1. NPS Acquires 9.58% Stake in Samyang Foods: What Happened?

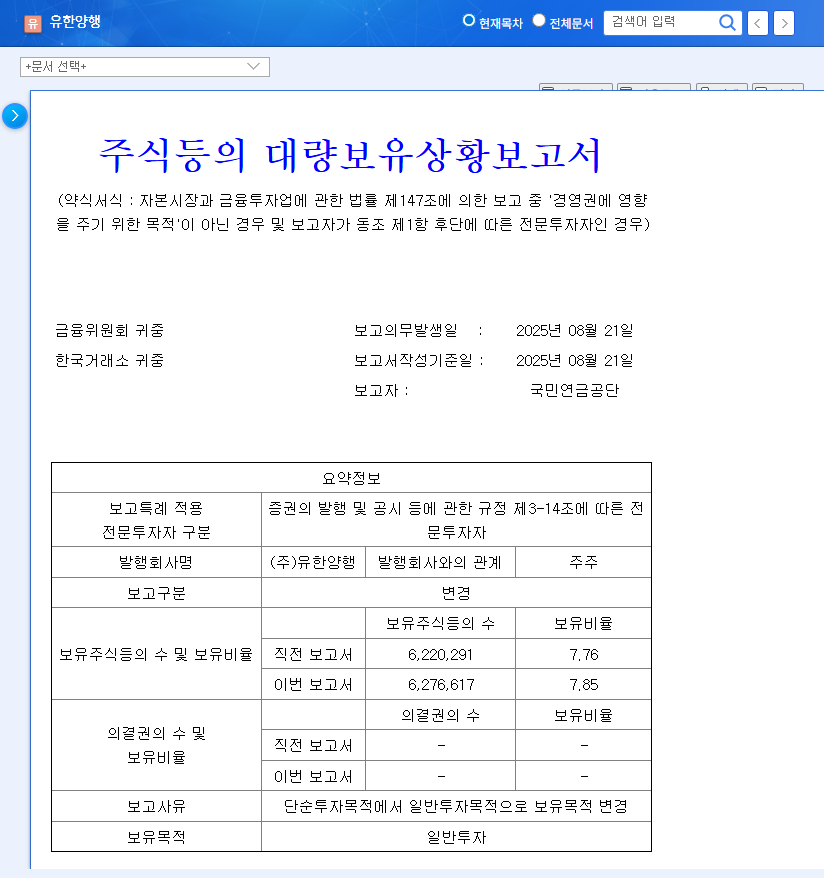

The NPS increased its stake in Samyang Foods from 9.46% to 9.58% and changed its investment objective from ‘simple investment’ to ‘general investment.’ This shift suggests a more active role in shareholder activities.

2. Why the Increased Stake?: Decoding the Rationale

The NPS’s decision likely reflects a positive outlook on Samyang Foods’ growth potential. The strong global brand power of Buldak Bokkeum Myun, increasing overseas sales, and ongoing diversification efforts likely contributed to the investment appeal. The change in investment objective signals a potential shift towards a more involved approach to shareholder engagement and value creation.

3. Impact on Stock Price: Short-Term vs. Long-Term Outlook

- Short-term Impact: The NPS’s increased stake could boost investor sentiment and provide upward momentum for the stock price.

- Long-term Impact: Increased management transparency and accountability are expected, which could attract other institutional investors. The NPS’s involvement could also lead to changes in the company’s fundamentals.

4. Investor Action Plan: Navigating the Investment Landscape

Investors considering Samyang Foods should carefully evaluate the implications of the NPS’s actions alongside the company’s 2025 first-half performance, which showed declining operating profits and increasing cost pressures. Closely monitoring the NPS’s future shareholder activities and level of management engagement is crucial for developing a sound investment strategy. A prudent approach that considers both the potential upsides and risks is recommended.

What does ‘general investment’ by the NPS entail?

‘General investment’ signifies a more active approach than simple financial investment, implying potential involvement in shareholder activities like exercising voting rights and engaging with management to enhance corporate value.

How did Samyang Foods perform in the first half of 2025?

While the global ‘Buldak’ brand showed positive growth, challenges emerged with declining operating and net profits, as well as increasing cost pressures.

What are the key considerations for investing in Samyang Foods?

Investors should consider the NPS’s future shareholder activities, the company’s performance challenges in the first half of 2025, increasing competition, and foreign exchange volatility.