Daechang Solution’s IR: What was discussed?

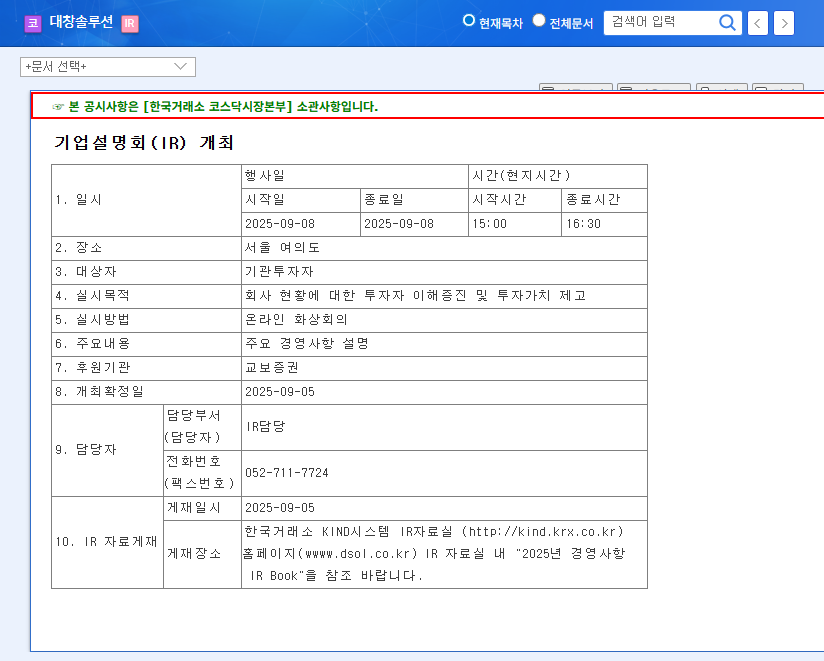

On September 8, 2025, Daechang Solution held an IR to enhance understanding of the company’s current status and highlight its investment value. The main focus was on explaining key management matters, with the market’s attention centered on the company’s efforts to improve earnings and its future growth strategy.

Why is this important from an investment perspective?

Daechang Solution operates various businesses including shipbuilding materials and marine solutions, and is recently attempting to expand into the eco-friendly energy sector. However, facing financial difficulties and declining profitability, this IR provided a critical opportunity for investors to assess the company’s future prospects.

Daechang Solution: Current Situation (SWOT Analysis)

- Strengths:

- Growth in shipbuilding materials due to increasing LNG-powered vessel orders and strengthening environmental regulations

- Efforts to secure future growth engines such as hydrogen energy and offshore wind power

- Weaknesses:

- Operating loss and net loss

- High debt ratio and increasing financial burden

- Declining order backlog

- Opportunities:

- Global expansion of the eco-friendly energy market (offshore wind power, etc.)

- Increasing demand for LNG-powered vessels due to stricter IMO environmental regulations

- Threats:

- Rising raw material prices, exchange rate volatility, rising interest rates

- Decrease in offshore plant orders

- Intensifying competition

What should investors do?

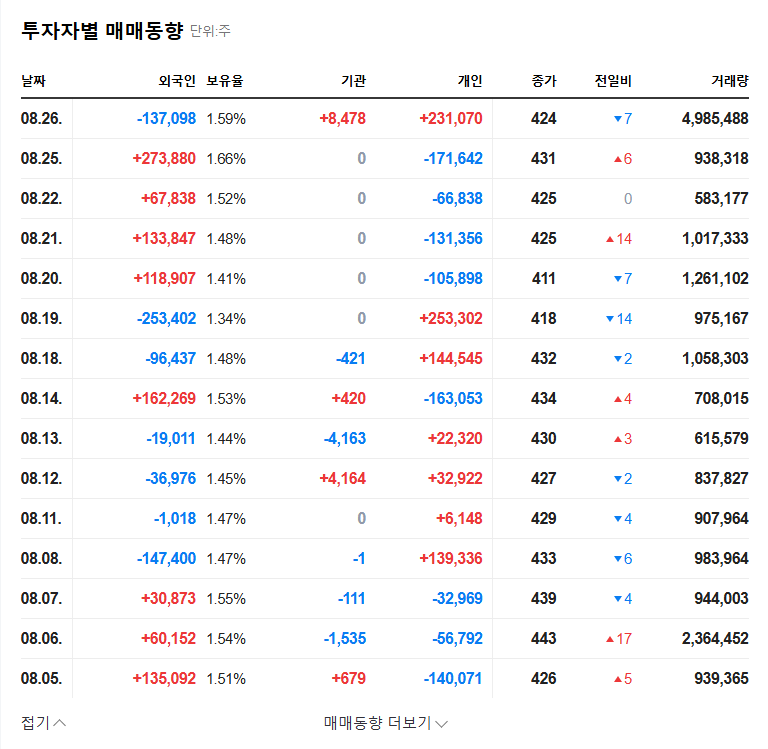

Investors should carefully review the financial improvement plans, derivative risk management measures, and the potential for monetization of new businesses presented at the IR. It’s crucial to focus on the company’s long-term growth potential rather than short-term stock price fluctuations and to make investment decisions cautiously.

Frequently Asked Questions (FAQ)

What are Daechang Solution’s main businesses?

Daechang Solution manufactures shipbuilding materials, marine solutions, and special containers. Recently, the company is expanding into eco-friendly energy fields such as hydrogen energy and offshore wind power.

What is the financial status of Daechang Solution?

Daechang Solution is struggling with a high debt ratio and declining profitability. Although they announced plans to strengthen their financial soundness at the IR, actual improvements need to be continuously monitored.

What should investors be aware of when investing in Daechang Solution?

While Daechang Solution has potential for growth, investors should be mindful of financial risks and market volatility. Before investing, it’s recommended to thoroughly review IR materials and public disclosures, and consult with a financial advisor.