1. What Happened?

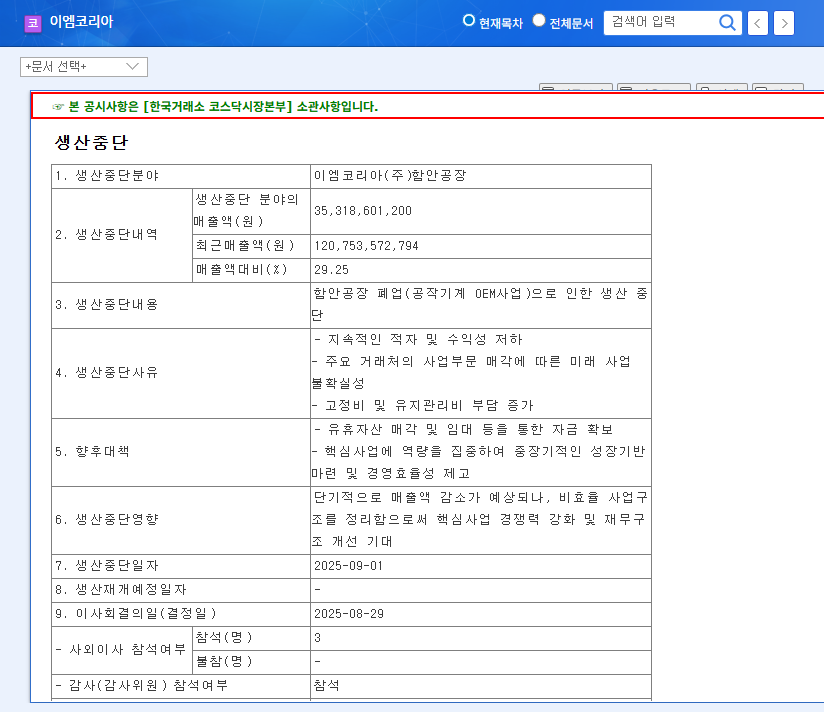

EM Korea announced on August 29, 2025, the closure of its Haman plant and the cessation of production in its machine tool OEM business. This represents a withdrawal from a business segment that accounts for 29.25% of total sales, equivalent to 353 billion won.

2. Why This Decision?

Despite sales growth in the first half of 2025, EM Korea experienced a decline in profitability. While the machine tool segment showed signs of recovery, its low margins and price volatility hindered overall profit improvement. Considering the high growth potential of the defense/aerospace sector, EM Korea likely decided that focusing on its core business and streamlining operations by exiting the low-margin machine tool business would be beneficial for long-term growth.

3. What’s Next?

- Positive Aspects: Potential for improved profitability due to the exit from a low-margin business, enhanced growth momentum by focusing on the defense/aerospace sector, and potential improvement in financial structure.

- Negative Aspects: Short-term sales decline, possibility of restructuring costs, and reduced diversification benefits.

Ultimately, this decision is interpreted as a strategic choice for long-term growth, accepting short-term impacts. However, securing new growth engines to fill the sales gap is crucial.

4. What Should Investors Do?

The investment recommendation is ‘Hold to Buy.’ The current P/E ratio of 7.70 and P/B ratio of 1.31 suggest potential for further upside depending on fundamental improvements. While positive stock momentum can be expected if backed by strong growth in the defense sector and new business performance, investors should carefully monitor the impact of the machine tool business withdrawal on sales decline and profitability improvement. Closely monitor the specific financial impact of the withdrawal, defense sector growth, and new business performance.

Frequently Asked Questions

What exactly is happening with the closure of EM Korea’s Haman plant?

EM Korea announced on August 29, 2025, that it will close its Haman plant and exit the machine tool OEM business, resulting in an expected sales decrease of 353 billion won.

How will the withdrawal from the machine tool business affect the stock price?

In the short term, a negative impact is expected due to the decrease in sales, but in the long term, it may contribute to improved profitability. The investment recommendation is ‘Hold to Buy,’ and investors should carefully monitor growth in the defense sector and the performance of new businesses.

What is the outlook for EM Korea?

Positive stock price momentum can be expected if backed by robust growth in the defense/aerospace sector and successful new business ventures. However, securing new growth drivers to compensate for the sales gap from the machine tool business will be crucial.