What was discussed at Neopharm’s IR?

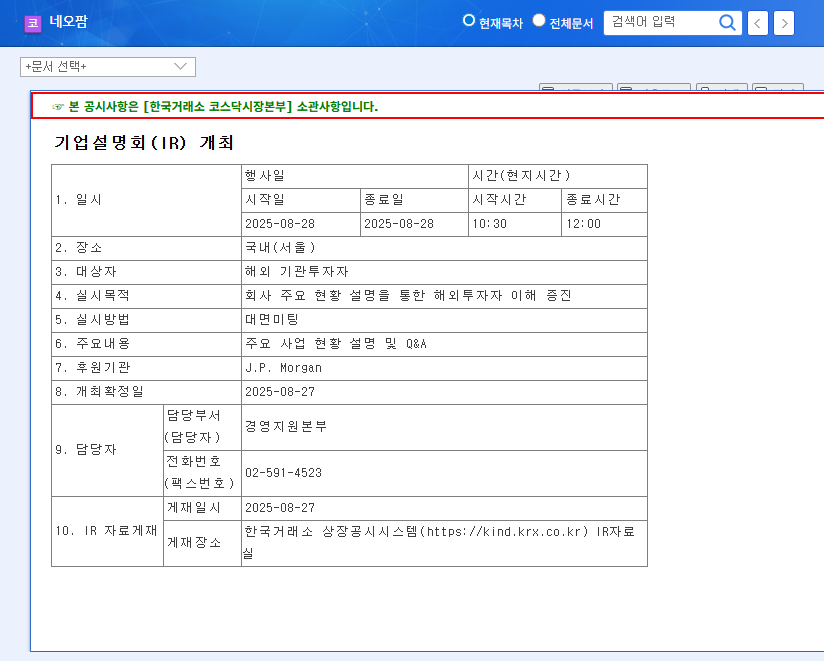

On August 28, 2025, Neopharm held an IR aimed at attracting foreign investment. Through presentations and a Q&A session, the company actively promoted its corporate value and growth strategies.

What are Neopharm’s key investment points?

Neopharm generates stable profits based on its solid brand portfolio, including ‘Atopalm,’ ‘Real Barrier,’ and ‘Derma:B.’ ‘Atopalm,’ in particular, boasts unparalleled brand power, having ranked first for 19 consecutive years. The company is also actively pursuing new growth engines such as pet care, genetic testing, and health functional foods. Its low debt-to-equity ratio of 8.43% demonstrates a stable financial structure.

What is Neopharm’s future after the IR?

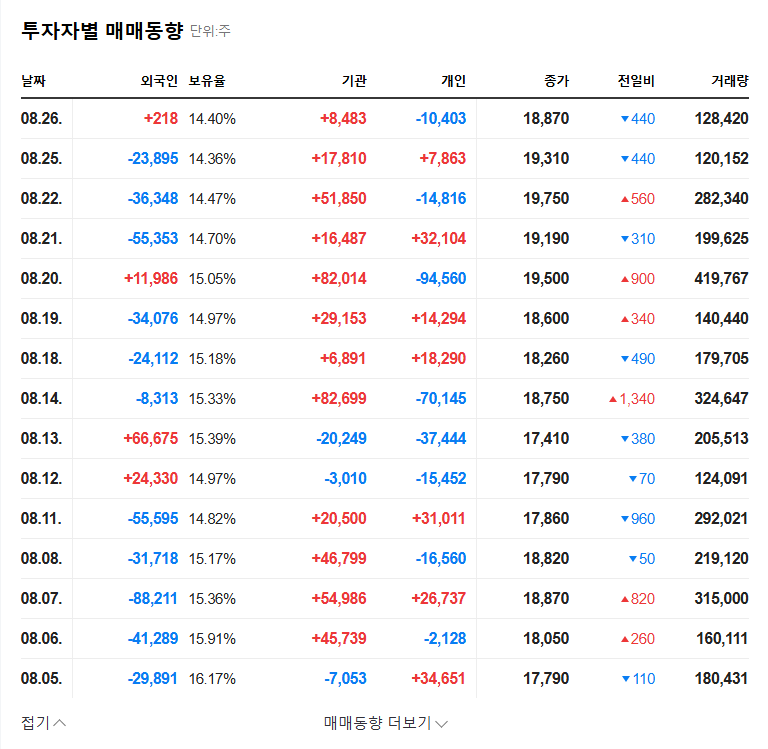

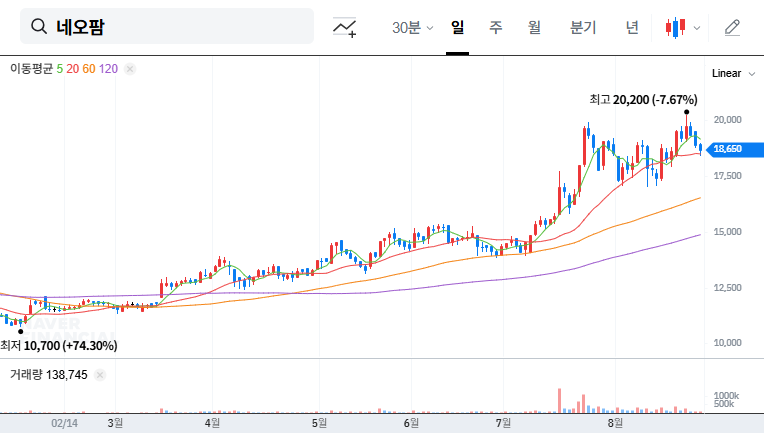

This IR is expected to be a crucial opportunity to convey Neopharm’s growth story to overseas investors and attract investment. Successful IR results could lead to upward momentum in stock prices. However, there is also the possibility of increased stock price volatility if the IR content falls short of market expectations or if unexpected negative news emerges.

Action Plan for Investors

- BUY: Considering Neopharm’s strong fundamentals, growth potential, and the positive impact of this IR, active investment is worth considering.

- Risk Management: Investment decisions should be made while monitoring risk factors such as uncertainties surrounding new businesses and intensifying market competition.

- Essential Monitoring: It is crucial to continuously monitor overseas investor reactions after the IR, the performance of new businesses, and changes in market share.

What is Neopharm’s main business?

Neopharm owns cosmetic brands specializing in sensitive skin and skin barrier strengthening, such as ‘Atopalm,’ ‘Real Barrier,’ and ‘Derma:B.’

What was the purpose of Neopharm’s IR?

The IR was held to explain the company’s current status to overseas investors and attract investment.

What are the investment risks associated with Neopharm?

The success of new businesses and intensifying competition in the cosmetics market can act as investment risk factors.