FINO INC. Signs KRW 10.8 Billion NCM Precursor Supply Contract with L&F

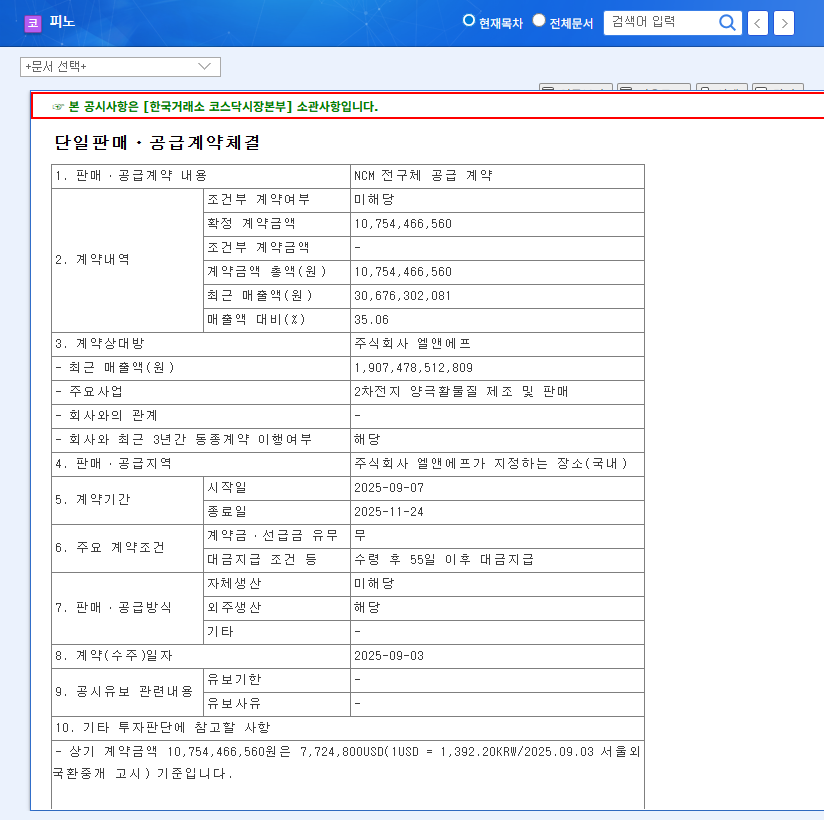

FINO INC. announced that it has signed a KRW 10.8 billion supply contract for NCM precursors with L&F. The contract period is approximately two months, from September 7, 2025, to November 24, 2025, and the supply location is designated by L&F within Korea. This represents approximately 35% of FINO’s projected KRW 31.2 billion revenue for 2025.

Implications and Background of the Contract

This contract is expected to bring short-term revenue growth for FINO, which has recently recorded sluggish performance. Securing a high-quality customer like L&F is also positive as it enhances market confidence and increases the possibility of further orders. FINO has been focusing on its new energy business since the change in its largest shareholder, striving to secure growth engines, and this contract can be interpreted as one of the fruits of these efforts.

Investor Perspective: Opportunities and Risks

While this contract may provide short-term upward momentum for the stock price, investors should consider several risk factors. The short contract period of two months, continuous decline in profitability, and high debt ratio remain challenges to overcome. Therefore, it is essential to objectively assess the company’s fundamental improvements rather than being swayed by short-term stock price fluctuations.

Key Investment Points

- Possibility of securing additional long-term contracts with L&F

- Efforts to improve profitability and stabilize financial structure

- Continued growth potential of the new energy business segment

- Expansion and performance of R&D investment

Frequently Asked Questions (FAQ)

How much will this contract contribute to FINO’s profitability improvement?

While this contract can contribute to short-term sales growth, it is expected to be insufficient to reverse the current trend of declining profitability.

What is the outlook for FINO’s stock price?

It may have a positive impact in the short term, but the mid- to long-term stock price depends on the company’s fundamental improvement.

What are the precautions for investment?

Investments should be made cautiously, considering the limitations of short-term contracts, the need for profitability improvement, and the stability of the financial structure.