1. DI Dongil Q2 2025 Performance: What Happened?

DI Dongil’s Q2 2025 consolidated revenue decreased by 5.6% year-over-year, while operating profit plummeted by 76.9% to 1.884 billion KRW. The company also reported a net loss of 7.363 billion KRW. The decline was primarily attributed to underperformance in the textile materials segment and increased market volatility in the aluminum sector.

2. Why the Decline? Understanding the Factors

The negative macroeconomic environment, including a global economic slowdown, increasing external uncertainties, and sluggish domestic consumption, significantly impacted DI Dongil’s performance. The decline in sales and the shift to an operating loss in the textile materials segment were particularly damaging. The aluminum segment also suffered due to heightened market volatility.

3. DI Dongil’s Future Strategy: Key Takeaways for Investors

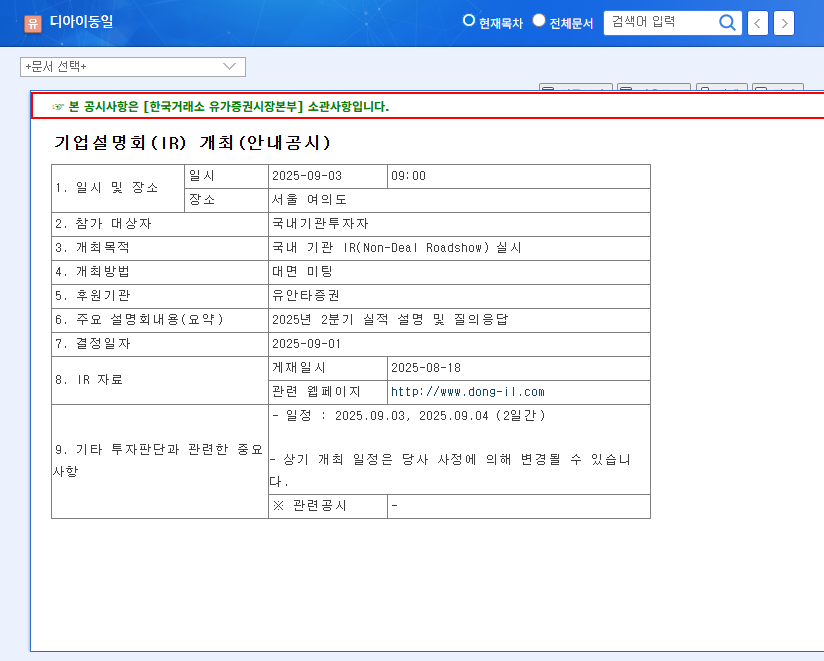

Despite the challenging environment, DI Dongil continues to invest in future growth drivers. The company is expanding its aluminum production capacity to meet the growing demand for 2nd battery materials and is diversifying its business portfolio by venturing into logistics, medical devices, and e-commerce. The September 3rd IR is expected to provide more details on these new business and investment plans.

- Key areas to watch in the IR:

- Detailed analysis of Q2 underperformance and plans for improvement

- Updates on the 2nd battery materials expansion and new business ventures

- Long-term growth roadmap and strategy

4. Action Plan for Investors

Investors should carefully review the information presented in the September 3rd IR to reassess DI Dongil’s investment value. Key considerations include management’s commitment to improving performance, the concreteness of their new business strategies, and the company’s long-term growth potential. A long-term investment perspective is recommended, rather than focusing on short-term stock price fluctuations.

What are DI Dongil’s main businesses?

DI Dongil has a diversified business portfolio, including textile materials, aluminum, plants, furniture, and cosmetics.

How did DI Dongil perform in Q2 2025?

Revenue decreased by 5.6% YoY, operating profit fell by 76.9% to 1.884 billion KRW, and the company reported a net loss of 7.363 billion KRW.

What is the outlook for DI Dongil?

The company is focusing on future growth drivers such as expanding into 2nd battery materials and new business ventures. More details are expected to be released during the IR on September 3rd.