1. What Happened?: OA’s KOSDAQ Listing and Stock Price Plunge

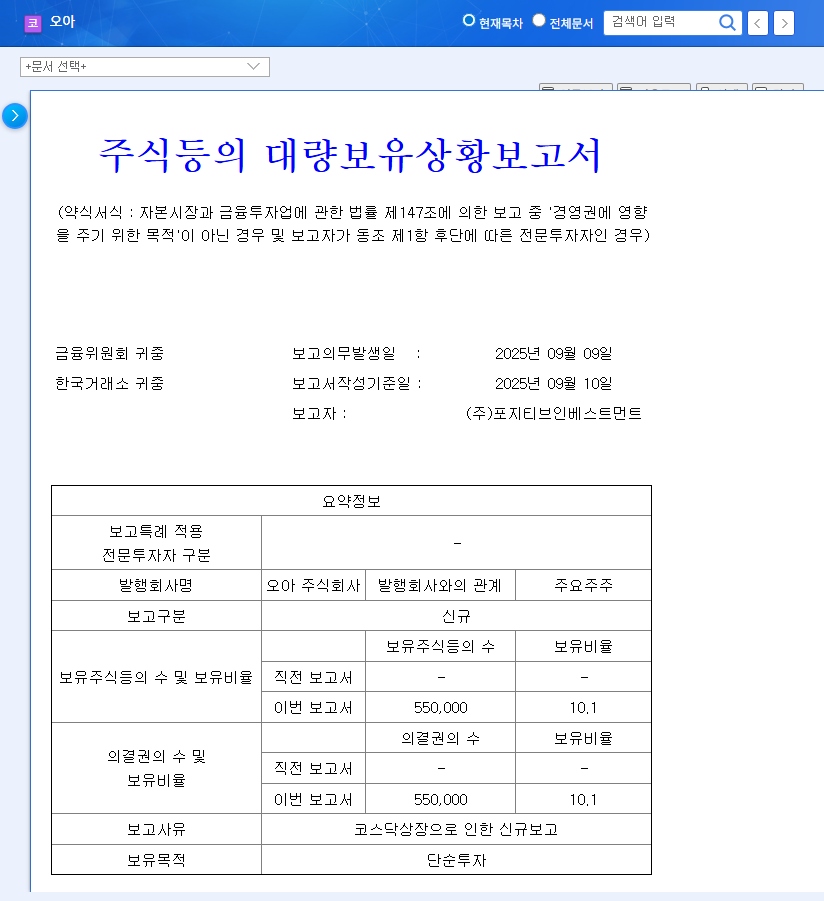

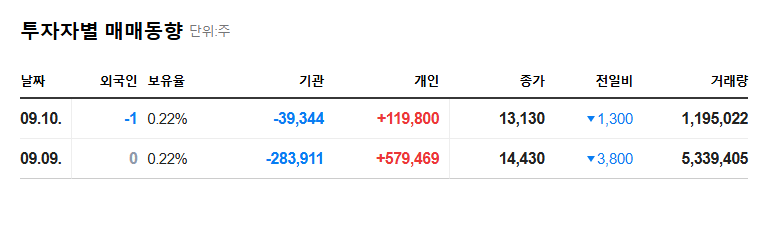

OA (342870) successfully debuted on the KOSDAQ market on September 9th. Although the initial price exceeded the IPO price on the first day, it has since turned downward and is currently significantly lower than its debut price. Despite the announcement of Positive Investment acquiring a 10.1% stake, the stock price has not rebounded.

2. Why Did This Happen?: Analysis of the Stock Price Decline

The main reasons for the stock price decline are profit-taking sell-offs following the listing, concerns about declining sales due to the sluggish small and medium-sized home appliance market, and financial risks such as recent increases in current liabilities. There is also the possibility that the company’s value reassessment after listing did not meet investors’ expectations.

3. What Should We Do?: Investment Strategies and Key Points

Rather than focusing on short-term stock price fluctuations, investors should focus on OA’s mid-to-long-term growth potential. The key factors are maintaining the trend of improving profitability, growth in the health food sector, new business development, and the future moves of venture capital. Investment strategies should be developed by carefully analyzing these factors.

- Profitability: Improved operating profit margin despite declining sales is a positive sign. The key is whether this trend can be sustained.

- New Growth Drivers: Growth in the health food sector and the performance of new businesses like smart home and big data marketing are crucial.

- Financial Stability: Managing the increasing current liabilities is necessary.

- Investor Trends: The future moves of Positive Investment should be monitored closely.

4. Investor Action Plan

Investors considering investing in OA should analyze the company’s fundamentals and growth strategies without being swayed by short-term stock price fluctuations. It is particularly important to continuously monitor the company’s growth prospects through future earnings announcements and business plans. Changes in the macroeconomic environment and competitor trends should also be considered.

What are OA’s main businesses?

OA operates in the small and medium-sized home appliance and health food businesses. They own brands such as ‘OA’, ‘Boir’, and ‘Samdaeobaek’.

What are the main reasons for OA’s stock price decline?

Profit-taking sell-offs after listing, concerns about declining sales due to the sluggish small and medium-sized appliance market, and increasing current liabilities are considered the main reasons.

What should investors be cautious of when investing in OA?

Investors should consider factors such as stock price volatility in the initial stages after listing, the possibility of continued decline in sales, debt structure, exchange rate fluctuations, and the future actions of venture capital firms.