KB Financial Group H1 2025: What Happened?

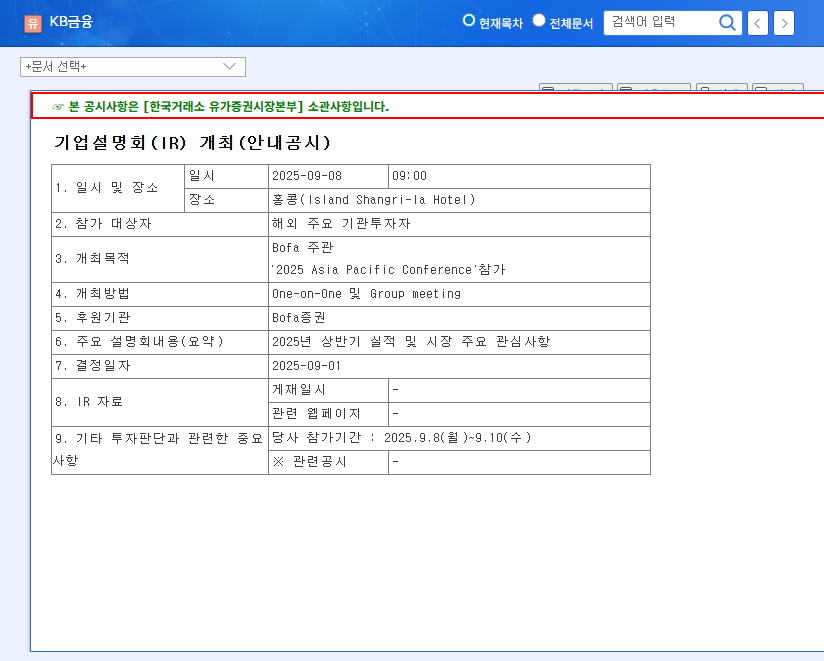

KB Financial Group held an investor relations (IR) session at the BofA-hosted ‘2025 Asia Pacific Conference’ on September 8, 2025, announcing its H1 2025 earnings. The group achieved a net income of KRW 3.436 trillion, a significant 23.8% increase year-over-year.

Reasons Behind the Strong Performance

This strong performance stems from KB’s stable revenue structure and diversified business portfolio. The banking sector maintained robust growth, while the non-banking sectors, including securities, non-life insurance, credit cards, and life insurance, showed balanced growth. KB’s focus on ‘efficient management’ and ‘innovative growth’ strategies, emphasizing digital transformation and ESG management, secured future growth engines. The Q2 dividend decision and treasury stock acquisition/cancellation plan also positively impacted shareholder value.

Future Outlook for KB Financial Group

KB Financial Group maintains a positive outlook based on its solid fundamentals. Investments in digital transformation and AI technology are expected to contribute to long-term competitive advantages. Strengthening ESG management will also positively impact corporate value. However, potential risk factors such as the global economic slowdown, interest rate volatility, intensifying fintech competition, and real estate PF risks require careful consideration.

Action Plan for Investors

- Consider a long-term investment approach, focusing on KB Financial Group’s robust fundamentals and future growth potential.

- Continuously monitor information from IR activities and market conditions to adjust investment strategies.

- Keep an eye on KB Financial Group’s strategies for addressing potential risk factors like macroeconomic volatility, increased competition, and regulatory changes.

What was KB Financial Group’s net income for H1 2025?

KB Financial Group reported a net income of KRW 3.436 trillion for the first half of 2025.

What are KB Financial Group’s key growth strategies?

KB Financial Group focuses on securing future growth engines through ‘efficient management’ and ‘innovative growth,’ emphasizing digital transformation, ESG management, and investments in non-financial new businesses.

What are the key risks to consider when investing in KB Financial Group?

Investors should consider macroeconomic uncertainties, intensifying competition within the financial industry, regulatory changes, and real estate PF risks.