KEPCO Q2 2025 Earnings: Key Highlights

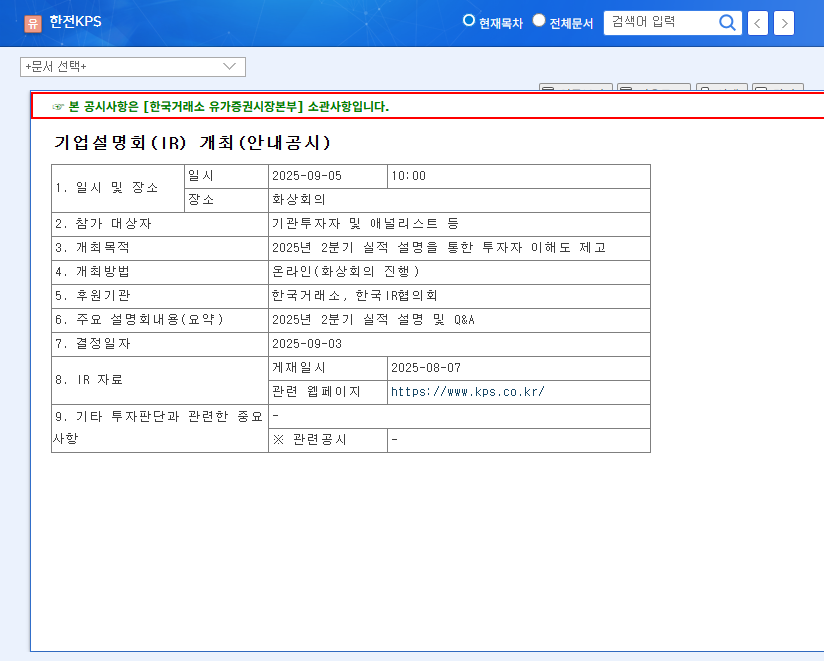

KEPCO held its Q2 2025 earnings call on September 5, 2025. Despite growth in the nuclear and pumped storage power segment, overall revenue and operating profit declined year-over-year. The underperformance of the thermal power segment and uncertainty surrounding overseas projects were cited as primary factors.

What Happened? Q2 Earnings Breakdown

- Revenue: KRW 741.993 billion (Slight decrease YoY)

- Operating Profit and Net Income: Decreased YoY (Growth maintained compared to FY2024)

- Nuclear/Pumped Storage Power: KRW 253.224 billion (Significant increase YoY)

- Thermal Power: KRW 300.003 billion (Decrease)

- Transmission & Distribution: KRW 54.584 billion (Slight decrease)

