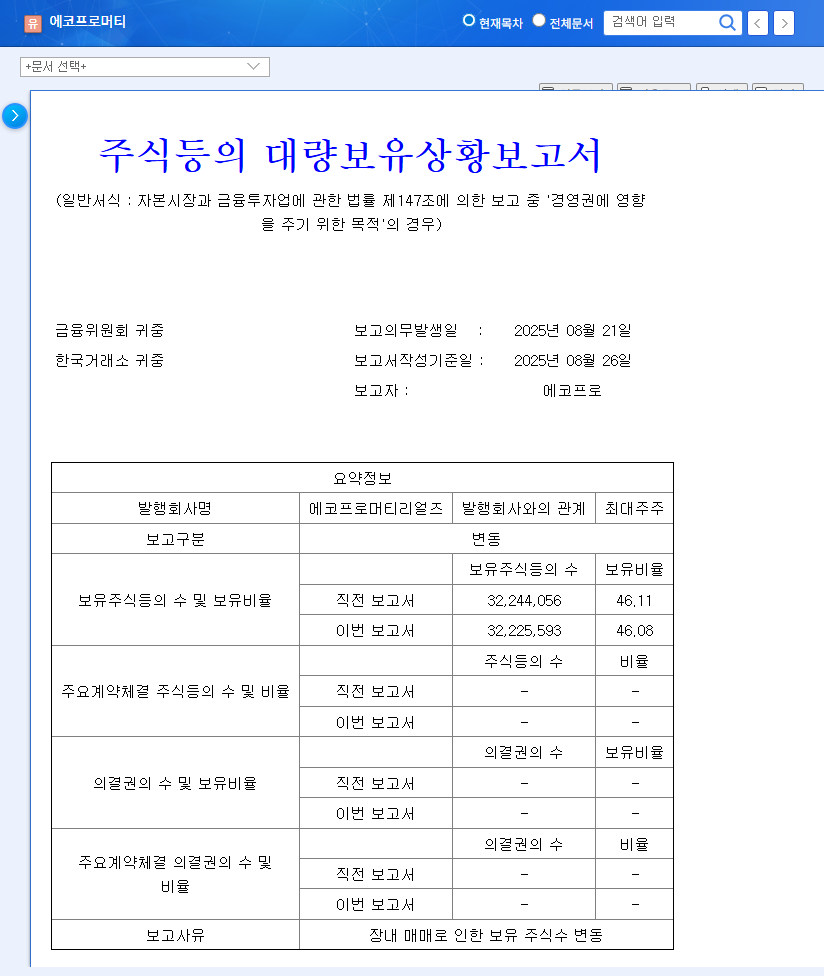

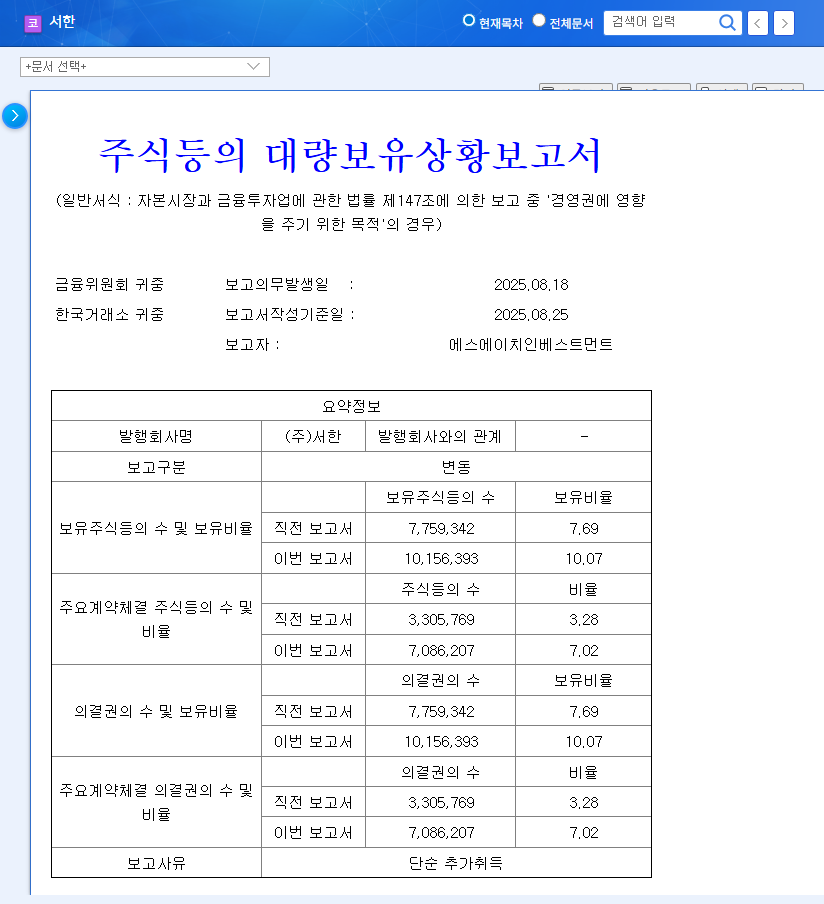

1. What Happened? Major Shareholder Stake Decreased by 14.55%

WSI’s largest shareholder and related parties reduced their stake from 66% to 51.45%, a significant drop of 14.55%. This is due to over-the-counter sales and a decrease in pledged shares from loan repayments. Such a large sale can send a negative signal to the market and lead to downward pressure on the stock price.

2. Why the Divestment? Liquidity vs. Management Control

The exact reason for the divestment is unclear, but it is generally related to securing liquidity, improving financial structure, or a change in management control. In the case of WSI, it is presumed to be for securing funds for new business investments or alleviating the high debt burden. However, investors should also consider the possibility of a change in management control and monitor the situation closely.

3. What’s Next? Short-term Decline vs. Long-term Growth Potential

In the short term, downward pressure on the stock price is expected. The sale of a major shareholder’s stake negatively impacts investor sentiment. However, if the funds from the sale are effectively used for new business investments and the financial structure improves, a positive impact can be expected in the long term. However, the situation remains uncertain at present.

4. What Should Investors Do? Conservative Observation and Close Monitoring

Currently, a conservative approach is recommended. Investors should be aware of the possibility of a stock price decline and closely monitor the company’s financial soundness and new business performance. It is especially crucial to continuously monitor the synergy effect of the pharmaceutical business acquisition, the visibility of results from the medical robot business, and the company’s ability to repay debt. Investors should also pay attention to changes in the macroeconomic environment, such as exchange rate and interest rate fluctuations.

Is the sale of a major shareholder’s stake a negative signal for the company?

Generally, the sale of a major shareholder’s stake can be interpreted as a negative signal in the market. This is because the possibility of a change in management control and uncertainty about the major shareholder’s outlook for the company can negatively affect investor sentiment.

What is the financial status of WSI?

Despite increased sales, WSI recorded a net loss in the current period due to increased SG&A and financial costs. There are ongoing concerns about financial soundness due to the large amount of total debt and the significant size of convertible bonds and convertible preferred stock.

Should I invest in WSI?

Currently, a ‘conservative wait-and-see’ approach is recommended. Careful investment decisions are needed, considering the increased stock price volatility due to the sale of the major shareholder’s stake, continued financial risks, and uncertainties about the performance of new businesses. It is advisable to consider investing after confirming positive changes such as improvements in financial structure and visible results from new businesses.