1. What Happened?

SM High Plus Co., Ltd. acquired an additional 13,000 shares of SM Vecell through market purchases from August 25th to 28th, 2025, slightly increasing its stake from 87.53% to 87.54%. The disclosure stated the purpose of the change was to influence management.

2. Why Does It Matter?

This stake increase can be interpreted as a signal of management stabilization. By further solidifying its already high stake, it demonstrates a commitment to responsible management and can positively influence the pursuit of mid- to long-term growth strategies. Furthermore, a major shareholder’s purchase of its own shares can send a positive signal to the market about the company’s growth potential, stimulating investor sentiment.

3. What’s the Potential Impact?

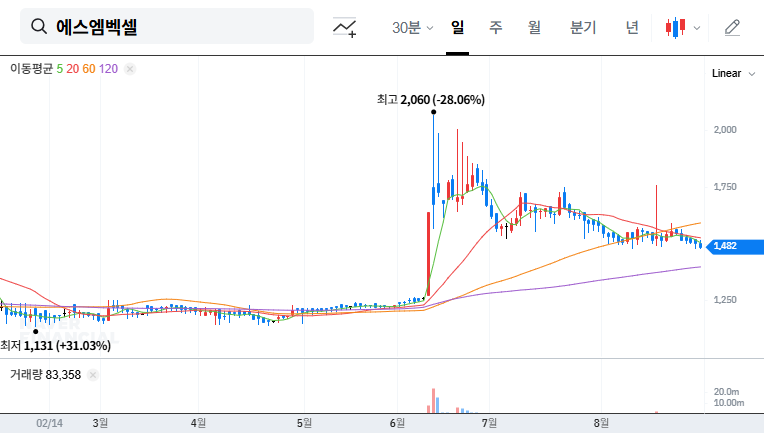

In the short term, there is a possibility of upward momentum in the stock price. However, it’s crucial to note that this stake change itself does not directly impact the company’s fundamentals. SM Vecell’s performance still faces challenges such as the sluggish automotive parts business and macroeconomic uncertainties. Therefore, investment decisions should focus on the company’s fundamental improvements, particularly the performance of the new battery business and the possibility of recovery in the automotive parts business, rather than short-term stock price fluctuations.

4. Investor Action Plan

- Short-term investors: A short-term investment strategy leveraging the potential upward momentum can be considered, but be mindful of increased volatility.

- Long-term investors: Continuously monitor key indicators such as the recovery of the automotive parts business, the performance of the new battery business, and improvements in financial soundness to confirm fundamental improvements.

Frequently Asked Questions

Does an increase in a major shareholder’s stake always have a positive impact on the stock price?

Not necessarily. While it can be interpreted as a positive signal in the short term, ultimately the company’s performance and future growth potential determine the stock price.

What is the outlook for SM Vecell’s battery business?

The company aims to secure growth engines by entering new businesses such as ampoule batteries for defense, but concrete results remain to be seen.

What are the key considerations when investing in SM Vecell?

Investors should consider factors such as dependence on the automotive parts business, the impact of the macroeconomic environment, and uncertainties surrounding the new battery business.