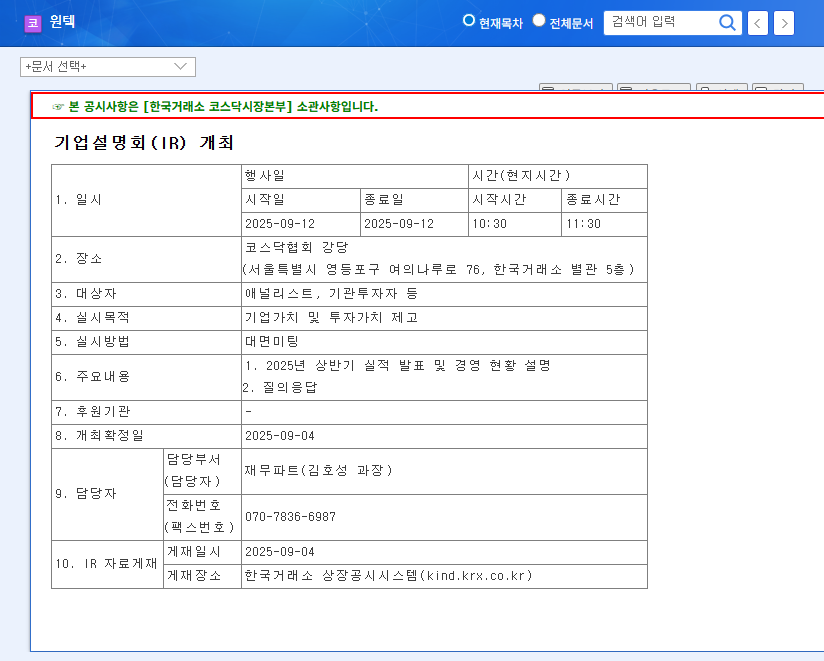

1. What Happened? WONTECH’s IR Session!

WONTECH held an IR session on September 12, 2025, announcing its H1 2025 earnings and providing a business update, followed by a Q&A with investors. With a market capitalization of KRW 878.1 billion, WONTECH has solidified its presence in the medical aesthetic device market, spearheaded by its ‘Oligio’ series.

2. Why Does It Matter? Strong H1 Results and H2 Growth Strategies Unveiled!

WONTECH showcased robust growth in the first half of 2025. Strong sales of the ‘Oligio’ series, coupled with new product launches and successful overseas expansion, drove revenue growth. Cost optimization efforts also significantly improved profitability. This IR session drew significant attention as it revealed the drivers behind the strong H1 performance and outlined the company’s growth strategies for the second half.

3. So What? Key Takeaways for Investors!

- Positive Factors: Strong H1 performance and the announcement of growth strategies can lead to a re-evaluation of the company’s value and improved investor sentiment.

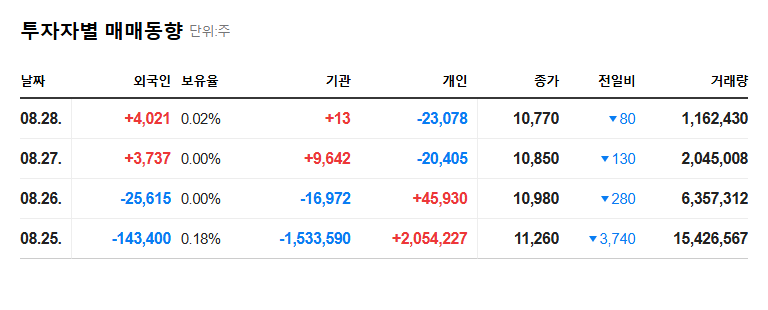

- Potential Risks: The impact of macroeconomic variables (exchange rates, interest rates), intensified competition, and delays in new product development could negatively affect the stock price. Investors should pay close attention to the potential for foreign exchange losses.

While the growth of the global medical aesthetic device market is favorable for WONTECH, rising interest rates and exchange rate volatility could pose challenges to profitability. WONTECH’s proprietary technology and product lineup are competitive advantages, but ongoing monitoring of the competitive landscape and market expectations is crucial.

4. What Should Investors Do?

Investors should carefully analyze the information presented in the IR session, paying close attention to the H2 earnings outlook and strategies for navigating macroeconomic variables. Making informed investment decisions requires a comprehensive evaluation of new product launch plans, overseas expansion strategies, and R&D investment plans.

What is WONTECH’s main business?

WONTECH develops and sells medical aesthetic devices, with its flagship product being the ‘Oligio’ series.

What were the key takeaways from this IR session?

The key takeaways included the announcement of H1 2025 earnings, a business update, and the unveiling of growth strategies for the second half of the year.

What are the key risks to consider when investing in WONTECH?

Investors should consider the impact of macroeconomic variables (exchange rates, interest rates), increased competition, and potential delays in new product development. Pay particular attention to the possibility of foreign exchange losses.