What Happened?

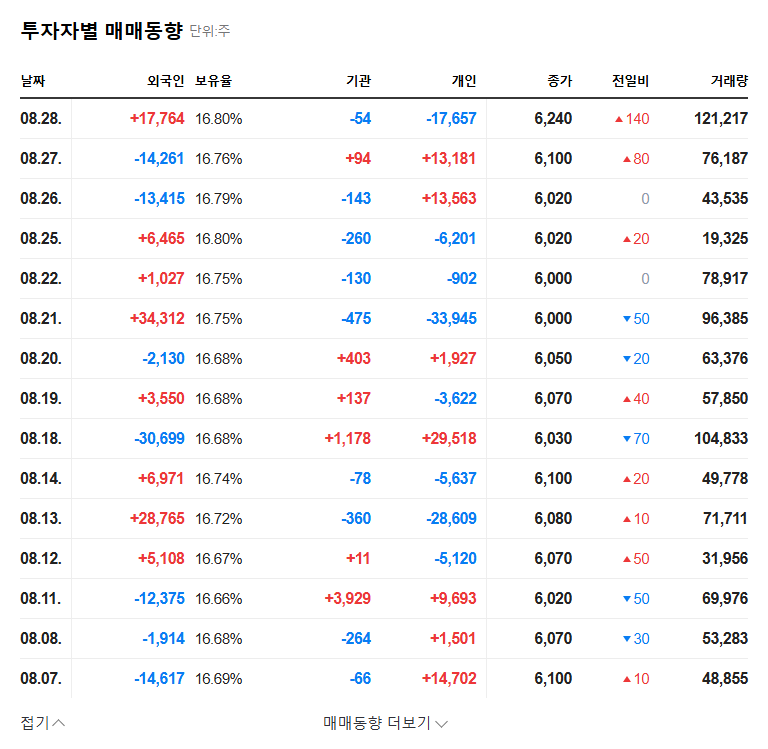

Samsung Asset Management acquired an additional 107,000 shares of KB Valhae Infra between August 25th and 29th, 2025, increasing its stake from 15.92% to 20.02%, a 4.1%p increase. This purchase, related to ETF allocation, is stated as a ‘simple investment’.

Why Does It Matter?

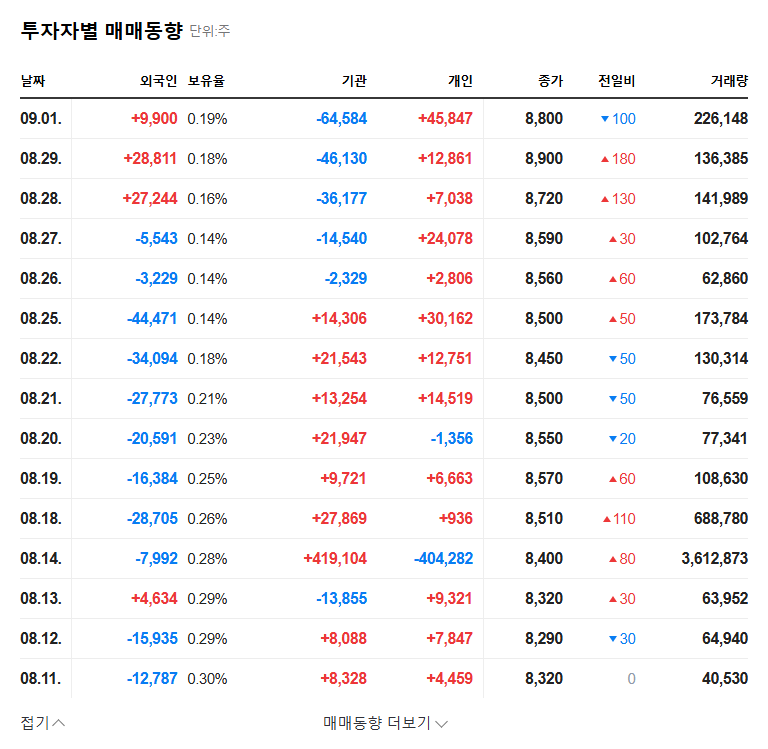

Stake changes by large institutional investors like Samsung Asset Management have a substantial market impact. This increase is likely interpreted as a reflection of market confidence in KB Valhae Infra’s growth potential. Recent stock prices have shown a steady upward trend, and foreign ownership is also increasing.

What’s Next?

- Short-term impact: Samsung’s increased stake could boost investor sentiment, strengthening upward momentum in the stock price.

- Long-term impact: The investment may be interpreted as a positive signal for improved fundamentals and long-term growth, potentially attracting further investment from other institutions and leading to increased shareholder activism.

What Should Investors Do?

- Analyze Samsung’s investment intentions: Look beyond the ‘simple investment’ statement to understand the specific investment rationale and future strategy.

- Monitor KB Valhae Infra’s response: Observe how the company leverages this event to enhance corporate value.

- Analyze macroeconomic indicators: Consider the impact of changes in interest rates, exchange rates, and other macroeconomic factors on KB Valhae Infra.

- Gather additional information: Continuously monitor the company’s financials, disclosures, and other relevant information to make informed investment decisions.

FAQ

What does Samsung Asset Management’s increased stake in KB Valhae Infra mean?

The increased stake can be interpreted as a positive assessment of KB Valhae Infra’s growth potential. It may provide short-term momentum for stock price appreciation and contribute to long-term enhancement of corporate value.

What is the outlook for KB Valhae Infra’s stock price?

While Samsung’s investment is a positive signal, investment decisions should be based on a comprehensive analysis of various factors, including macroeconomic conditions, company fundamentals, and market sentiment. Caution is advised.

What are the key considerations for investors?

Before investing, carefully review KB Valhae Infra’s business model, financial statements, and public disclosures. Make informed investment decisions based on your investment objectives and risk tolerance.