1. Decoding the $7.9 Billion Copper Deal

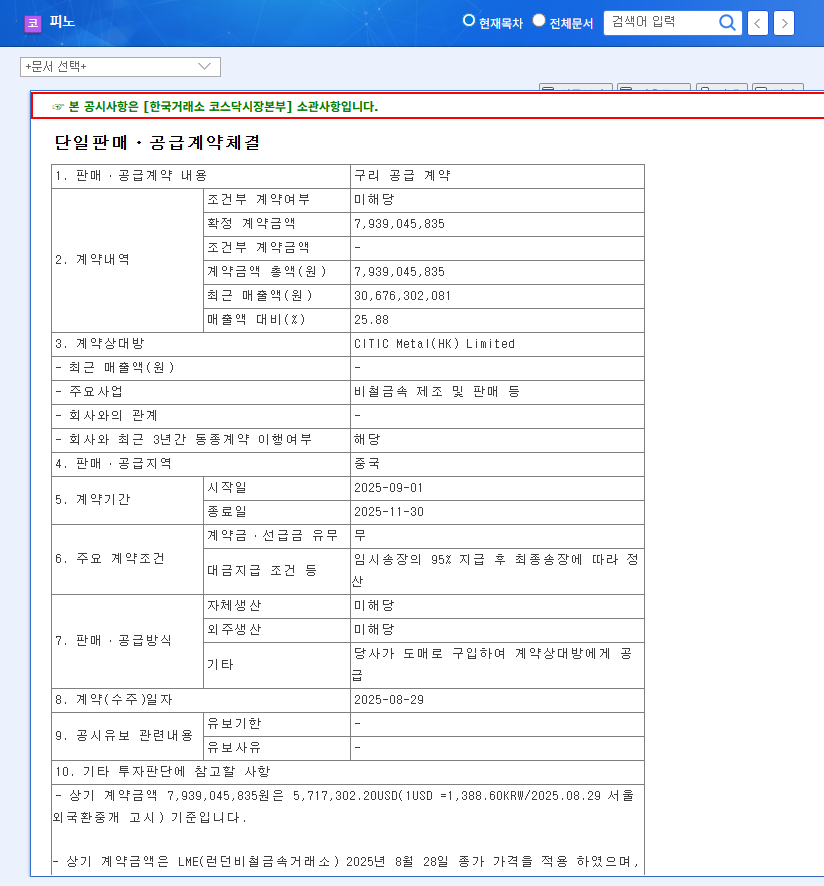

Pino’s agreement with CITIC Metal(HK) Limited for a $7.9 billion copper supply marks a significant development. Representing 25.88% of Pino’s recent revenue, this deal, although short-term (3 months), secures a vital raw material for its core battery precursor business.

2. Why Pino is on Investors’ Radar

Pino is experiencing exponential growth in its battery precursor and related materials segment, with sales skyrocketing by approximately 14 times year-over-year. The recent change in majority ownership to a CNGR subsidiary, a global leader in precursors, further strengthens Pino’s growth prospects.

3. Contract Impact: What’s Next for Pino?

This contract is expected to directly boost Pino’s short-term revenue and profitability. Furthermore, partnering with a global player enhances Pino’s credibility and opens doors for future contracts. However, the short 3-month duration and copper price volatility present potential risks.

- Positive Impacts: Revenue and profit growth, enhanced business competitiveness, short-term improvement in financial indicators

- Negative Impacts: Limitations of a short-term contract, copper price volatility, high debt ratio

4. Investor Action Plan

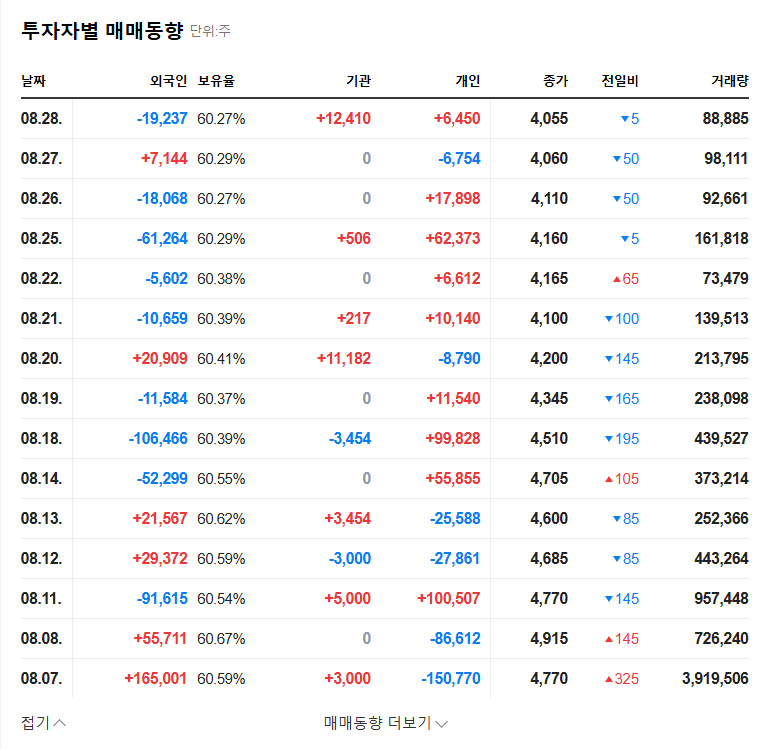

Pino is a compelling investment prospect riding the wave of the booming EV battery market. This contract could trigger short-term stock price gains. However, investors should carefully consider the risks, including contract renewal prospects, copper price fluctuations, and Pino’s high debt ratio. Continuous monitoring of future contracts with CITIC Metal, sustained growth in the new energy sector, and efforts to reduce the debt ratio are crucial.

What is Pino’s main business?

Pino’s primary focus is on battery precursors and related materials, which constitute the majority of its revenue. They also operate in the telecommunications equipment and gaming sectors, although these are currently underperforming.

What is the value of the copper supply contract?

The contract is valued at $7.9 billion, representing approximately 25.88% of Pino’s recent revenue.

What is the contract duration?

The contract runs for three months, from September 1, 2025, to November 30, 2025.

What are the key investment considerations?

Investors should consider the short contract duration, copper price volatility, and Pino’s high debt ratio. The possibility of contract renewal and the sustained growth of the new energy business are also important factors.