1. What Happened? SK Securities and Trinity Asset Management Acquisition Rumors

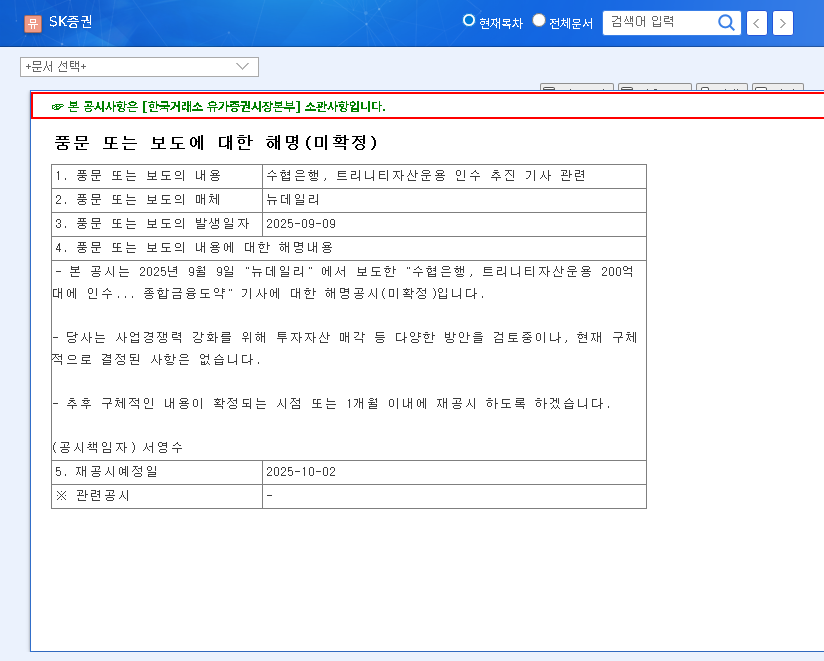

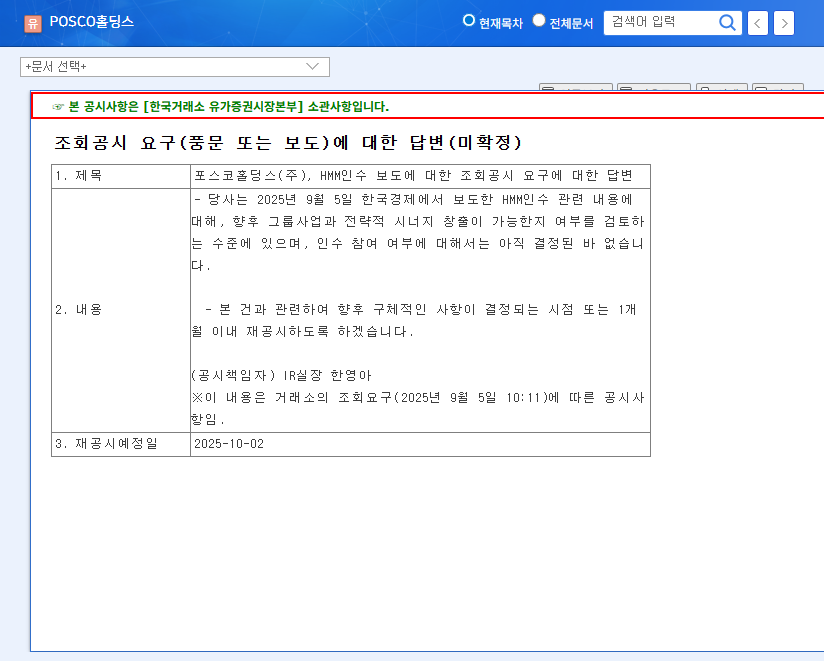

On September 9, 2025, news broke of Suhyup Bank pursuing the acquisition of Trinity Asset Management, leading to rumors of SK Securities also participating in the bid. SK Securities issued a statement clarifying that while they are exploring various options to enhance competitiveness, nothing has been finalized. A further announcement is expected on October 2nd.

2. Why Does It Matter? Mixed Outlook Despite Return to Profitability

While SK Securities returned to profit in H1 2025, underperformance in proprietary trading and brokerage, along with significant losses in other segments, remain concerning. The potential acquisition of Trinity Asset Management presents both opportunities and risks – diversification and new growth engines versus increased financial burden if the acquisition fails.

3. What’s Next? Acquisition Confirmation and H2 2025 Earnings are Key

The confirmation of the acquisition will come on October 2nd. If the acquisition is successful, the focus will shift to the potential synergy and expansion of SK Securities’ portfolio. The company’s ability to maintain profitability in the second half of 2025 and improve performance in struggling segments will also be crucial.

4. What Should Investors Do? A Cautious ‘Wait-and-See’ Approach

A ‘wait-and-see’ approach is recommended at this time. Investors should wait for the October 2nd announcement to clarify the acquisition uncertainty and assess the H2 2025 earnings before making investment decisions.

FAQ

How did SK Securities perform in H1 2025?

SK Securities returned to profitability in H1 2025, reporting operating revenue of KRW 615.4 billion and net income of KRW 15.5 billion.

Is SK Securities acquiring Trinity Asset Management?

While there have been reports, SK Securities has stated that they are exploring various options and nothing has been finalized. A further announcement is expected on October 2nd, 2025.

Should I invest in SK Securities?

A ‘wait-and-see’ approach is recommended. Investors should monitor the acquisition developments and H2 2025 earnings before making any investment decisions.