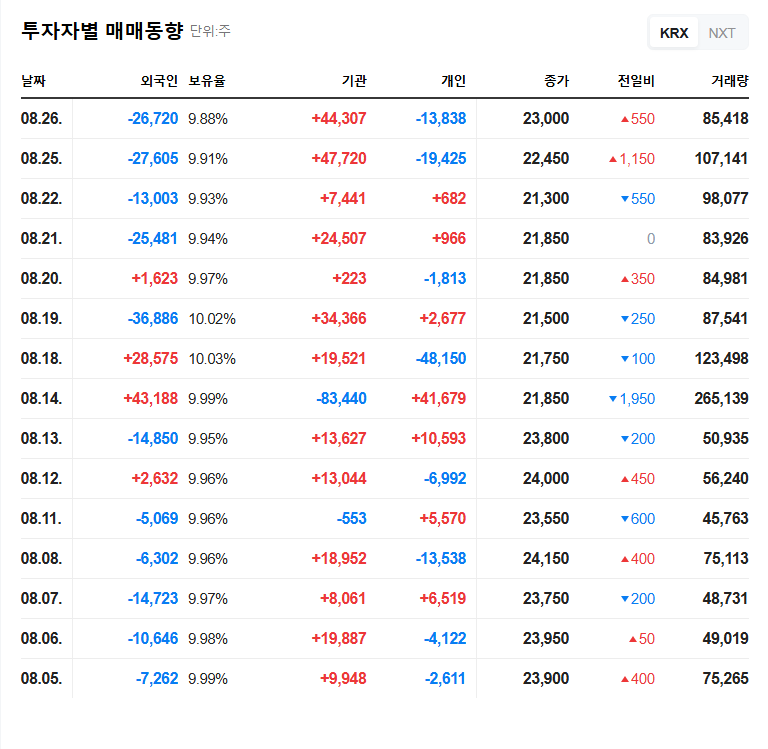

On September 1, 2025, SK Oceanplant announced the selection of ‘D Ocean Consortium’ as the preferred bidder for the sale of its majority stake. This increases the likelihood of a change in management control at SK Oceanplant, and the company will proceed with due diligence and final contract signing procedures.

2. Why is it Important?: Seeking a New Turning Point Amidst Sluggish Performance

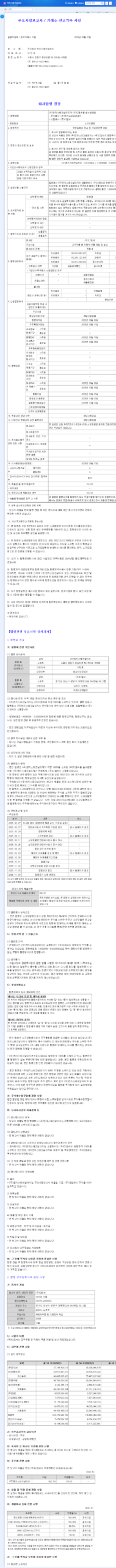

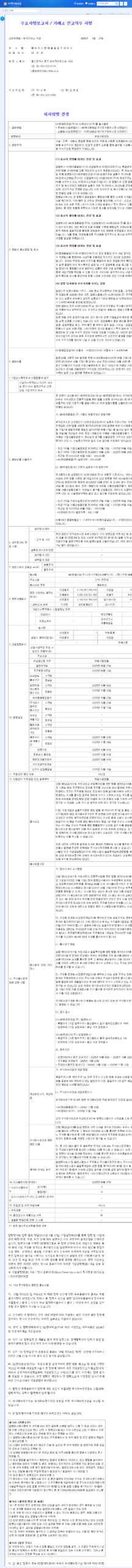

Recently, SK Oceanplant has been struggling due to sluggish performance in its main business areas such as offshore wind power and special vessels. In 2024, sales decreased by 28.4% year-on-year, and operating profit and net profit also decreased by 44.7% and 70.7%, respectively. In this situation, the sale of stake can be an opportunity to secure new growth engines and improve the financial structure.