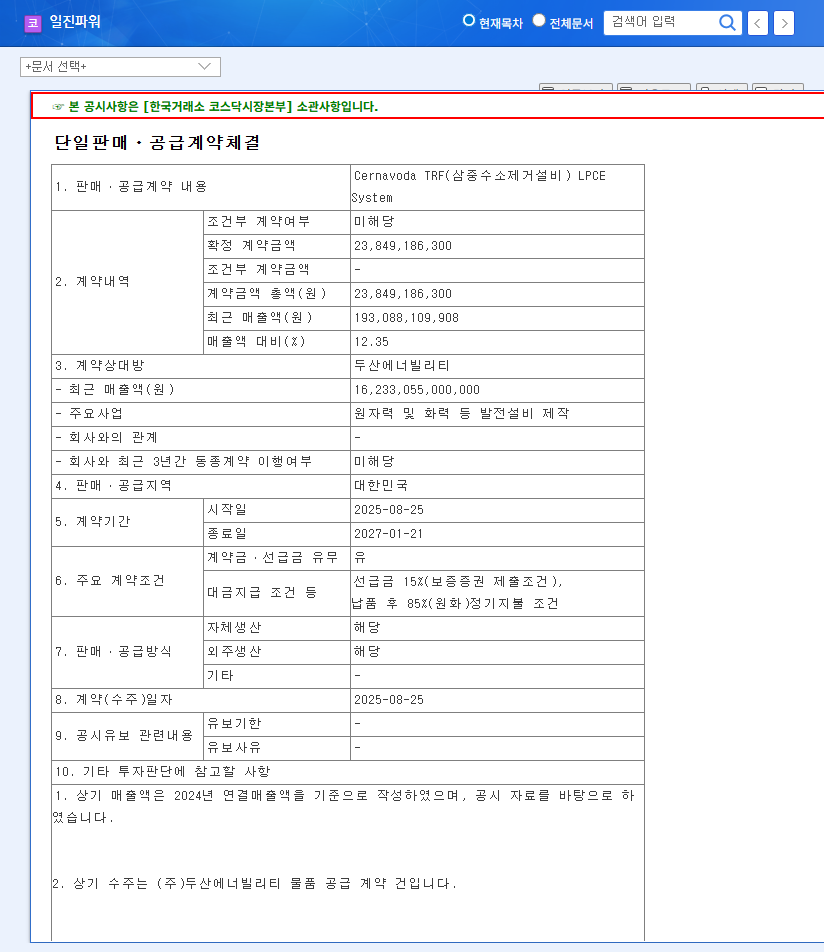

- Overseas Projects: Decrease in revenue

Why Did This Happen? Drivers of Performance

- Nuclear/Pumped Storage Growth: Driven by pro-nuclear energy policies outlined in the 11th Basic Plan for Long-Term Electricity Supply and Demand

- Thermal Power Decline: Attributed to aging facilities and reduced investment

- Overseas Project Challenges: Increased competition in the private power plant maintenance market and project volatility

What’s Next? Outlook and Investment Strategy

The government’s pro-nuclear policies are expected to be a tailwind for KEPCO. However, the slowdown in thermal power and intensifying competition in overseas markets require careful monitoring. Securing future growth engines, such as renewable energy projects, is crucial.

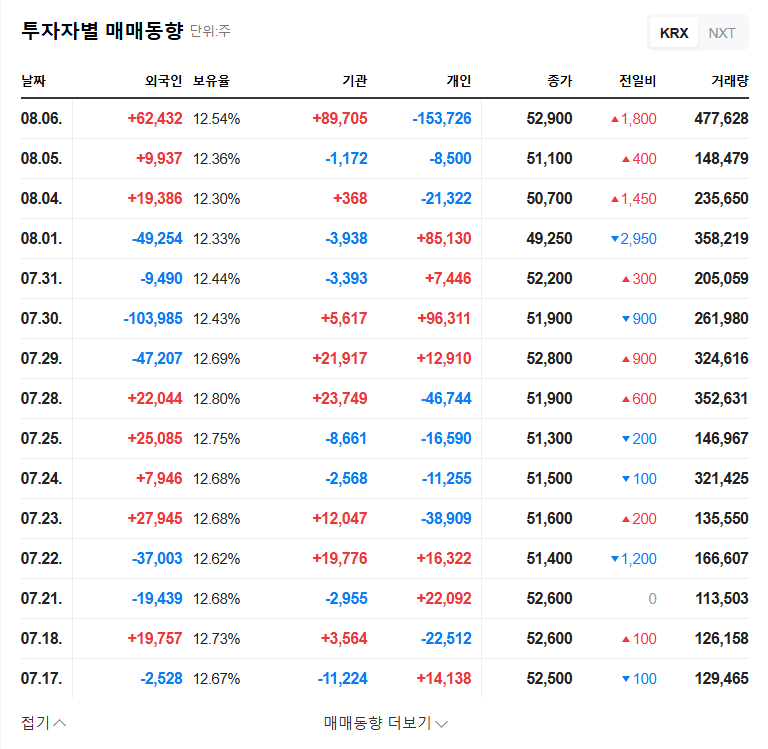

What Should Investors Do? Action Plan

Investors should thoroughly analyze the information presented in the earnings call and continuously monitor macroeconomic indicators and competitor activity. Closely examining the growth potential of the nuclear/pumped storage segment and the company’s plans for renewable energy projects is essential.

Frequently Asked Questions (FAQ)

What are KEPCO’s main business segments?

KEPCO primarily focuses on power plant maintenance, providing services for various types of power generation facilities, including nuclear, hydro, thermal, pumped storage, and transmission & distribution. The company also participates in overseas power plant construction and operation projects.

Why were Q2 results weaker than expected?

Despite growth in the nuclear/pumped storage segment, the overall decline in performance was attributed to the underperformance of the thermal power segment and uncertainty surrounding overseas projects.

What is the outlook for KEPCO?

Supportive government policies for nuclear power are anticipated to benefit KEPCO. However, the decline in thermal power and increasing competition in overseas markets need ongoing attention. The development of new growth engines, such as renewable energy, is critical.