What Happened? NCSOFT Holds Earnings Call

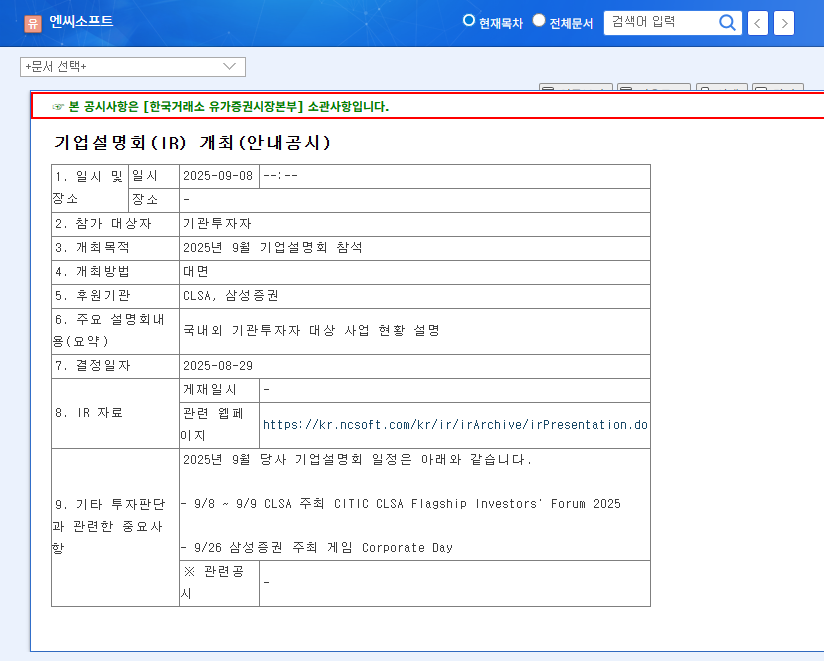

NCSOFT held an earnings call (IR) for domestic and international institutional investors on September 8, 2025. The primary focus was on announcing H1 2025 results and sharing future business strategies.

Why Does it Matter? Improved Earnings and New Game Momentum

Despite market slowdown, NCSOFT showed positive performance in H1 2025, including a return to profitability in operating income and improved net income. Consistent performance of the Lineage series, positive market reception for new titles like Hoyeon and Journey of Monarch, and efficient cost management were key factors. Planned releases of multiple new games, including Aion 2, raise expectations for future growth.

What’s Next? Stock Price Outlook

This earnings call is expected to be a significant factor influencing NCSOFT’s future stock price. The success of new game releases, securing global competitiveness, and sustainable efficient cost management will be key determinants. Potential risk factors include delays in game releases, increased competition, exchange rate volatility, and macroeconomic uncertainty.

What Should Investors Do?

The current investment recommendation is ‘Hold and Observe.’ Carefully analyze the earnings call content and monitor market reactions before making investment decisions. Pay close attention to the potential success of new games, global market competitiveness, and cost management strategies.

Q: What were the key takeaways from NCSOFT’s earnings call?

A: The key takeaways were the announcement of H1 2025 financial results and future business strategies, especially the new game release pipeline and global market entry plans.

Q: How did NCSOFT perform in H1 2025?

A: Despite a market slowdown, NCSOFT showed positive results, returning to profitability in operating income and improving net income. Efficient cost management and the positive reception of new releases were key factors.

Q: What is the outlook for NCSOFT’s stock price?

A: NCSOFT’s stock price may experience volatility depending on the details revealed in the earnings call and the success of new game releases. The current investment recommendation is ‘Hold and Observe.’ Investors should analyze the information from the call and market reactions before making any decisions.