1. What is Maeil Holdings’ Treasury Stock Disposal?

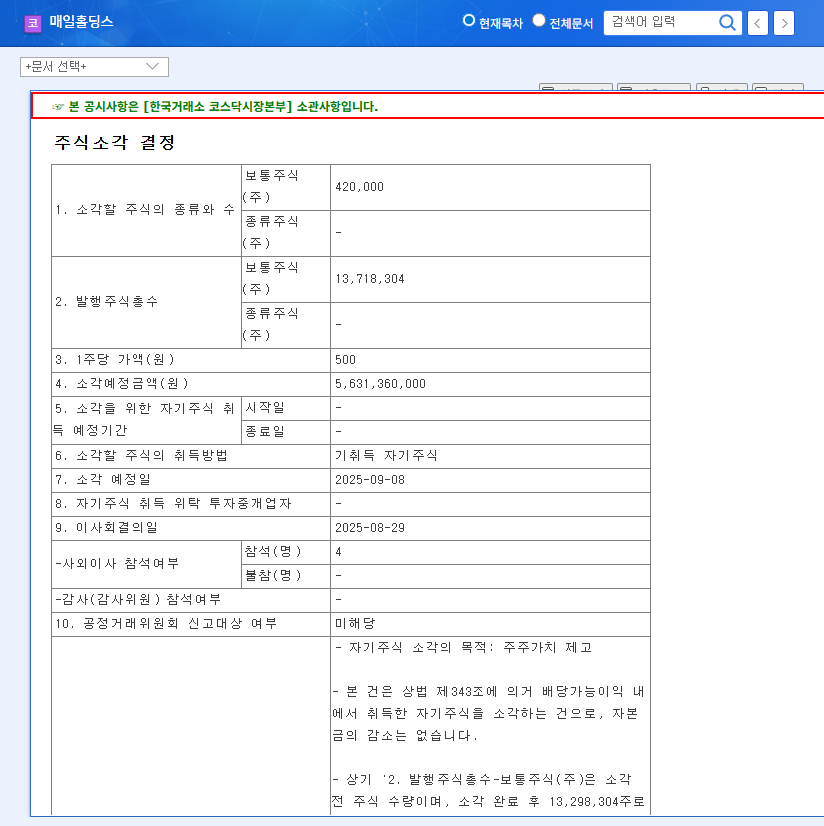

On August 29, 2025, Maeil Holdings announced the disposal of 4,760 treasury shares (worth KRW 100 million) to its employees as a means of boosting motivation and encouraging long-term retention. This represents a negligible 0.03% of the total outstanding shares.

2. Why the Disposal?

This decision is part of Maeil Holdings’ ongoing efforts to reward employees and strengthen its human capital. The company has a history of shareholder return policies, and this move is consistent with that approach.

3. Impact on Stock Price?

Given the small scale of the disposal, the direct impact on the stock price is expected to be limited. Broader market trends and investor sentiment are likely to be more influential factors in the short term. While the move could positively impact corporate value in the long run by motivating employees, the effect is anticipated to be minimal.

4. What Should Investors Do?

This treasury stock disposal alone shouldn’t drastically alter investment decisions. Maeil Holdings maintains its investment appeal with a stable business structure, diversified portfolio, and commitment to ESG management. However, investors should exercise caution and consider potential risks such as macroeconomic changes, intensifying competition, and fluctuating raw material prices. A comprehensive investment strategy should consider the company’s fundamentals, future earnings outlook, and the broader economic environment.

Will Maeil Holdings’ treasury stock disposal affect its share price?

The impact on the stock price is expected to be limited due to the small size of the disposal.

Is it a good time to invest in Maeil Holdings?

Investment decisions should be based on the company’s fundamentals and future outlook, rather than solely on this treasury stock disposal.

What are Maeil Holdings’ main businesses?

Maeil Holdings has a diversified business portfolio, including dairy products, food service, distribution, and other services.