3. So, What Will Happen?: Coexistence of Opportunities and Risks

Positive Impacts

- • Strengthened Financial Support and Management Stability

- • Expected New Business Opportunities and Synergy Effects

Negative Impacts

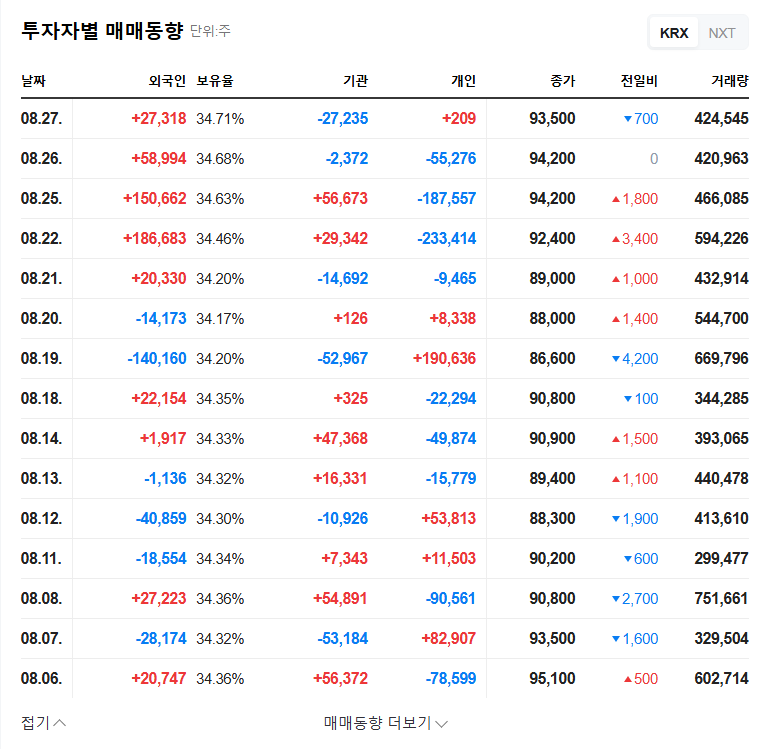

- • Uncertainty Until Final Contract and Short-term Volatility

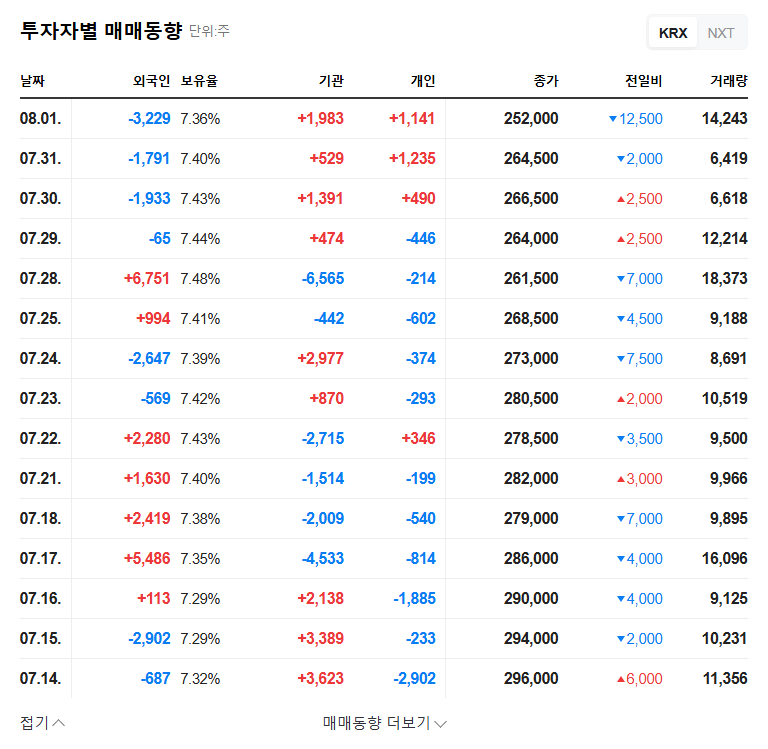

- • Uncertainty Due to Changes in the New Management’s Strategy

- • Potential Financial Burden Depending on Sale Conditions

4. What Should Investors Do?: 4 Key Checkpoints

- • Analyze the business capabilities and acquisition conditions of D Ocean Consortium

- • Prepare for Short-term Stock Price Volatility

- • Monitor the new management’s business plans and financial improvement measures

- • Continuously check market trends in offshore wind power and defense industries

This analysis is not investment advice, and the responsibility for investment decisions lies with the investor.

What is the main purpose of the SK Oceanplant stake sale?

It is analyzed to overcome the recent sluggish performance, improve the financial structure, and secure new growth engines.

What kind of company is D Ocean Consortium?

Further information is needed in addition to the information provided in this report. Please refer to related articles and disclosures.

What is the expected stock price outlook after the stake sale?

Short-term volatility is expected due to uncertainty, and the long-term outlook is expected to depend on D Ocean Consortium’s business plan and market conditions.