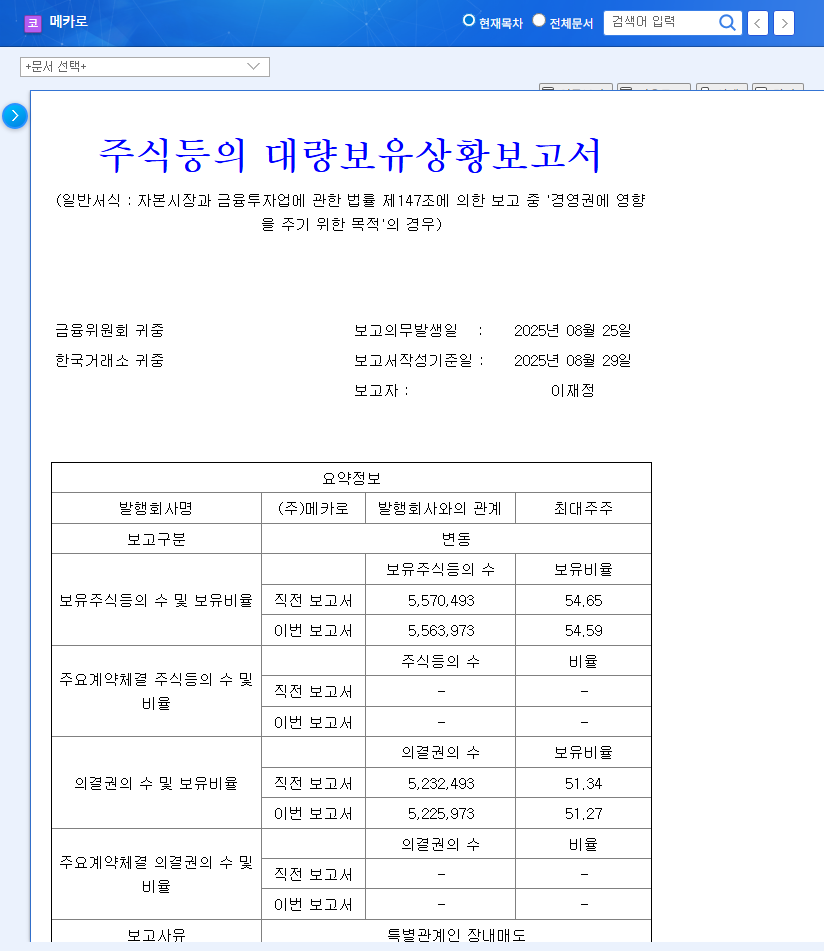

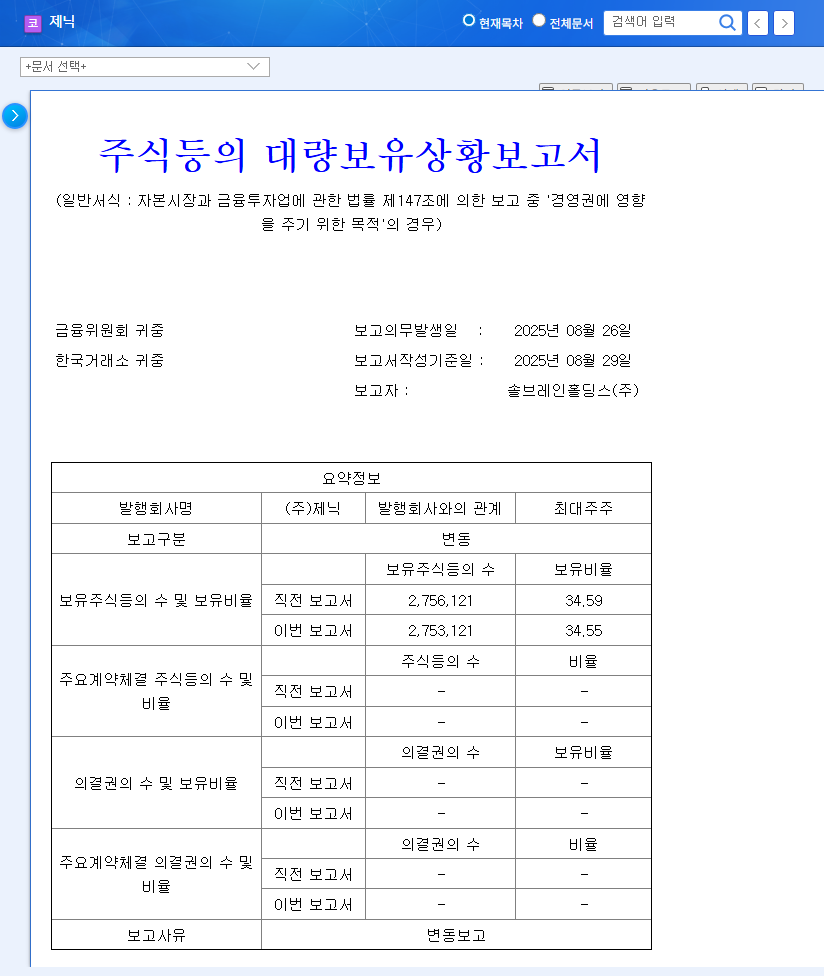

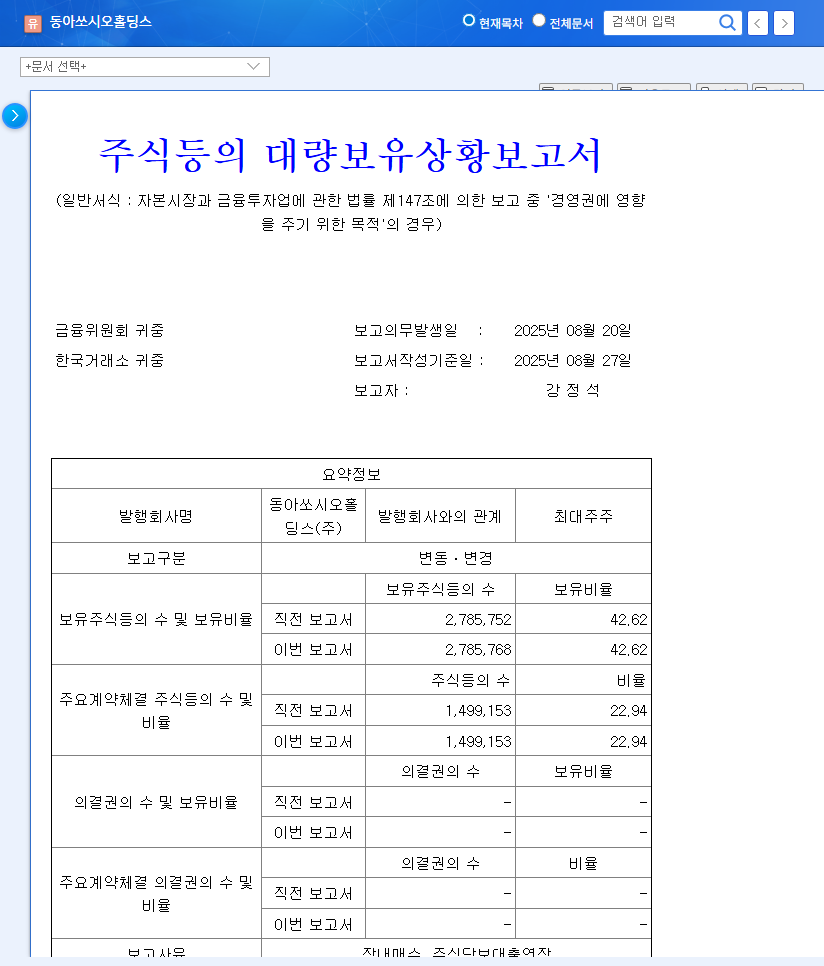

1. What Happened?: Analysis of Hisco’s Largest Shareholder Change

Hisco’s largest shareholder changed from Eom Shin-young et al. to Eom Shin-cheol et al. While the stake remains at 53.47%, the change resulted from a gift/receipt of shares between related parties. Although seemingly insignificant, the arrival of new management always brings both expectations and uncertainties about a company’s future.

2. Why Does it Matter?: Potential Impact of the Change

A change in the largest shareholder suggests the possibility of a shift in the company’s management strategy. Positive aspects include increased management efficiency, new business ventures, and increased investment. On the other hand, the new management’s lack of experience, friction with existing management, and uncertain business strategies can act as risk factors.

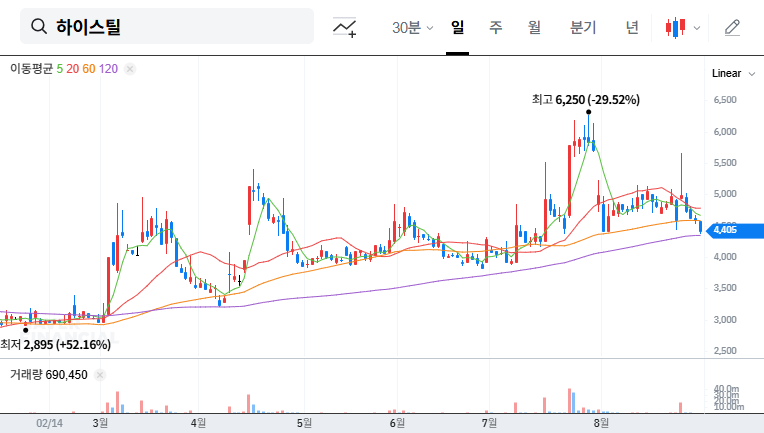

3. What’s Next?: Fundamentals and Stock Price Outlook

- Positive Factors: Increased sales and return to profitability in the first half of 2025 are positive signs. Further growth can be expected through management stabilization and business streamlining.

- Negative Factors: Increasing debt ratio, appeal to the US Court of International Trade (CIT), and the global economic slowdown are ongoing risk factors. The new management’s strategy and risk management capabilities will be crucial.

4. Investor Action Plan: What to Watch For

- New Management’s Vision: Pay close attention to the announcement of Eom Shin-cheol’s management plan. Their strategy for securing new growth engines will be a crucial criterion for investment decisions.

- CIT Appeal Outcome and Fundamentals: Monitor the CIT appeal outcome along with the continued improvement in performance.

- Macroeconomic Changes: Continuously monitor the impact of macroeconomic variables such as exchange rates, interest rates, and raw material prices.

FAQ

Will the change in Hisco’s largest shareholder have a positive impact on the stock price?

In the short term, there may not be a significant impact, but in the long term, it can have a positive or negative impact depending on the new management’s strategy. Pay attention to announcements of management plans and changes in performance.

What is Hisco’s main business?

Hisco’s main business is the manufacturing and sale of steel pipes.

What are the key things to consider when investing in Hisco?

Consider risk factors such as high debt ratio, appeal to the US Court of International Trade (CIT), and the global economic slowdown. Also, carefully examine the new management’s strategy and business direction.