What Happened at Studio Dragon?

In the first half of 2025, Studio Dragon recorded revenue of KRW 248.3 billion (a 24.6% decrease year-on-year), operating profit of KRW 1.4 billion, and a net loss of KRW 1.36 billion. Declining drama broadcasting revenue and a reduced new lineup were identified as primary factors. External influences such as the global economic slowdown, intensified competition, and the declining influence of traditional broadcasting channels also contributed.

Why the Decline?

- Global economic slowdown and weakened content consumption

- Increased competition in the OTT market

- Declining influence of traditional broadcasting channels

- Continued fixed cost burden

What’s Next?

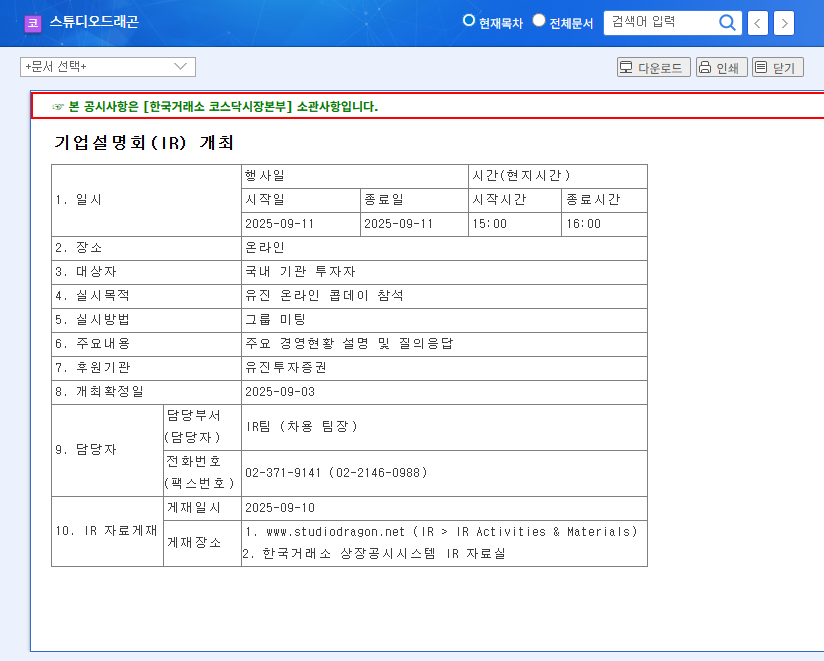

Studio Dragon will announce their business strategies for the second half of 2025 and beyond at the IR meeting on September 11th. Investors should pay attention to the following:

- Competitiveness and potential success of the new lineup: Reveal of anticipated titles and expected performance

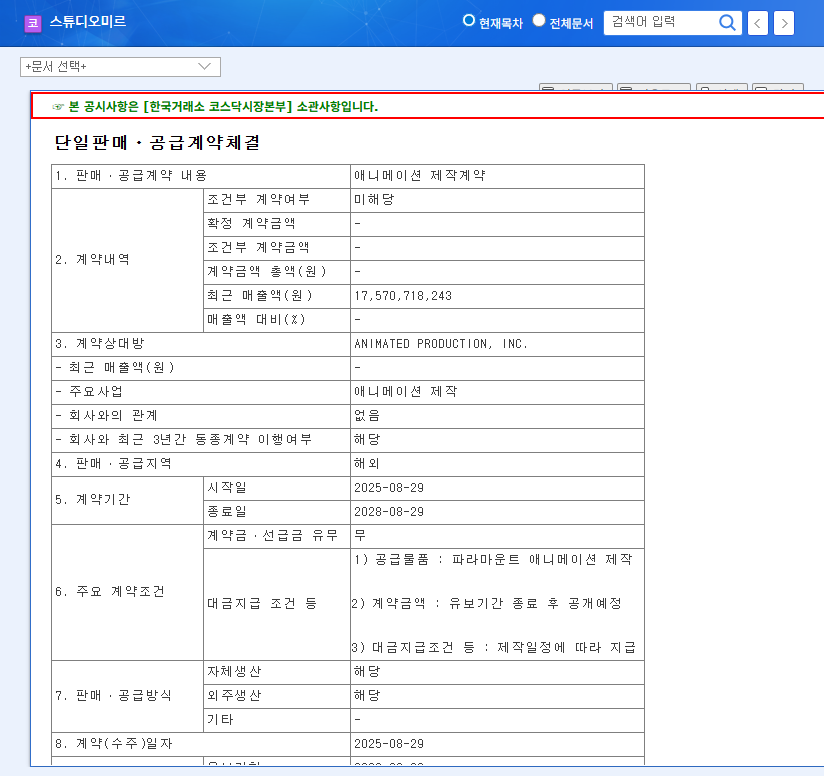

- Strengthened partnerships with global OTT platforms: Plans for expanding collaborations with major OTT players like Netflix and Amazon

- Global market expansion strategy: Plans for further international expansion, building on the success of “Marry My Husband: Japan Edition”

- Concrete plans for new business models: Progress and future plans for new businesses utilizing their IP

- Financial soundness measures: Plans for improving profitability and managing debt ratios

What Should Investors Do?

Investors should carefully review the announcements made during the IR meeting and make informed investment decisions based on a comprehensive assessment of the company’s potential and risk factors.

- Analyze the IR announcements: Evaluate management’s vision and strategies, market analysis, and competitiveness against rivals

- Monitor macroeconomic indicators: Consider external factors such as interest rates, exchange rate fluctuations, and the possibility of an economic recession

- Understand content market trends: Analyze competition in the OTT market and changes in content consumption trends

Frequently Asked Questions (FAQ)

What is Studio Dragon’s main business?

Studio Dragon plans, produces, and distributes drama content and engages in related businesses.

How was Studio Dragon’s performance in the first half of 2025?

They experienced a decline in revenue and profitability. Refer to the article for details.

What is the outlook for Studio Dragon?

While they have growth potential based on global OTT partnerships and IP competitiveness, there are uncertainties due to market conditions and changes in the competitive landscape.

How can I invest in Studio Dragon?

You can purchase Studio Dragon stock on the stock market. Be sure to thoroughly review IR materials and related information before making any investment decisions.