1. What Happened? : Background and Key Takeaways from Hyundai Bioland’s IR

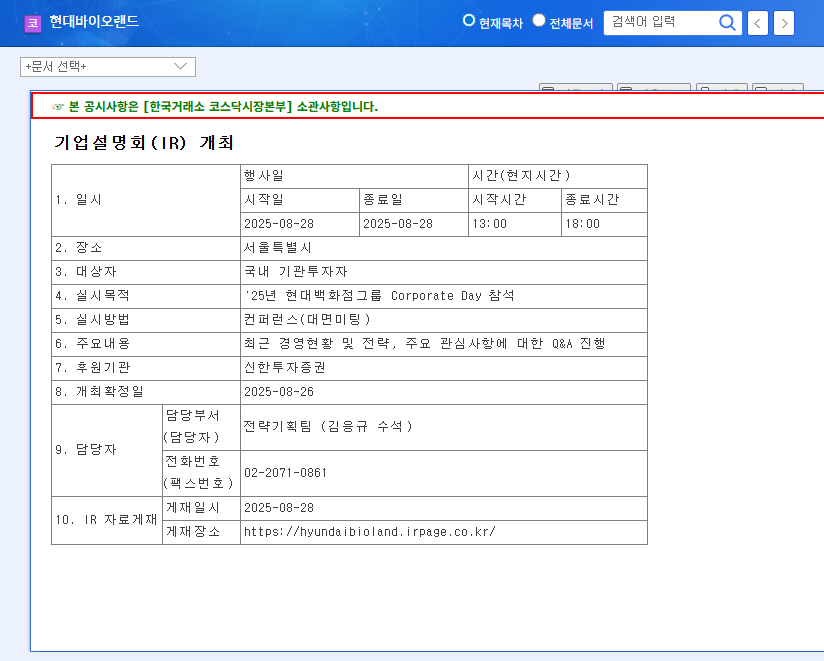

Hyundai Bioland held an investor relations (IR) meeting on August 28, 2025, to present its recent performance and future strategies. This IR meeting provided a crucial opportunity to address investors’ questions regarding performance changes and future business direction following the sale of a subsidiary. Key topics included brand business expansion, new material development, and overseas market entry strategies to secure future growth momentum.

2. Why Does it Matter? : The Changing Market Landscape and Hyundai Bioland’s Challenges

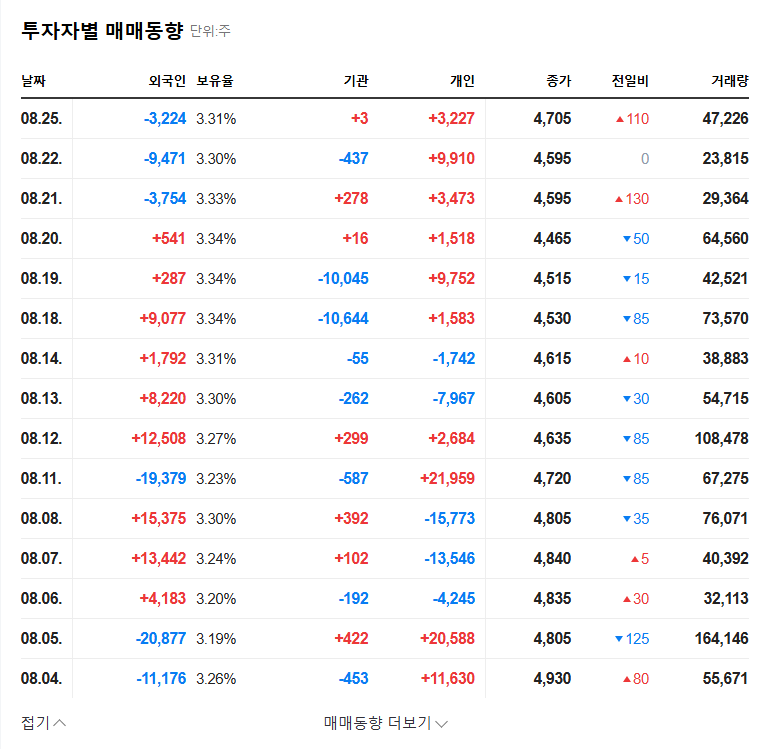

Hyundai Bioland experienced a decline in revenue and a net loss due to the sale of its subsidiary. However, the growth of its brand distribution business and cost efficiency efforts are positive signs. While the rise in the KRW/USD exchange rate is favorable for exporting companies, the weakening KRW/EUR exchange rate could pose challenges for expansion into the European market. In this context, Hyundai Bioland is seeking growth breakthroughs through the development of new materials like vegan collagen and plant-based PDRN, and its collaboration with Nestlé Health Science.

3. What’s Next? : Post-IR Market Outlook and Investment Strategy

The market’s reaction to the IR meeting will likely be positive, neutral, or negative, depending on the presented future growth strategies and management’s responses. A clear vision for the company’s growth potential can lead to a positive response, but a lack of concrete plans for performance improvement could have a negative impact.

4. Investor Action Plan: Key Information Checklist and Investment Decisions

- Investors should carefully review the company’s financial status, business strategies, and market competitiveness through IR materials before making investment decisions.

- Evaluate the company’s risk management capabilities and future growth potential based on management’s responses.

- Adjust investment strategies by considering post-IR market reactions and expert analysis.

Frequently Asked Questions

What are Hyundai Bioland’s main businesses?

Hyundai Bioland operates businesses in cosmetic ingredients, health functional food materials, and brand distribution. Recently, they are focusing on expanding their brand business.

What is the reason for the recent decline in earnings?

Sales decreased due to the sale of a subsidiary, but the brand distribution business showed growth.

What is the future growth strategy?

The company plans to strengthen its competitiveness in the cosmetics business and expand its global market presence through the development of new materials such as vegan-certified next-generation collagen and plant-based PDRN, as well as advanced formulation technology.